M/W/D are all bullish. Price can dip into discount, close the weekly FVG and get rejected from bullish 4H zones as marked inside the weekly OB+ Eventual target is the M+W upside liquidity Do note : there's a bearish breaker in formation after price rejected from the D OB-. However, since every timeframe is bullish, I would rather buy than sell. Wait for price...

Price on 4H has very recently rejected off a Daily bearish OB- and has formed a bearish OB- in the process. I look to trade that with a clear liquidity target of equal lows. The trade setup is invalidated if price dips below equal lows to collect liquidity before giving us an entry.

Price on 4H has very recently rejected off a Daily bullish OB+ and has formed a bullish mitigation block – which I intend to trade

There are very clearly visible daily order blocks on both side of the price. Wait for price to come to those zones and then look for rejection on a smaller time frame - then trade along.

2 potential areas to trade from for EURUSD for next week. M/W/D are all bullish. We want price to come to an area of discount before going long.

EURUSD just rejected from a weekly Rejection block and created a 4H breaker in the process. We look to sell when price comes back to mitigate the breaker.

Price tries to create a bearish breaker, fails, grabs liquidity from equal lows & runs back higher! Monthly / Weekly / Daily on ES1! (or SPY) are all bullish. This allows us to buy from area of a seemingly discounted zone.

Liquidity is building up on both sides of the price. Watch for a false breakouts!

Price grabbed liquidity on 4H and then dropped, creating a bearish breaker in the process. When price comes back to this breaker, we want to be a seller.

CADJPY just showed bullish sponsorship when the price ran into a Weekly FVG+ – and in the process, it created a 4H OB+ which we would like to trade. Upside targets are lots of equal highs.

M & W charts for AUDJPY are bullish. Daily chart just rejected from a Daily bullish Order block and created a 4H mitigation in the process. Trade idea - as price comes back to the 4H mitigation block, watch for any form of price rejection and then trade along. Confluences for the 4H mitigation+ block - in 50% discount area for the range - 4H mitigation+ is...

Monthly / Weekly / Daily + 4H analysis for E-mini SPY (ES1!). Order flow on all timeframes is bullish - hence expecting 38% trend rejection, or 4H bullish Fair Value Gaps or Order Blocks to hold in discount area. Wait for these areas to get tested - and trade only if you see a bullish sponsorship at these levels. Trade safely, apply good risk management & take...

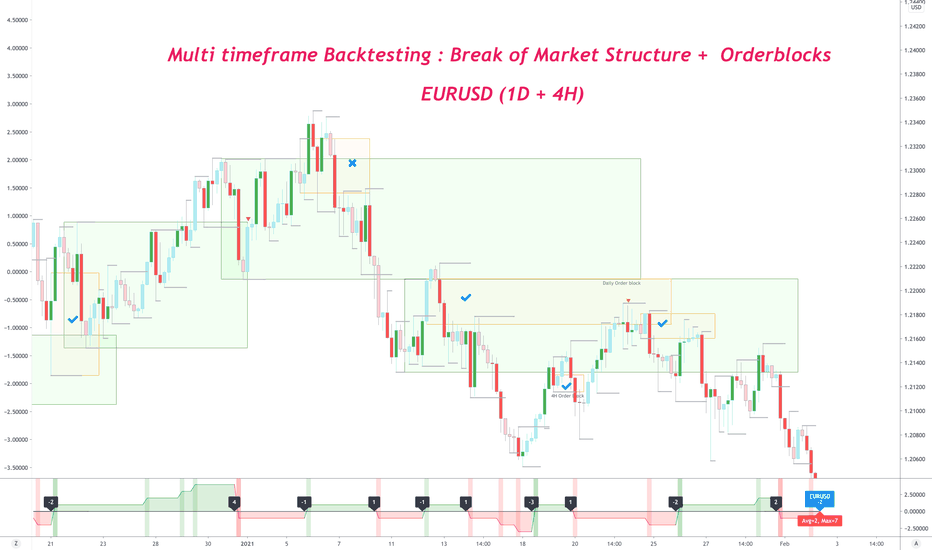

Strategy Create a zone from the order block which created break of market structure on 1D timeframe Wait for it to be tested on 4H timezone => which will create new 4H order block Trade the retest of that 4H order block Color coding & icon use Green boxes : 1D order block zone Yellow boxes : 4H order block zone Tick icon : Trade won on 4H Cross icon : Trade...

Price gapped up, trapping sellers => LONG trade

We all try to find the strategies which offer best possible win probabilities. Yet, we often overlook another crucial component of increasing your odds of winning => risk management. Today, I am going to show you how you can use a simple risk management trick to tilt the "Math" in your favor. Would you like to increase the output of your strategy by 25% without...

First a gap down, trapping longs Then a gap up, trapping shorts DXY / DX1! is certainly playing with traders. Note : USDXXX pairs have started moving up & XXXUSD pairs down. This should give an idea of where DXY will eventually go!

This Sunday, DXY / Dollar Index / DX1! gapped up, trapping a bunch of shorts. When price comes back to them, there's a high probability of them exiting - giving us a long trade!

![[Risk Management trick] Tilting the "Math" in your favor! EURUSD: [Risk Management trick] Tilting the "Math" in your favor!](https://s3.tradingview.com/a/aq9gfHHi_mid.png)