As noted in my previous analysis on the 26th September, KRC failed to close above $0.064 on the monthly and is on the way to test the intra-week lows of $0.044-$0.037. IF these areas hold, this month ill be looking to scale my buys in between $0.044-$0.037. Overall the R/R trade is appealing. Over the next 3 weeks, for the price to have any hope of going up...

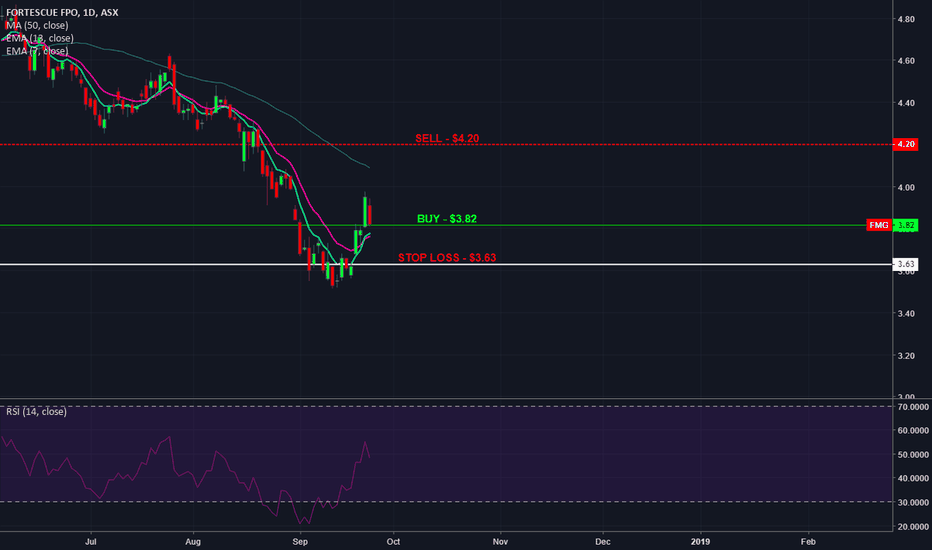

AS NOTED IN MY ANALYSIS LAST WEEK WHEN THE PRICE WAS AT $17.80 I EXPECTED A TEST OF THE SUPPORT AT $17.20, WHICH HAS BEEN HOLDING. IF YOU GOT IN AT $17.20 LAST WEEK, I BELIEVE THE R/R FOR A TRADE HERE IS GOOD. VARIOUS TRADE SETUPS ARE POSTED ON THE CHART. OUTSIDE OF A GOOD SWING TRADE, I BELIEVE THERE IS ALSO GOOD SCALPING OPPORTUNITIES ON THE DAILY, LOOK AT...

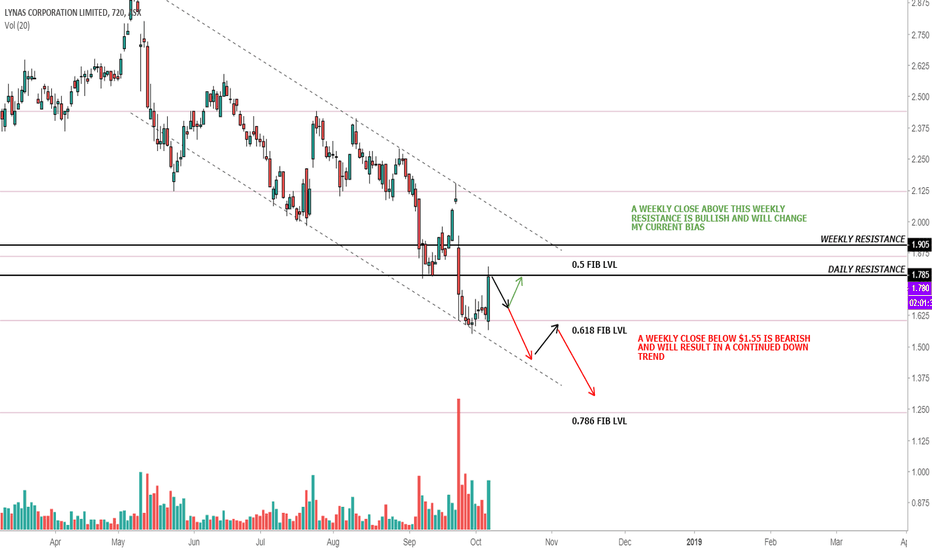

Update to the idea posted on 27 September. As expected and noted the $1.80 region got tested. Fundamentally nothing has changed, we are in a down trend and I still expect the price to go down to $1.425, at which point I will be scaling my long term buys in. This is not withstanding the fact that LYC is still a good swing trade option, as per my call last week...

MONTHLY IS OBVIOUSLY BEARISH DUE TO FUNDAMENTAL NEWS, FINDING SUPPORT ON THE 0.618 FIB LEVEL CURRENTLY. FUNDAMENTALLY A SAFETY REPORT OF LYNAS OPERATIONS IN MALAYSIA WILL BE RELEASED IN 3 MONTHS. WE SHOULD SEE SOME BUY PRESSURE AT THESE LEVELS NEXT WEEK BUT I EXPECT FURTHER DOWNSIDE TO THE 0.786 FIB REGION WHERE MAJOR SUPPORT IS. I BELIEVE THE REGION AROUND...

WE SEE THE PRICE BREAKING ABOVE THE PREVIOUS WEEK OPEN WHICH IS BULLISH. WAIT FOR THE RETEST OF $17.26. IF IT HOLDS, BUY. IF THIS LEVEL DOES NOT HOLD WAIT FOR RETEST OF $15.82. TO SEE IF THAT HOLDS

KRC seems to be complete market cycle and suggests a potential buy in the following months. I'd watch the monthly and coinciding weekly close to see what the price does. A close above $0.075 is bullish. A close between $0.075 and $0.064 is neutral. A close below $0.064 is bearish and will test the intra-week lows of $0.046 No trade zone for me, waiting for...

Ansell Cleaning: Trend indicates another push up to test ATH. Currently completing a 5th Wave. Wave 2 & 4 respected the .65 Fib levels. We see a long term trend being respected. A price gap from 5 weeks ago is yet to filled, expect the price to re-tested the $27.80 region. Two Setups available.

Significant increase in volume recently. Expecting significant moves over the next month. Stop Loss - 0.00181 T1 - 0.002850 T2 - 0.003500

REFER TO CHART FOR COMMENTS. TO 100% CONFIRM THE UPTREND WAIT FOR THE PRICE TO HAVE A WEEKLY CLOSE ABOVE THE 100DMA @ $9.50. ALTERNATIVELY BUY NOW AND SCALE ALL THE WAY TO $8.20 STOP LOSS AT $7.50. LOSS OF THE LONG TERM TREND LINE IS NO GOOD!!

Refer to chart for comments