lukanos

Retail trader data shows 77.5% of traders are net-long with the ratio of traders long to short at 3.44 to 1. The number of traders net-long is 0.3% lower than yesterday and 6.6% higher from last week, while the number of traders net-short is 2.7% lower than yesterday and 6.4% lower from last week. I typically take a contrarian view to crowd sentiment, and the...

We can see a prominent bullish pinbar on the weekly chart which had a high-low range of 4.7%. The last time we saw a reversal candle of this magnitude was the bullish hammer in November 2016, which marked the beginning of a rally spanning over 19%. That’s not to say that the cross is poised for a double-digit return from here, but the bull-camp will likely take...

Retail trader data shows 54.2% of traders are net-long with the ratio of traders long to short at 1.18 to 1. The number of traders net-long is 20.5% lower than yesterday and 21.0% higher from last week, while the number of traders net-short is 27.0% higher than yesterday and 14.4% lower from last week. I typically take a contrarian view to crowd sentiment, and...

After rejection of going down, it follows the strong move up and now we need to wait on which side will be breakout. I always use H1 and M15 for execution. The move up is more favorable but also 90% of retail traders are watching the move up so i prefer the contrarian trade. Retail trader data shows 76.5% of traders are net-long with the ratio of traders long to...

Retail trader data shows 59.4% of traders are net-long with the ratio of traders long to short at 1.47 to 1. In fact, traders have remained net-long since Dec 18 when USDJPY traded near 112.517; price has moved 1.6% lower since then. The number of traders net-long is 0.4% higher than yesterday and 3.6% lower from last week, while the number of traders net-short is...

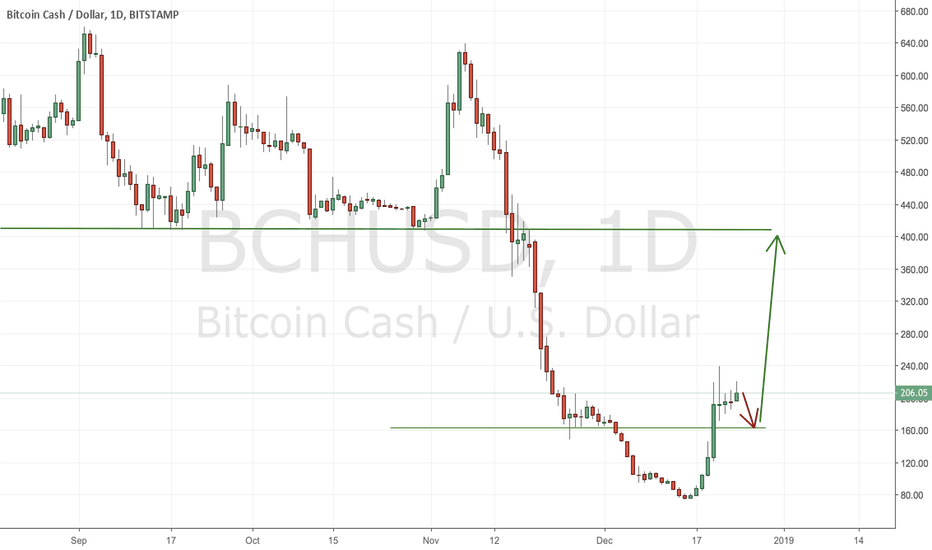

Bitcoin, the first largest cryptocurrency, has had it rough since it reached its peak at $19,500. After the 2017 December to 2018 January frenzy ended, everyone was expecting BTC to recover. Unfortunately, it didn’t recover and things only got worse. Right now, BTC is hovering above $4,000 and there is no saying when another bear grip will take the price below...

Retail trader data shows 75.0% of traders are net-long with the ratio of traders long to short at 2.99 to 1. The number of traders net-long is 2.5% lower than yesterday and 4.7% lower from last week, while the number of traders net-short is 3.8% higher than yesterday and 15.5% lower from last week. I typically take a contrarian view to crowd sentiment, and the...

IOTA is still in buyers territory on 4h chart. We expect the continuation in up trend but most digital currencies tend to follow the trend of Bitcoin – the biggest player, to the point that the value of Ethereum and other digital currencies are greatly influenced by the losses and gains of Bitcoin (BTC) in the market. . Sentiment can change really quick so we need...

Retail trader data shows 94.6% of traders are net-long with the ratio of traders long to short at 12.69 to 1. The number of traders net-long is 1.8% lower than yesterday and 1.9% higher from last week, while the number of traders net-short is 10.6% lower than yesterday and 40.4% lower from last week. I typically take a contrarian view to crowd sentiment, and the...

Retail trader data shows 84.9% of traders are net-long with the ratio of traders long to short at 5.61 to 1. The number of traders net-long is 4.4% lower than yesterday and 2.4% higher from last week, while the number of traders net-short is 45.3% higher than yesterday and 57.1% higher from last week. I typically take a contrarian view to crowd sentiment, and the...

We might see target at 1.14300 and appreciation in EUR. In such example i always wait that candle closed and then enter the trade if candle is above the green line. I will update the analysis.

If EUR/USD breaks bellow the 1. red line then our 1. Target is 2. red line which is also good support. Retail trader data shows 49.9% of traders are net-long with the ratio of traders short to long at 1.0 to 1. The number of traders net-long is 0.1% lower than yesterday and 32.5% lower from last week, while the number of traders net-short is 24.9% lower than...

Litecoin: Retail trader data shows 92.3% of traders are net-long with the ratio of traders long to short at 11.98 to 1. The number of traders net-long is 2.1% lower than yesterday and 1.8% higher from last week, while the number of traders net-short is 10.4% lower than yesterday and 40.3% lower from last week. I typically take a contrarian view to crowd...

Retail trader data shows 61.6% of traders are net-long with the ratio of traders long to short at 1.6 to 1. The number of traders net-long is 2.3% lower than yesterday and 37.3% higher from last week, while the number of traders net-short is 11.5% lower than yesterday and 48.2% lower from last week. I typically take a contrarian view to crowd sentiment, and the...

Retail trader data shows 72.8% of traders are net-long with the ratio of traders long to short at 2.68 to 1. The number of traders net-long is 3.1% lower than yesterday and 1.5% higher from last week, while the number of traders net-short is 5.4% lower than yesterday and 6.6% lower from last week. I typically take a contrarian view to crowd sentiment, and the fact...

Retail trader data shows 91.4% of traders are net-long with the ratio of traders long to short at 10.6 to 1. The percentage of traders net-long is now its highest since Nov 23 when Ether traded near 117.81. The number of traders net-long is 0.1% higher than yesterday and 0.8% higher from last week, while the number of traders net-short is 11.3% lower than...

Retail trader data shows 96.9% of traders are net-long with the ratio of traders long to short at 30.96 to 1. The number of traders net-long is 0.3% higher than yesterday and 0.3% lower from last week, while the number of traders net-short is 5.6% lower than yesterday and 5.6% lower from last week. I typically take a contrarian view to crowd sentiment, and the...

The commodity linked Canadian Dollar would rise in value as Oil prices rise, whilst the Safe haven YEN would depreciate as stock markets rise