kventinka

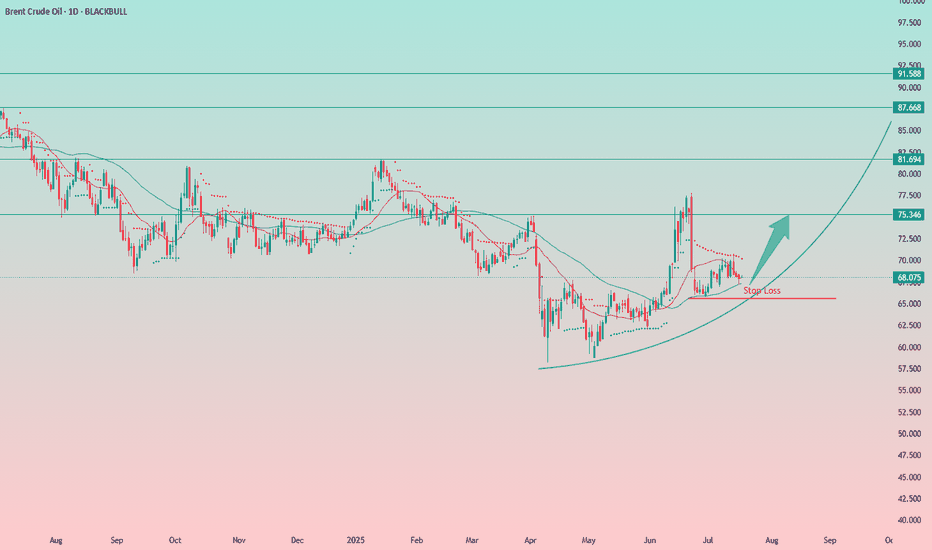

PremiumThe upward structure of the chart remains intact, and I believe the growth will likely continue in the near future. At the moment, we’re seeing a price pullback, which provides new opportunities to enter a long position. I will place a wide stop at the 37.35 level.

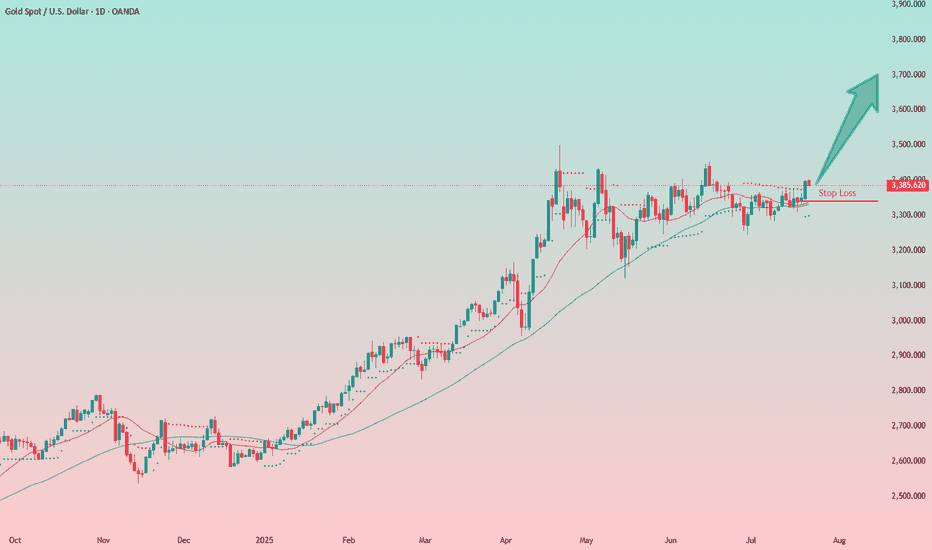

This may not be the best decision right now — I understand that — but it's one of those " I'm exhausted and just want to buy " moments. The setup isn’t fully formed yet, but I have a strong feeling we’re going higher. I like the chart structure: low volatility, a spike to 3430 followed by a pullback to the moving averages without breaking key levels. I also like...

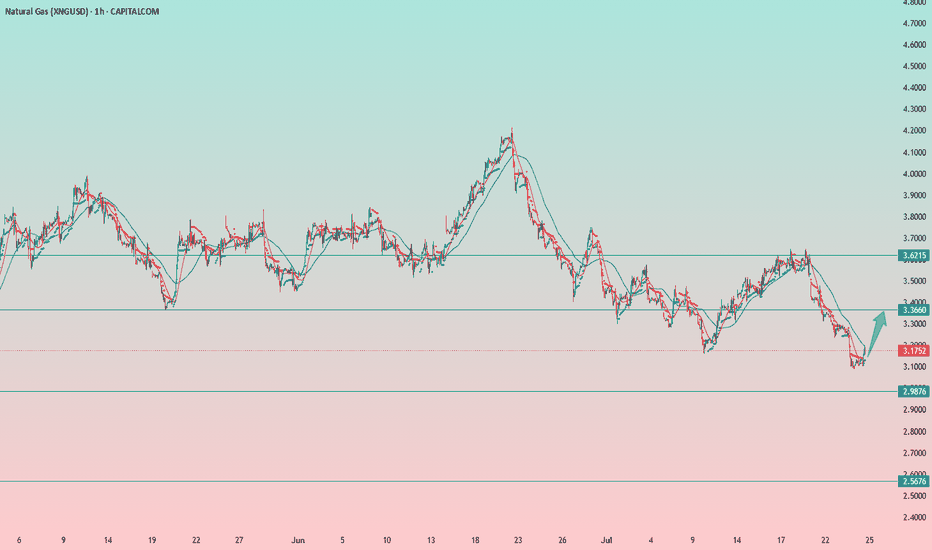

Natural gas has made a decent pullback, and a solid long setup is forming here with a relatively tight stop-loss for gas. If the stop gets hit, the second entry will be from the $3.00 level. Entry is from current levels. 📝Trading Plan Entry: Entry is from current levels. Stop Loss: 3.0855 Target: 3.36

Gold has reached the area of previous wicks. It's the best to close the position here, especially since the price is pulling back from this level. I closed the position I opened yesterday based on the previous trading plan. For the uptrend to continue, we need a breakout above today's high . That level could be used to open a new long position. Alternatively, ...

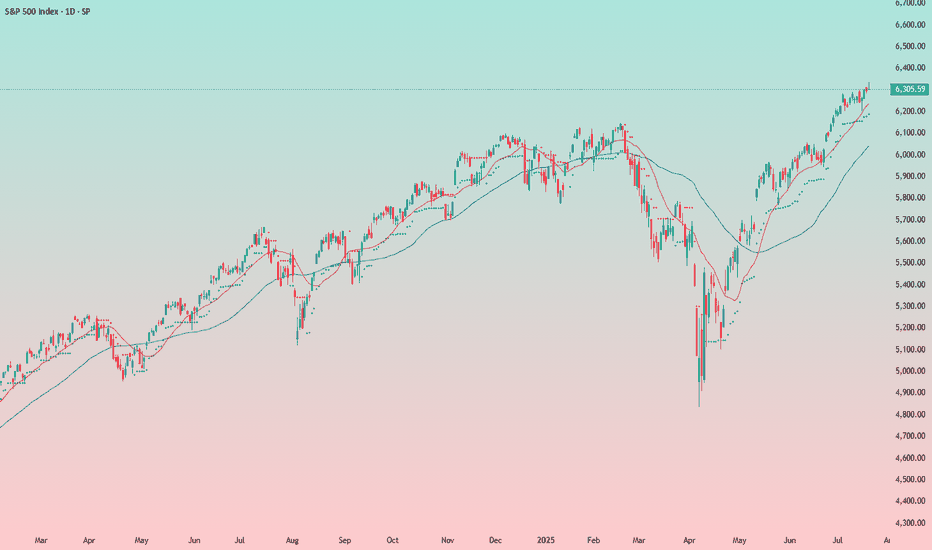

Nothing interesting is forming on the index so far. My outlook remains neutral. I previously attempted to short it, but those attempts were unsuccessful. Now I need to wait for a more reliable entry point — the chart will show the way. For now, I’m staying on the sidelines. Historically, the start of the Fed’s rate-cutting cycle has always coincided with the...

Gold looks well-positioned for further upside. We've seen consolidation at the current level since April, volatility has decreased over the past few weeks, and yesterday there was a decent breakout to the upside, with price hugging the moving averages. As of the current trading session, the price has pulled back slightly. I believe the chances for continued...

Bitcoin doesn't seem to be slowing down and continues its bullish momentum. Overall, I believe the chart shows a solid setup for further growth. I'm not exactly sure how high we’ll go, so in this case, I’ll be trading with a clear stop-loss strategy. 📝Trading Plan Entry: I’m building a position from current levels. Stop Loss: Stop-loss set at $115,000...

Oil is in an uptrend, and I expect it to continue. At the moment, the stop-loss would be too wide — around 3.5%, which is a bit too much for my portfolio, especially considering I already have a wide stop on palladium. On the 1-hour chart, I’m watching for a possible entry slightly below the current level. For now, just observing.

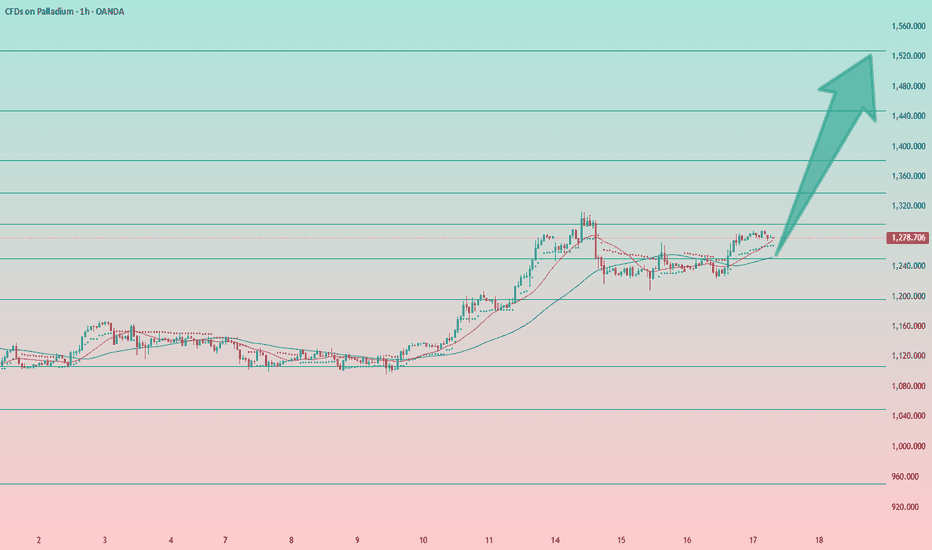

The long setup remains valid. The structure on the daily, weekly, and monthly charts is clearly bullish, and I expect the uptrend to continue. Entering from the current level is tricky, as the stop-loss would need to be placed below the local low — around the 1200 area. A better approach would be either: – Wait for a breakout above the local high at 1314 and...

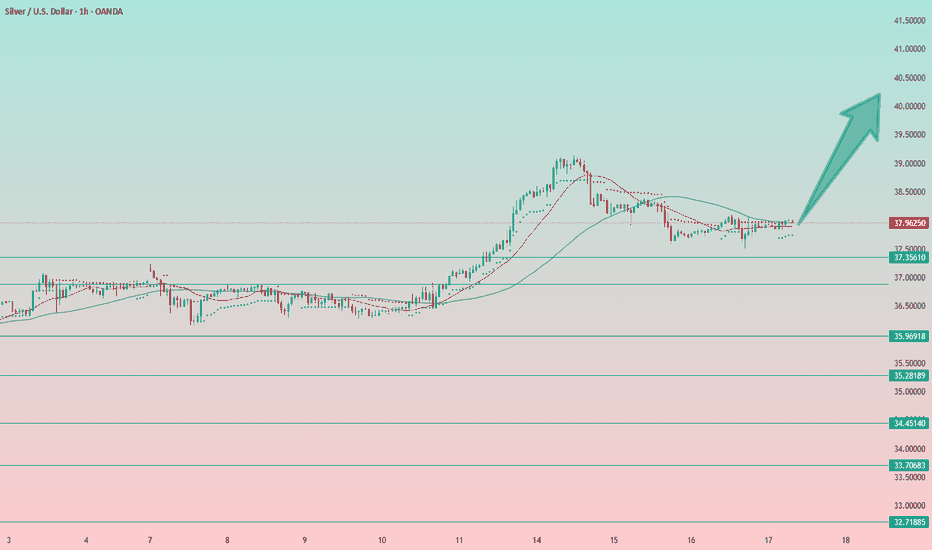

Silver touched its support level at $37.50 and quickly bounced back into the accumulation zone. From the current levels, I expect an upward breakout. The setup looks very bullish. I'm going long from the current price of $38. Stop-loss is placed just below the local low at $37.50. A break below $37.50 would signal further downside toward the next strong support...

Palladium has undergone a solid correction. The bullish factors remain in place. I believe the current level is acceptable for entering a long position, with a stop at 1230. If the stop is hit, we’ll need to reassess further long opportunities. No shorts on metals — only longs for now! The market is in an upward trend.

Silver is showing a pretty solid upward movement. It’s a harmonious and steady growth. I believe we’re just at the beginning of the trend, so it’s not too late to buy even now. If you don’t have a position yet, you can still take advantage of this opportunity. Set your stop-loss just below today’s low — at 36.90.

Yes, the attempt to catch the bottom in natural gas ended in failure. Let it be a lesson for the future. Just because something looks cheap and low doesn’t mean it can’t go even lower — and the question is whether your margin and nerves can handle the drawdown. In short — it's a bad path. It’s too late to short, too early to go long. I think we’ll most likely...

Gold is holding up well for now and consolidating at the current level. But there’s no clear opportunity to buy or sell. It’s just guesswork at this point. And why would I need that? I want to make money, not to be "right." On a global, long-term horizon (up to a year), I believe the metal will go higher. On the daily and weekly charts, the trend is still...

There are plenty of apps, platforms, and trading tools available for tracking your trades — but personally, I believe in creating your own solution. It’s simply more effective and, most importantly, more impactful. Create your own spreadsheet in Excel, Google Sheets, or any tool of your choice. The key columns to include are: Trade date Instrument Position size...

Copper is in a strong uptrend. Currently, it has pulled back to the 18 EMA level, which offers a potential long opportunity with an initial target at 5.25, and a further upside toward 5.60. The era of metals continues. Gold was the first to react — and I believe its rally is not over yet, with new all-time highs still ahead. Now, it's industrial metals' turn:...

This is a good opportunity to go long on silver. Nothing has changed fundamentally — I still expect the asset to move higher. The recent drop following the economic data release is giving me a chance to add to my silver position.

Palladium is beginning to show strong bullish momentum. I believe this is a good opportunity for those who haven’t entered yet. A stop-loss can be placed at $1120, or better yet at $1090 — giving the trade a bit more room to move. Target: $1250. On a broader scale, platinum and palladium are trading at parity, so we could potentially see a breakout toward...