maikisch

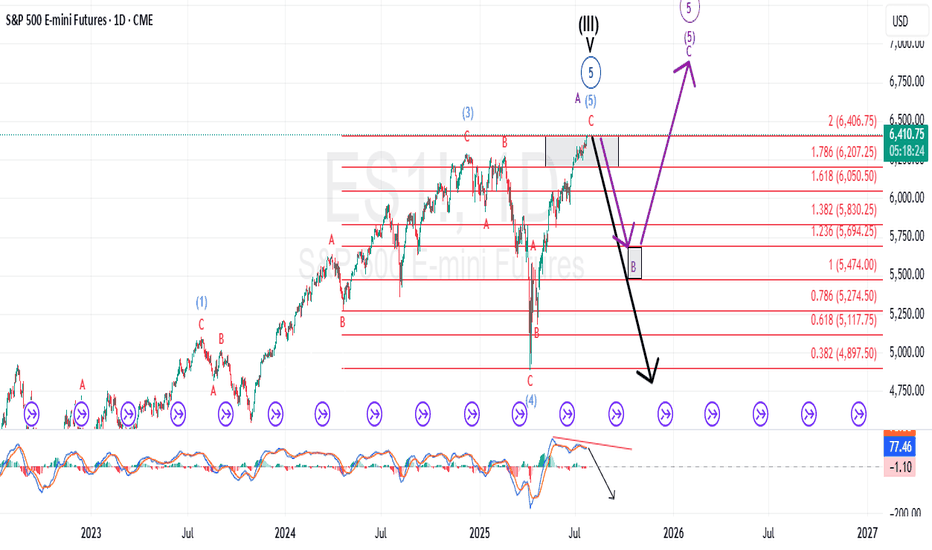

PlusEvery so often, a market move defies conventional expectations of retracement—and the rally off the Liberation Day lows is exactly that. It’s extended longer and climbed higher than even the most bullish forecasts imagined in early April. No one remembers the calls for an imminent recession by most large Wall Street firms. Now, we're pushing into yet another...

The last time I updated followers of my work; I stated that the pattern was advancing, but NOT with confidence, and that it is marked with choppy, overlapping price action that appears to be an ending diagonal. Those sentiments have not changed. However, what has changed is I was forecasting a more pronounced drop first before getting to new highs. It is now...

Since mid-last month, the broader equity market has been grinding higher — but not with confidence. The advance has been marked by choppy, overlapping price action that feels more hesitant than bullish. Yes, prices continue carving out higher highs and higher lows, but MACD momentum tells a different story. With every push upward, the MACD weakens, flashing...

While the futures market has yet to break into new all-time high territory, the previously discussed bearish micro setup has now been invalidated. In its place, we’re witnessing a complex, overlapping advance—creeping steadily toward the prior highs in the S&P 500 (ES). At the micro level, I currently see no compelling bearish setup. However, this grinding upward...

I am tracking a micro pattern with the new local high made in the ES last night and today's price action as a micro 5-down....we should get a slight retrace into the 5960 ish area. Maybe tomorrow...maybe in the overnight session tonight. If price can then breach todays micro low of 5884 in the ES futures...we need to then follow through with a breach of 5857 to...

My last market update ended up receiving a comment from a Trading View user that seemingly was mocking the fact that my shorter-term chart posted in an update to my followers had directional arrows down to the approximate area of ES 4400. Here's my longer-term expectations. If some didn't like 4400, I suspect they will equally dislike sub-ES 1,000. Best to all. Chris

In my last post…” We Have a Full Pattern into The Target Box” … I stated, “I am now looking for a 5-wave pattern to develop to the downside, followed by a 3-wave retrace, that in the coming weeks can take us back out of the target box to the downside.” That pattern may have begun today in the very micro sense. This is very preliminary, so we need follow through to...

I am now looking for a 5-wave pattern to develop to the downside, followed by a 3-wave retrace, that in the coming weeks can take us back out of the Target box to the downside. Price must breach the 5578 area to give us any indication the pattern to the upside below is cracking.

So far, our minor B wave price action has not thrown us any curveballs, which is somewhat unusual considering B waves can become very complex. As I get into the micro price action, this pattern would fit better completed with at least one more high. Nonetheless, I will offer a warning, we are in the target box...if you are long, please use stops, and make sure...

As per the individual stocks I cover that have not yet reached their ideal retracement areas I am looking for the SPX to get higher into my target box. In any event it's reasonable for me to say we're in a B wave and therefore our pattern can develop into something more complex. Nonetheless, I am mainly looking for MACD to reach the zero line at the very...

I have been discussing the potential for a Super-Cycle wave (III) top in the US markets for the last couple years. To experience a wave (IV) of SUPERCYCLE PREPORTION, would be a consolidation of price action back to the 1929 stock market crash. The byproduct of this type of price action would be a decline of 50% or more (likely more) in the value of global stock...

In truth, the levels we're seeing this morning when the SPX cash market opens, I was not anticipating seeing till the 3rd quarter of this year. Mid last week, we had positive MACD divergences on the intraday charts and was setting up to be almost a textbook bottom. Nonetheless, the SPX cash market will not hold the must hold zone when it opens this morning. This...

Last week on one of my member live videos I pointed out to the attendees that European markets were currently at, or very close to their All-Time highs...whereas in the US, we've entered the technical definition of a stock market correction...(down 10%). If you're so inclined to Google an economic calendar, it also appears the economic metrics like CPI,...

In the days to come our initial pattern off the recent has the high probability to get into the 5850 area. Here I will be looking for a pullback. If this pullback can be viewed as corrective in it's structure then I expect the subdivisions and pathway on my ES4Hr chart should follow suit. However, if the pullback turns out to be impulsive, I will be looking for...

In the interest of full disclosure we have not even confirmed our minor A has in fact bottomed...but assuming we have struck a short term bottom, we are now embarking on a minor B wave retrace that I anticipate taking us into the start of summer. In any respect, I am viewing this as only a counter trend rally with a scary (c) of C of (A) to come into the low SPX...

Last week I posted an update on my SPX cash index analysis...found below. At the end of last week, we see where the price action has been filling in nicely as of Friday. Some key take-a-ways. First, is the price action has breached the area that I am counting as the wave 4 of one lesser degree. This would be an initial clue that the bull market pattern that...

In lieu of such price action, we retain the ability to make one more low. In the very short term and observing the micro price action $11.79 could extend our black wave (iv) but above $11.93 with price action to get above $12.50 and I start to lean on the purple count. Best to all, Chris

Lately the market has been confusing. It appears traders are not clear minded on the economy, the recently voted in administration's policies, and that uncertainty is definitely showing up in the price action. Be that as it may be, this is an update on the SPX cash index I posted last week as more of the price action fills in. I'll try to update this...