leftey

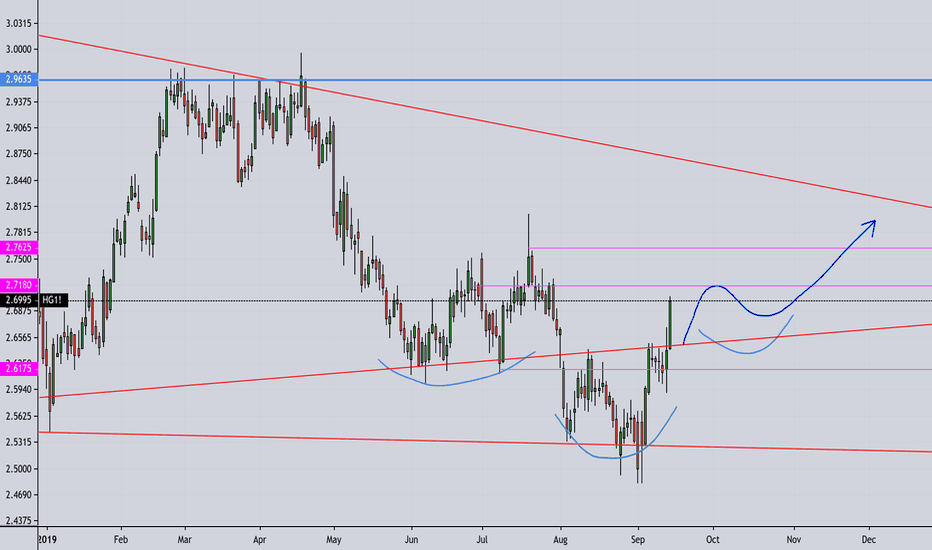

here's something im sure we've all been watching.. looks pretty flaggy. IF the trade stuff is settling out, and markets general attitude stays upbeat. I think this looks real nice. Of course this has a lot of strings attached. good luck!

fcx buyers are very excited for the future! has been a good run. but, seems we never really got past phase 0 on the trade deal.. will the tariffs start to become bullish? Harder us pushes maybe quicker we find a solution.. agree to disagree? Taking a bit off table.. keeping close eye on copper.. who knows how high it may run. has been depressed for so...

Not sure what oct 24 was about. . fcx bounced back. Appears to be a pretty good reversal. Hard saying in current light.. Maybe? 200 day seems right.

Copper making move ER in rear view Grasberg pit on track Things are looking ok here. Just need to hop over that resistance line... : ) What do ya'll think?

Like the idea here.. couple big green days, some take advantage and sell off.. buyers step in and pick up slack.. end up with 2 big green candles? We'll see Should be good here. until next panic hits

pure play copper not exactly best idea for global recession positioning.. but, who knows how this thing is going to go down. Copper is so important, it cant be left behind for long? Maybe it can? But accumulation at least shows some promise.. Should be fun next few months! Please let me know your thoughts.. FCX performance lately is scary. Big money know...

nat gas tuff industry these days.. Maybe they've found support? A/D shows promise..

What started as a nasty looking h/s has turned into a possible invert h/s? We shall see? FCX...

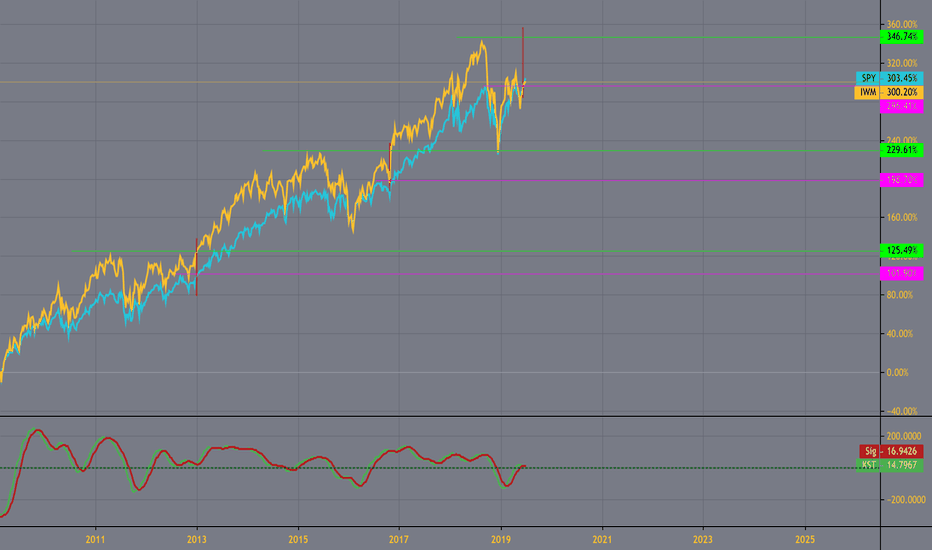

IWM has been the spy's faithful partner up chart since 2009. This run is different. I think we may be destined for failure.. until iwm can muster the strength to breaks its trend. Suppose there's 2 possibilities here. either spy's gonna retreat, or iwm needs to make up some ground.. has a large distance to make a new high. Given circumstances i think retreat...

See we may have another place for the veggie traders. If Kellogg starts making a thing of this, we may see a reaction? Drew some lines that outline some bullish divergences. problem- These big older companies seem to have a tuff time with balancing their budgets. I have a hard time adding something like this to anything but an active trading account, so...

Heres some interesting spots on chart. xlf been lagging. similar to iwm.. which looked to be backing out of similar resistance zones. May pickup some puts to add to my rally for nothing hedge.. Keep waiting to hear why we're back up here. fed rate that never changed? trump deals that never get made? earnings revisions everywhere.. so much debt.. etc Seems...

Market loves it when trump claims a victory.. but how many times will we fall for same news? Last time the tweet news did not make sustainable rally. seems like nothing new here. Why would we break highs and continue up? Maybe.. There's some lines showing possible lack of confidence. We'll see how the cpu's play it. Trying to keep stance balanced. But im...

Here I have drawn a couple lines showing what look like some bullish divergences. This stock surprises me with the lack of confidence. I feel comfortable buying here seeing basically zero pump, and what appears to be market deflation.. Im no expert by any measure, but this seems to be an excellent opportunity to buy into a company that has been making a...

V, and xlf have pretty close trend relationship. They have split paths for time being.. likely to find each other again? RSI divergence since split...

Heres a trend that may continue? Not sure I see a reason to break out to upside? Not sure what china will do as retaliation, but I imagine market wont think of it as a reason to rally back to highs.. but who knows, been wrong many times before. Why this forecast will ultimately prove to be incorrect: Im around 90% that monday, if market starts falling, we'll be...

Copper and fcx have had a long, relatively tight relationship. how long will division last? trade deal? I feel like at some point in near future the words trade deal signed will appear in headlines.