From the bottom left of the chart, we see the price move upwards to form a Wave 1(Green) then a 2(Green). It is important to note that this Wave 2(Green) was a Zigzag correction. This means we should expect a Flat Correction for Wave 4(Green). Wave 3(Green) is long and goes beyond the 161.8% Fib. level, and this normal expressive behaviour for Waves. Our Wave...

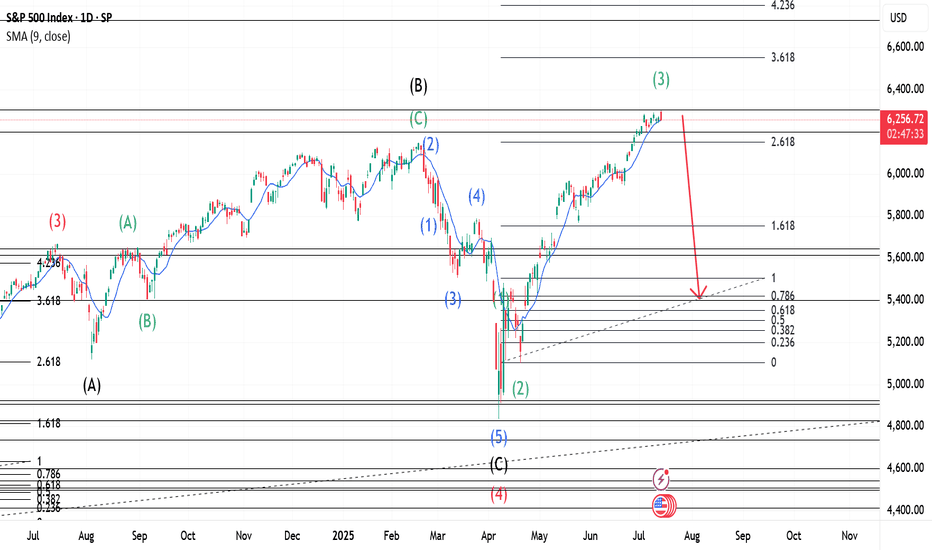

This is a continuation of a Weekly chart that I had previously posted. Our Wave 2(Red) was a Zigzag and the expectation is a Flat for Wave 4(Red) which we see occurred. Since Wave 4(Red) completed, a Wave 5(Red) was triggered. We can expect our Wave 5 to express itself in 5 Waves just like any other Wave. We can observe that our Wave 2(Green) was a Flat and we can...

Wave 2(Blue) was a Zigzag and we should expect a Flat for Wave 4(Blue). After Wave 3(Blue) completes, a lunge to the downside occurs and this is our Wave A of the Flat. We are on the Wave B(Black) of a Flat as Wave A(Black) has already completed. Our Wave B(Black) should go beyond the end of Wave 3(Blue) since it is a Flat.

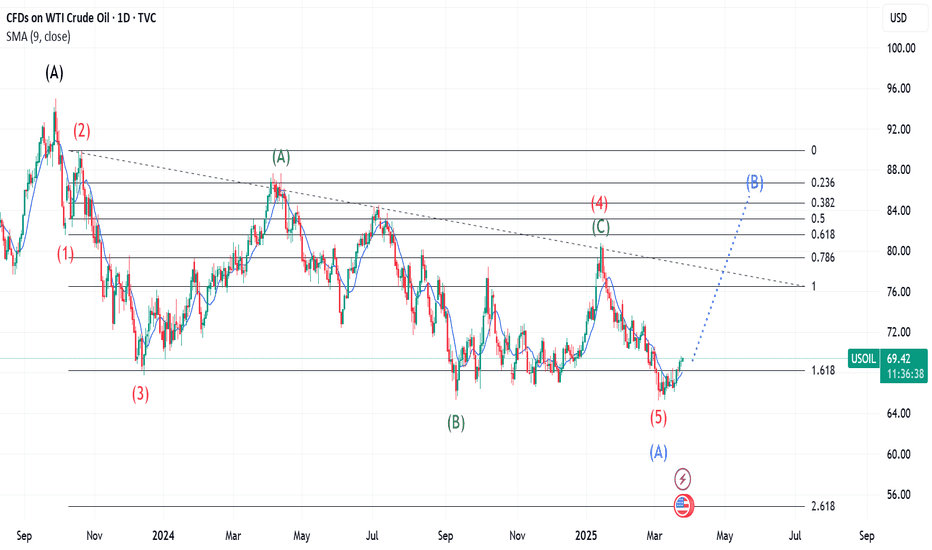

We are currently on a Flat correction shown in Blue of a Zigzag which has its first wave marked in Red. We should expect a Wave C(Blue) which would be Wave B(Red), then a continuation to the upside.

We are currently on a Wave 5 that started when Wave 4(Red) completed. This 5th Wave expresses itself in 5 waves that are shown in Black. Our Wave 2 was a Zigzag and and we should expect a Flat correction for our Wave 4. When Wave 3 is complete an A Wave retests on the 261.8% Fib. level. Wave B goes beyond the end of Wave 3 and retests the confirms at the 423.6%...

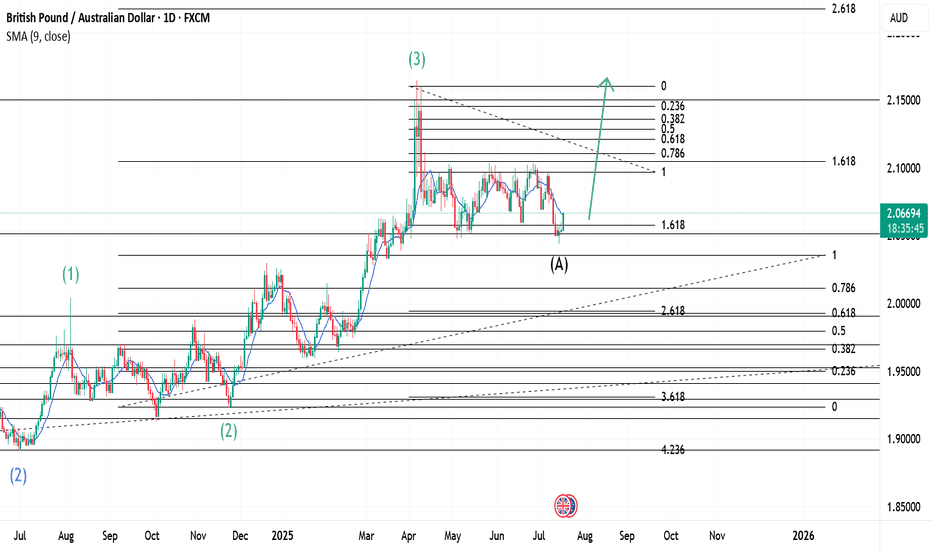

Our D1 chart is a continuation of a wave that started earlier and had a Flat correction for its Wave 2(Red), hence a Zigzag should be expected for our Wave 4(Red). When Wave 3(Red) completes, an aggressive selling move is triggered this is our Wave A(Black). A correction of this move occurs in the form of a Flat and this is now our Wave B(Black) of the major...

We are on the last 'leg' of an impulse move that should contain 5 Waves and is marked in Red. After Wave 1(Red) completed, we witnessed a Zigzag correction for Wave 2(Red). This means we should expect a Flat correction for Wave 4(Red). Wave 3(Red) is extended to the 361.8% Fib. level and this is very normal for both impulse and corrective waves. When Wave 3 (Red)...

Analysis shows that the Wave 3(Black) correction is a Flat because Wave 2(Black) was a Zigzag. From the ending of Wave 3(Black), we see a shallow Wave A(Blue) forming. This is our first Wave of the 3 move correction. From A(Blue), another 3 wave move MUST occur and must go beyond the ending of Wave 3(Black) as seen. The correction of Wave A(Blue) is marked by an...

Wave 2(Green) was a Zigzag and we should expect a Flat correction for a Wave 4. An A Wave forms shortly after Wave 3 was formed and a Wave B should follow. B's have 3 waves-- two impulses and one corrective-- and in this case Wave A was a simple Wave that was corrected by a Flat for B(Black). Our last impulse is a 5 Wave move and is marked in Black. We are...

The market drops to the 61.8% Fib and a confirmation would trigger the last wave of Wave B. All other analysis remains the same as earlier posted. This is just an update.

Our Green Wave 2 was a Flat and we could expect a Zigzag for the 4th Wave(Green). Zigzags have 3 waves just as Flats but they do not allow their B Waves to go beyond the previous impulse-- in our case Wave 3(Green). A retest and confirmation at the 161.8% Fib would trigger a Wave C(Red) and on its completion, would be named B(Black). A retest around the Fib 261.8%...

The structure seen is a 5 Wave move and is part of a B(3 Wave structure) of a Flat marked in Black. In this 5 Wave move marked in Red we can see that Wave 2 was a Zigzag, meaning our Wave 4 would be a Flat. Wave 3 hits the 161.8% mark and moves back to form an A of the Flat marked in Green. B must be a 3 Wave move and must move beyond the ending of 3(Red). When...

We are in the Wave B of Flat that started in late April 2024, and from the rules of Elliott Wave, B must have 3 waves(two impulses and one corrective). The first impulse is marked in Green as Wave A. Wave B(Green) is the correction that comes inbetween the two impulses and is a Zigzag. Our last impulse unravels in a 5-Wave move and is marked in Blue.Wave 2 of this...

My reasoning; Wave 2 of the Wave was a Zigzag from the weekly time frame, and as per the rules, Zigzags must be followed by Flats in any correction-- meaning our Wave 4 must be a Flat. Indeed, Wave 4 is a Flat, seen clearly in the daily time frame and it begins after Wave 3(in Black), with a three wave move that is not deep enough to be a correction. This is...

A 5 Wave move to the upside started around mid October 2022. Wave 2 was a Zigzag and 4 should be a Flat as per the rules. Indeed Wave 4 is a Flat and we are currently on Wave B of the Flat marked in Black. As we know, Wave B of a Flat MUST have 3 Waves(Two impulse and one corrective) marked as A,B,C(all in Green) and we are on the last Wave(C) of Wave B. A retest...

We are currently in the Development of a massive Flat after Wave 5(Green) hence Wave 3(Black) ended. Wave A(Red) followed and a Wave B(Red) is in the works. Wave B of a Flat has 3 Waves, two of which are impulse and one is corrective. The last wave of the three waves must go beyond the Wave 3. In this case our Wave 3 is marked in Black. Back to our Wave B of the...

Marked in Blue is the Main Wave. This wave expressed itself in 5 Waves. Though incomplete at the moment, we can see that Wave 4 is completed and a lunge to the upside would complete Wave 5(Red), hence Wave 3(Blue) of the Main Wave. After 3(Blue) is complete, a Wave A would begin for the Flat as a Wave 4(Blue). How do I know it would be a Flat? Because Wave 2(Blue)...

A complete 5 Wave move marked in Brown ended in confirmation at the 261.8% and 161.8% Fib levels. We can expect a buying move to the 361.8% Fib to complete the 5th Wave. Keep in mind that is the last Wave of a B(Green) of a Flat. What follows after that is a Wave C. The Elliott Wave is the map and compass of the Market and this is one clear example.