libertasrei

This is a general outline of current trends. DXY may or may not have a correction soon. The picture will become more clear tomorrow. Any deviation from the elliot waves, may suggest a more determinate trend. The idea is simply a sketch to provide some basic material for analysis, what there is to expect and not. The currently strong sell presssure and EMA may be...

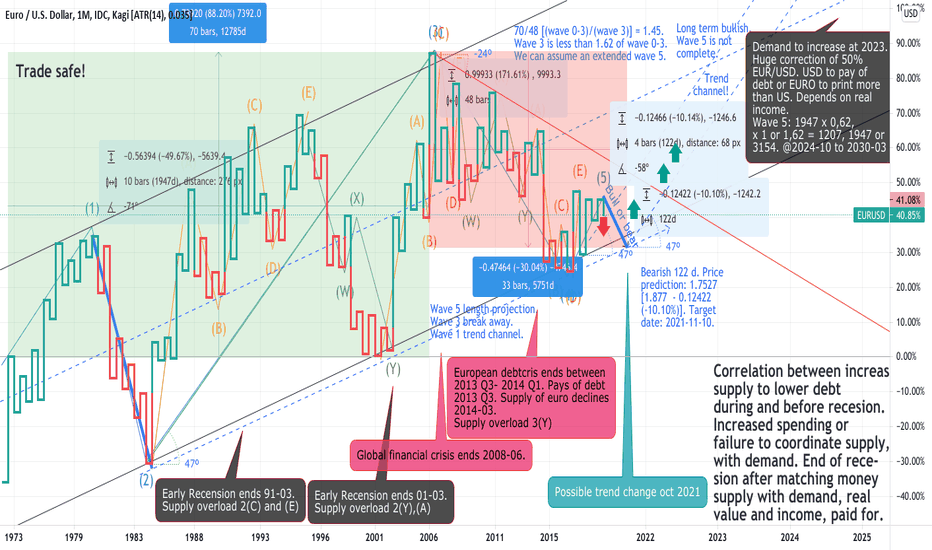

Elliot wave analysis with trend channels. No major news tomorrow. Increased yields and decreased gold, spotprices, may set up a bull DXY.

There may be a bounceback, but we're in a strong bearish trend.

USD bull have surpressed the EUR price. Trend change.

Correction of primary wave 1. May have a bullish reversal and stay bullish for a couple of weeks.

Elilot wave analysis to predict monthly trendlines. Expected to be bearish untill october. May have a monthly trendline reversal soon. Upcoming weeks, neutral to bearish. Applied elliot wave analysis to measure wave lengths and identify major trends. Studied economic data of money supply M1 and M2 of USD, save ,EU M2, for eurodebt cris 2009-2014. There seems to...

Yields have increased and gold may pullback. If this happens, then USD and DXY, may have a retracement. Overall trend, according to elliot wave analysis is about to have a correction this upcoming week. The FED may change the trend, and increase wave 5 or decrease the correction.

See mars 2018. The motive waves share similarity in lenght. I predict TP1: -2,69%. Wave 5 will go up a bit, near to 9.5+. I think the process will happen with quicker speed. Elliot wave analysis, first correction 2021-06-12, wave a will start a sharp decline. First correction wave (a), may reach -2.45 or lower, at 2012-06-14 (tuesday). Prediction is based on one...