I have done a short term volume profile analysis with support and resistance levels. Market is at long term trendline as well. I Expect a small bounce and some grinding for a week or so fighting the long term trendline. Personally I think it will crash through the trendline after a week of grinding, but will watch closely and make short term trades

As I write this futures are sharply down to 5440 and ViX is at 40. I expect to see a short technical bounce to about 5550, being at major trendline. The wedge formation is similar to 2022. A breakout from Wedge would be sharp either way. If it holds at this level for a couple of weeks then I expect to see a bounce to 5775.I had said earlier in my vix analysis we...

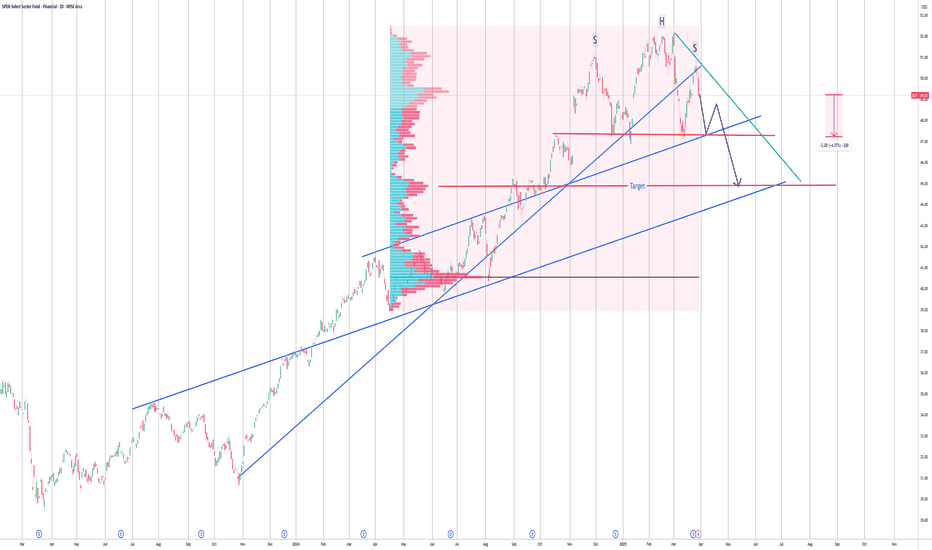

XLF has yet to fall 4% at least and then maybe another 4-5 % from the SHS neckline. For now I will go one step at a time and target the neckline in a weeks time

Time for Gold to rest pause consolidate after climbing 21.37%. What's with this number? Even the best can't climb Mt Everest in one go. They must rest at every base camp, so must gold

A month back I wouldn't have believed this post though I did expect 10% correction and exited my major position at the top. I post this as pure academic purpose and my own record. I find volume profile the most important tool in technical analysis. Whatever I present here is an educated guess and not pure speculation. Before doing the profile I did a VP study on...

The VIX is following similar pattern to 2022 and gradually increasing. Using that pattern, I can compare current spx to 2022 and draw a channel to 2022. then we have a way down to go. I also agree with ContraryTrader's post on spy specially his observation on Wyckoff distribution. I have been following the news and I know that big investors like Warren Buffet...

SPX is going to finish a bear flag and could break down. The Vix is also showing slight upward strength but not much yet. Based on that I don't think we have much downside now in next 2/3 months. However the overall trend of VIX is trending upwards similar to 2022 making higher bottoms since Dec 24, So we could have a year with big swings like we did in 2022

200 days HILO EMA central line has always given a strong support resistance in the past and I would expect that to be so this time as well. Since the market structure broke when prices crossed the lower outer ema band, even if the price goes above the middle line I would not consider it to be bullish.Only when the prices hit the upper or lower band a new trend...

Tesla is heading to 320 to be shorted again During its climb to 485 TSLA had hardly any volume bove 285, but on the fall side it had significant volume, indicating short sellers were the net cause of volume. The same are taking profits now causing sharp rise. There is volume imbalance at around 320, also the middle line of hilo ema (200 days) which is powerful...

Using Hio Ema Squeeze band you can quickly find support/resistance levels as confirmed here with the trend lines. Here I have used 1000 for all the bands, this makes it look cleaner. Another trick is use two bands one with 200,1000,1000 and the other with 1000,1000,1000 and you will double squeeze bands resulting in one with 200 and other with 1000

AUDUSD on 1h chart, is most likely going down once the red trendline breaks. That will also be a break of a triangle (RED) A large bearish flag with Head and shoulder pattern almost complete. The centre line and the trendline break frequently meets the centre of the swing range. So if the red trendline breaks we are looking at 130 pips down! which is the height of...

Did you know this market geometry/symmetry: When a (strong) trendline is broken, the market will fall equal distance or more from the trendline as from the peak to the breakpoint. If google breaks (or has it?) it could fall another 20% and meet the long term trendline, if doesnt then the recent breakpoint would become resistance

If PLTR breaks the trend will reach 45. But at that point it 1) Fills the gap of Nov 24 2) will be 2021 high When a (strong) trendline is broken, the market will fall equal distance or more from the trendline as from the peak to the breakpoint. I have shown multiple example on Nasdaq from the past.

Did you know this market geometry, symmetry: When a (strong) trendline is broken, the market will fall equal distance or more from the trendline as from the peak to the breakpoint. I have shown example of Nasdaq from the past. This is also true for the reverse, a falling trendline break can predict the upside target Hope this is useful in your trading What it...

Having studied volume profile and price geometry I expect SPX to see 5734 today. I am showing trend convergence to confirm my target. Iast two days green bars have been with low volume, show low confidence so it needs to spend some time between 5620 and 5734 if it has to move higher. I also believe 5520 was the bottom, dipping below the long trendline to shake...

The cycles and the crosses are clones, therefore not exact fit.It doesn't look like a correction when I look at the cycles and pattern. I am more convinced that it is going to be a bear market in USA not just on technical but even on fundamentals: China has just finished a recession and will grow with higher cost of production, unlike 2000-2015. Market and Fed...

$161 by 30 May is my price target. I believe there will be rotation from BABA to BIDU now I use convergence of trend to estimate price with timing, which can be useful if trading options Baidu valuation is ridiculously low with PE at 11

A Lot of retail & banking stock are showing low volume prices at the top, like WMT, COST, HD,AXP, JPM and consumer discretionary like TSLA, but not so much in other sectors like Energy, Semi. I think Banking and retail still have a way to go whereas Semi, energy, tech could be close to support So a lot of the bubble stock were bound to burst. Trump just provided...