There are clear confirmations of bullish momentum on the 📈EURAUD: This is evident from the breakout above a resistance line in a bullish flag pattern and the formation of a confirmed change of character CHoCH on the 4-hour chart. I believe that the market is likely to sustain its upward movement, with the next resistance level seen at 1.7300.

I have seen another bullish pattern on the EURUSD pair, specifically an ascending triangle formation. The price has broken above the neckline of the pattern, indicating a strong bullish trend. There is a high likelihood that the price will continue to rise, with the next resistance level at 1.1016.

I spotted a great example of a bullish reversal on 📈US100. The index formed a double bottom pattern on a 4-hour chart and broke and closed above a resistance line of a descending channel. There is a positive response on retesting the key support level based on a broken neckline. It is expected that the index will continue to rise towards the 20,000 / 20180 levels.

I believe the 📉GBPCAD pair is showing signs of being overbought. On the 4-hour chart, there is a descending triangle pattern with the neckline being broken and a 4H candle closing below it. This could indicate a correctional movement coming soon. Targets for this correctional movement are at 1.8506 and 1.8446.

After reaching a new high of $3000, a psychological level, the Gold price started to consolidate within a horizontal channel on the 4-hour chart. To buy Gold this week, it is advisable to wait for a breakout above the channel's resistance, which could lead to a movement towards at least 3020. On the other hand, a bearish breakout below the channel's support...

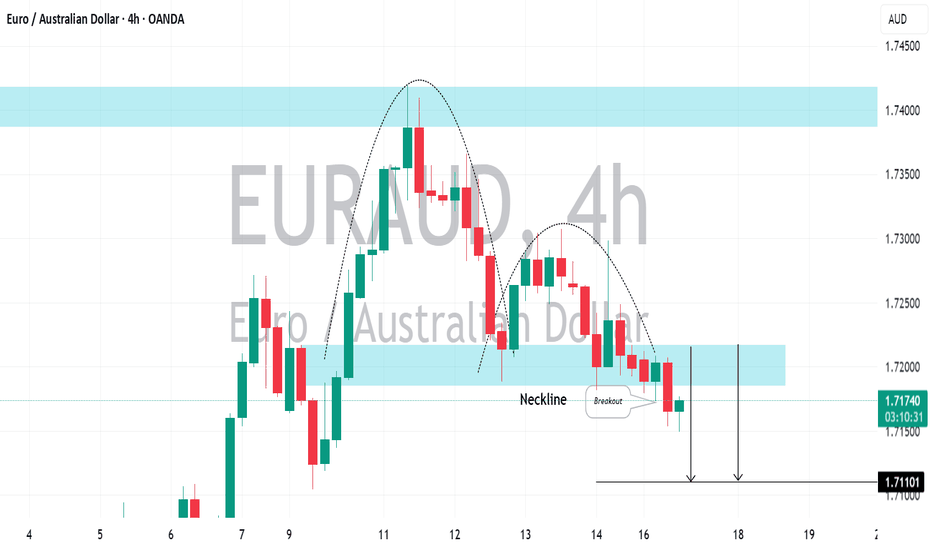

📉EURAUD has broken through and closed below an important horizontal support level during the day. The highlighted blue section also serves as the neckline for an inverted cup & handle pattern. This violation suggests that there may be further decreases in price. The next support level to watch for is at 1.7110.

It is likely that the CADCHF will retrace from the highlighted blue intraday support. Additionally, there is an ascending triangle pattern forming, along with a breakout of its neckline, which further supports this prediction. The target for this move is 0.6183.

📈Gold has been consolidating for over a week, remaining within a large horizontal range on a 4-hour chart. However, after the release of today's US fundamentals, the market appears to be bullish. Breaking through the resistance line of the range suggests a bullish accumulation has been completed, potentially leading to further growth. The next focus is on...

EURNZD is currently trading within a rising, expanding channel and recently reached a new higher high on a 4-hour timeframe, violating a significant horizontal resistance level. This could indicate a possible continuation of the upward trend towards the 1.920 resistance level. The best entry point to consider is within a demand zone formed by a broken...

As I expected, the Dollar Index decreased last week. Analyzing the price movements throughout the day, we can see further evidence of a strong downward trend. After consolidating within a horizontal range on a 4-hour chart, the price broke below its support level and closed below it. Sellers are showing their dominance once again, with a retest of the broken...

The EURGBP has shown a significant bullish pattern on the 4-hour chart. I have identified an ascending triangle, which is a bullish pattern indicating a break above its resistance level. There is now a contracting demand zone formed by a trend line and a broken horizontal structure. It is likely that the bulls will continue to drive prices higher in this scenario.

The price of 📉GOLD appears to be on a downward trend following a period of consolidation. A break below a support level within a sideways trading range is a strong indication of a continued decline. It is likely that the price will drop to the 2870 support level or lower.

Look at the price movement of 📈GBPCAD. Following a significant bullish movement, the price began to consolidate within a horizontal channel on a 4-hour chart. The breakout above the upper boundary of the channel, signifies a strong bullish trend continuation. The next level of resistance to watch for is at 1.8703.

Bitcoin is currently experiencing a downward trend on a daily basis. Following a period of consolidation within a horizontal range, the market broke below its support level and reached a new low. On retesting the broken structure, the market formed a symmetric triangle pattern. The breakout of the support line within this pattern indicates a strong confirmation...

📈USOIL may experience a reversal from an important daily support level. The formation of a cup & handle pattern and a breakout above its neckline on a 4-hour chart suggest that the price is likely to rise. The target price is 68.50.

📉NZDJPY formed a cute head & shoulders pattern on a key daily/Intraday horizontal resistance. A bearish breakout below the horizontal neckline indicates strong selling pressure and is a powerful bearish signal. It is likely that the pair will continue to decline and potentially reach a level of at least 83.83.

📈EURNZD is trading in a strong bullish trend on a 4H time frame. After a long period of bullish momentum, the pair started to trade within a sideways range for a while. The upper boundary of the range was breached today, indicating strong buying pressure. I believe that the uptrend may persist, leading the market to the 1.9030 level in the near future.

The 📉US500 appears to be in a bearish trend after breaking below a support line within a tight consolidation range on a 4-hour chart. It is likely that the price will continue to decline, with the next potential support level at 5,710.