lonelyPlayer0

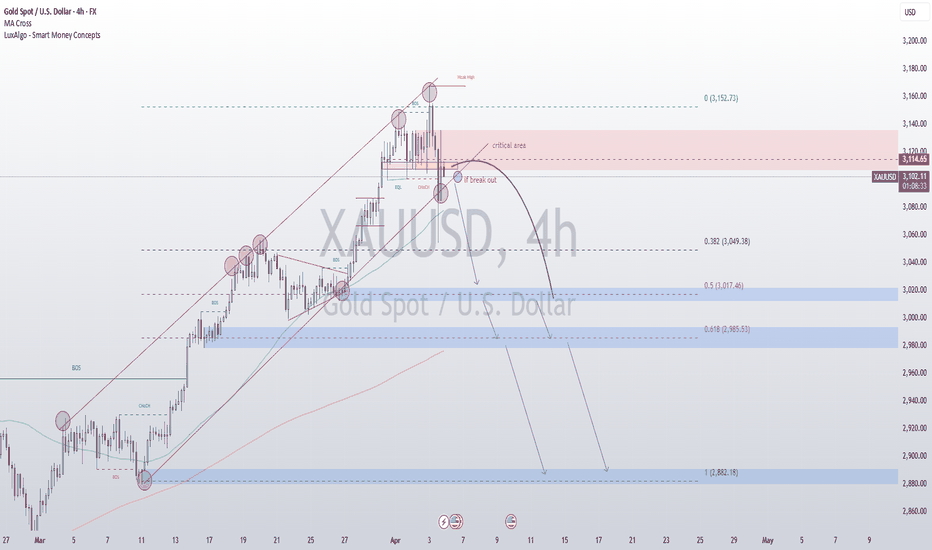

Gold's Bearish Outlook Continues Despite Temporary Upside Spike Market Overview: The overall outlook for gold remains bearish, even though the market recently experienced a surprising and sharp upward movement. While a deep correction was anticipated and in line with prior expectations, the nature and timing of the recent surge raised some eyebrows among...

Gold Surges Amid Global Uncertainty, Testing Key Resistance Gold has continued its impressive rebound, climbing steadily from its recent trough at $2,957 to reclaim territory above the psychological $3,000 mark. This upward momentum is being driven by a confluence of macroeconomic factors, including a softening US dollar and a pause in the previously relentless...

Gold on the Brink of a Downturn: A Shift in Market Sentiment Gold, once a shining symbol of financial security and prosperity, now finds itself on the cusp of a significant bearish turn. The precious metal, which has long been a safe haven for investors during times of economic uncertainty, is entering a new phase that could see its value dwindle in the face of...

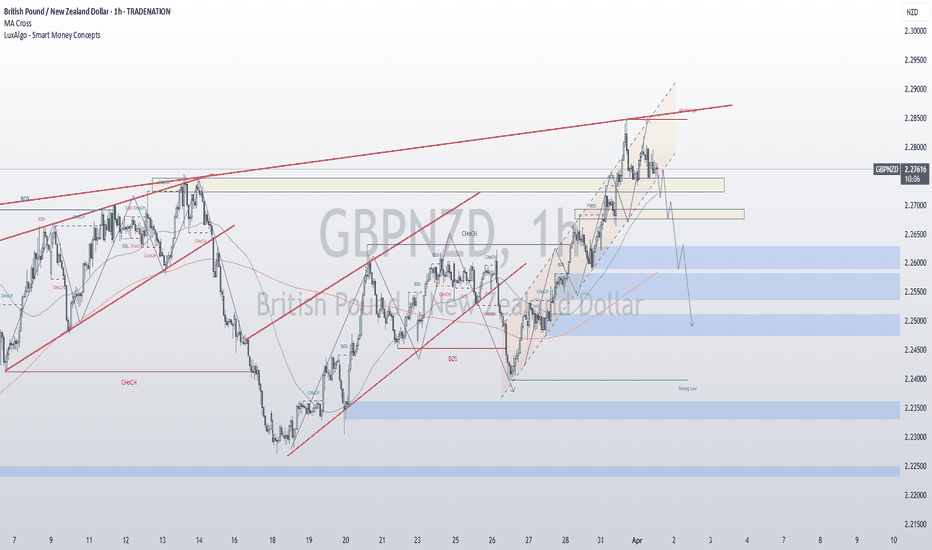

GBPNZD Approaching Key Resistance: A Closer Look at the Megaphone Pattern and Potential Reversal Zones The current price action of GBPNZD on the 1-hour chart reveals the formation of a prominent megaphone pattern, a significant technical formation characterized by fluctuating price swings and widening ranges. This pattern, which often indicates increased market...

XAU/USD Technical and Fundamental Analysis: Preparing for Volatility Ahead of NFP The XAU/USD (Gold) market is currently facing a pivotal moment, with the price nearing key resistance after a false breakdown below the 2895 mark. This false breakdown, a move that initially suggested a bearish continuation, has ultimately proven to be a temporary setback, setting...

Fundamental Factors Driving Gold Prices 1. Record Highs and Investor Sentiment Gold is currently trading near its all-time high of $2,956, a level that represents a key psychological threshold for market participants. The fact that the price has not seen significant rejection from these highs suggests that the bullish momentum remains strong, but investors are...

Gold (XAU/USD) Outlook: Navigating Key Support Amid Economic Uncertainty Gold prices remain in a bullish trend, rebounding from previously tested trend support and signaling a potential upside continuation. The metal’s safe-haven appeal remains intact as global economic uncertainties persist, driving investor interest. However, market sentiment is influenced by...

XAU/USD: Gold Eyes New Highs as Market Dynamics Align for Further Upside Gold (XAU/USD) is once again testing its all-time high (ATH), a critical technical level that historically increases the probability of continued upward momentum. With the psychological 3000 level gradually coming into focus, the market remains on edge, closely monitoring key economic data...

EUR/USD: Eyeing a Breakout Amid Dollar Weakness The EUR/USD pair is navigating a critical juncture as it attempts to capitalize on the ongoing correction in the U.S. dollar. After a prolonged period of downward pressure, the price is now testing a crucial resistance level, hinting at the possibility of a breakout that could pave the way for renewed bullish...

Gold Market Outlook: Northbound Momentum Persists Amid Inflation and Trade Concerns XAU/USD Rebounds from Inflation Shock, Poised for Further Gains Following a temporary shakeout triggered by inflation data, gold (XAU/USD) has regained its bullish momentum, reinforcing the narrative of an ongoing uptrend. The precious metal demonstrated remarkable resilience,...

Gold at a Crossroads: Awaiting Key Triggers XAUUSD is navigating a critical juncture, testing a pivotal risk zone that could dictate its next major move. From this level, we either witness a trend continuation or a deeper corrective phase. Key Drivers: CPI Data & Policy Uncertainty All eyes are on the upcoming US CPI report, which could inject fresh momentum...

Gold is currently navigating a critical phase of correction, gradually transitioning from a previously bullish market structure toward a more bearish outlook. This shift is primarily driven by increased selling pressure, spurred by the rising strength of the US dollar. The demand for the dollar is growing due to heightened global concerns over trade policies,...

XAU/USD: Navigating Uncertain Currents Amid Resistance Challenges Gold (XAU/USD) has been navigating a phase of consolidation while steadily creeping toward the critical resistance level at 2667. This level stands as a psychological and technical barrier, and the market seems poised for a decisive moment. The current upward trajectory suggests a potential...

Gold Market Analysis: A Balancing Act Between Uncertainty and Opportunity Gold (XAU/USD) currently finds itself at a crossroads, consolidating just above the critical level of 2645 while attempting to breach the formidable resistance at 2664. The market is rife with uncertainty, with downside risks looming large. A liquidity grab could very well trigger a sharp...

USD/JPY: A Strategic Pause Before the Next Bullish Wave The USD/JPY currency pair is taking a breather, consolidating after a period of robust growth. This pause comes as a natural result of market dynamics, offering traders an opportunity to reflect on the underlying forces shaping the pair’s trajectory. The strengthening U.S. dollar, supported by a resilient...

XAUUSD Analysis: Navigating a Complex Gold Market Amid Volatility The XAUUSD pair is currently navigating a critical juncture as it tests key zones of interest within an ongoing counter-trend correction. This comes after successfully breaching a significant resistance level earlier. However, the broader market landscape remains challenging, with bearish sentiment...

Gold (XAU/USD): Consolidation in a Bearish Territory Amid Uncertainty The gold market has entered a consolidation phase, trading within a defined bearish range following a sharp sell-off on Wednesday. This pullback comes as the precious metal adjusts to a complex interplay of technical and fundamental factors, with current attention focused on the critical price...

PNUTUSDT → A Promising Reversal Ahead: Poised for 30-50% Growth in the Near Future PNUTUSDT is setting itself up for a potentially significant rebound, with the possibility of a 30-50% growth in the coming weeks. After experiencing a sharp and substantial drop (often referred to as a "dump"), the asset is now showing signs of a reversal, forming a bullish pattern...