on the higher timeframe the dollar index seems very bearish seeking a strong surport level before it embarks on an upward trajectory as indicated on my technical analysis

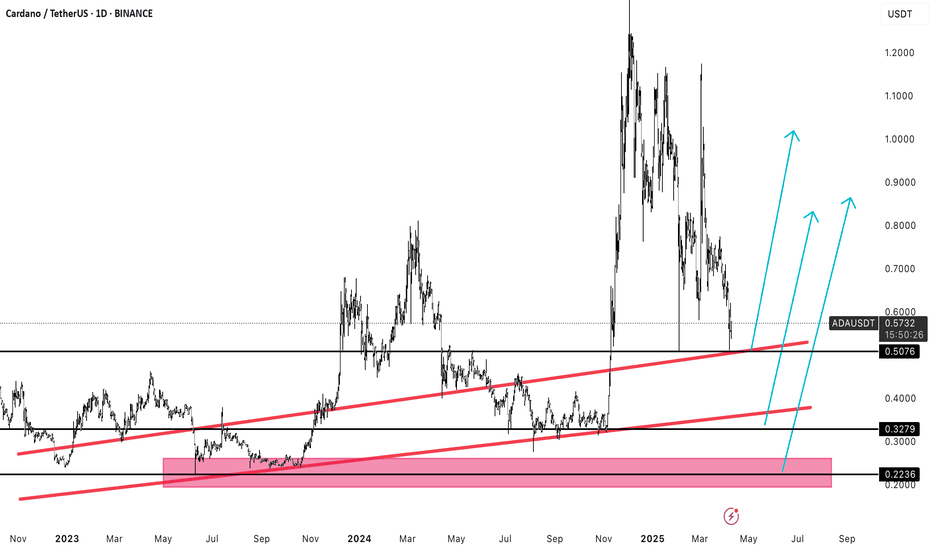

After the the recent price drop on most of the asset classes , i made my analysis and highlighted my key surpport zones where price is likely to respect and switch to an upward trajectory hence gaining a bullish momentum

After the recent american initiated trade wars most asset classes went on a sharp downward trajectory that included btc and the rest of the cryptos and alt coins. from my analysis i anticipate that btc is trying to drop towards the key surpport zones that i have highlighted on the chart ,then it should gain a solid bullish momentum from either of the zones.

i anticipate that dogecoin will continue dropping down to the key surport zones that i have highlighted on the chart, before it gains the bullish momentum within those key zones highlited.

the recent tariff wars have gotten most asset classes to drop hard . in this regard i anticipate xrp to define a solid surpport zone within the key zone s i have highlited , so that it can gain back the initial bullish momentum as it was earlier this year

after the recent tariff wars , which mostly began in america , most asset classes plumeted, so my anticipation is that solana will pick up an upward trajectory from the key zones i have highlited.

price is headed to a key supply zone ,so technically ill be looking out to go short on EJ ,the pair has a potential of dropping 500pips

this is just a follow up post on this initially called EG set up. Price decided to respect the zone, I've placed my breakeven appropriately . initial setup attached.

price seems to have respected a key demand zone , buyers may take over the market to the upside .

i can see price pumping up to meet the nearest significant supply zone, be the bears can dominate the market.

AUD has been oversold in the past three weeks. i was able to ride the downtrend . bulls are now slowly taking dominance

price may retest the supply zone highlighted before letting the bears to take control of the direction

potential buy on the euro , since price is at a key demand zone

I'm looking for price to rally to the upside to the next nearest supply zone, then go in for short positions next week's premarket analysis.

Gold overbought throughout the week at the same pace that the dollar index had been oversold. Next week if gold respects the current supply zone. I will maintain a bearish bias for the week. during that week's market open, price is likely to retest the key supply zone multiple times, I'll be looking out for price to respect the zone or breakout. patience will be...