lukemtesta

There was an error on the fib level scaling in the previous post. Just updating the error

Playing around with some fibs are spotted some weird coincidences off the back of Michael Burrys 1850 estimate

a fun idea on spx for future reference - lets see how it plays out

will btc hit this theoretical trend line and bottom at 11.5k? Perhaps we are in wave 4. 2-3 months per wave

Short video brainstorming some ideas about volatility, its impact on technical analysis and brownian motion (random walks)

Extension on darobstas parabolic trendlines which held true from 2018 to 2022.

General view of the current market as the US10Y-US02Y flirts with a negative cross over. US yield curve leading recessions SPX fib channel & 4-year MAs SPX vs BTC capm BTC falling wedges crypto market inheriting BTC TA behaviour

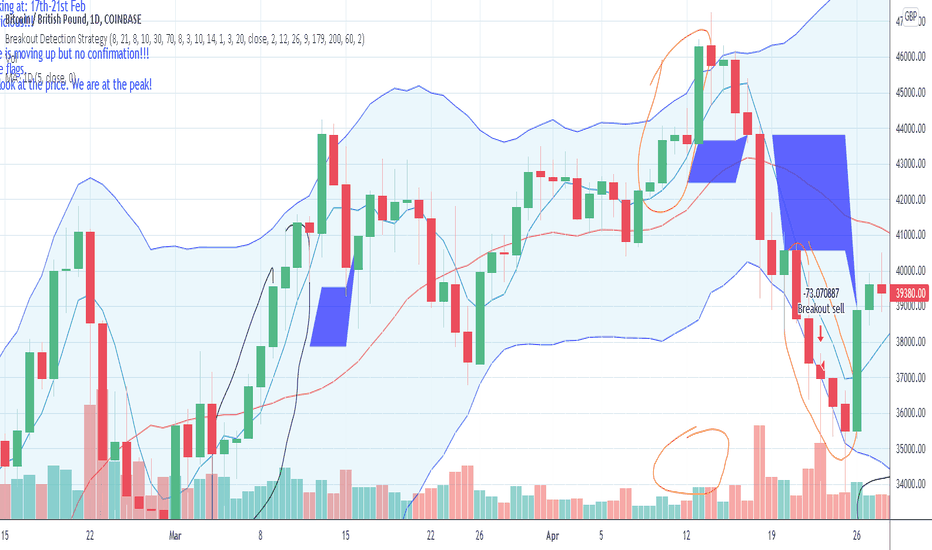

In this video I discuss using the concept of supply & demand in-conjunction with gradient rate of change to find peaks in trends for take profit.

Brief look at the macro economic climate, specifically at the US 10-year treasury yields, the US spending power, US large caps & crypto

Recently my automated system has been signalling a few alts. When I went into to check the chart patterns, I saw the same fib behaviours again and again. In this video I demonstrate some new ideas and predictions for bitcoin and the alt market.

In this video I do a live analysis on a cryptocurrency ticker signalled by my automated trading algorithm. I use breakout, volume and wave analysis to look for patterns in the ticker, and check its regression analysis against BTC and SPX to ensure its a safe hedge against corrections.

Today I will expand on: I will use the 50-MA trailing stop to paper trade the Supply & Demand strategy outlined in part 1. We then run a monte carlo simulation for back testing and calculate the profit metrics to see if this strategy is profitable. 1-7:30 mins: Why TradingView backtest can be bad and how to gather your trading data. 10.30mins - end:...

Today I will expand on this post: www.reddit.com I will use the concept of Supply & Demand and Risk-to-Reward from previous videos to... (1) Validate whether supply and demand can be used to create a trading strategy (2) Find a method to apply dynamic stop loses (3) Discussion into position size 1-5:30 mins: Background into supply & demand:...

In this video I explain three different types of trading systems: Trend followers, Scalpers and Retracers. I explain concepts such as Risk:Reward, bet expectancy, position sizing and how to compare them. This is the first of a two part video on designing trading systems. In the second part, I will apply these concepts to some TA strategies such as 200-DMA, MA...

Fibonacci lines drawn from Q1 2018 to Q1 2019 forecasted almost every market reversal from Q2 2019 to Q1 2022. I also discuss how 2017 and 2021 played out in elliott waves

Here I talk about how you can use the foreign markets to as a leading or lagging indicator for cryptocurrency price moves, how to quantify it with regression and analysis, and what that means for the alt market.

I'm super long on gold. Perfect setup for Stan Weinsteins trading setup - Mansfield RSI, multiple testing of resistance (5 times + breakout). Breaking out of statistical range & increasing demanding on volume to validate.

Small presentation on what supply & demand is and how to use volume to anticipate where the market might move. Part 2: