This is why I have become a DeFi degen. From October of 2021 through June 2022, wFTM/GEIST LP token appreciated by 76,000%. That's a whopping 760X. $5k netted $3.8MM in 9 months.

Good relative strength, insider buying aggressively, breakout confirming consolidation/correction coming to an end and setting up an initial run to $86 for NASDAQ:MCHP

PTON has collapsed from the Covid highs around $170 to current level around $29. Short interest has been persistently rising since November of last year. This bounce on Monday could set of a chain of short coverings, which will probably put the stock on the radar of Wall Street Bets., which can be a catalyst in and of itself. There's a huge gap at $61 so if...

NYSE:WTI This is a nice set-up I trade aggressively. The bigger picture is a wide base, Head & Shoulder bottom. First break of the neckline was a head fake, as usual, the consolidation following the fake out is a tight falling wedge. I buy an initial line here and load up aggressively on a 2nd break above the neckline. NYSE:WTI

This is a great example how forward looking indicators, when used in conjunction, can provide the most accurate support and resistance levels. While most indicators are lagging, projection indicators that help define major price pivots are predictive. MRNA ran into the upper MSP boundaries and has been trading between the bands with TDS lines from prior signals...

Beginning to build lines in some names, AMD one of them. Solid bullish divergence and as this is a very high beta stock, any short term low in the markets will have the greatest impact here because correlations are tighter than I've seen. NASDAQ:AMD

Massive, textbook 2x bottom with equally symmetrical tight consolidation into a major trend reversal confirmation... Look at that volume.... Major target levels: $124 and $170 Minor target levels: $72, $82, $89

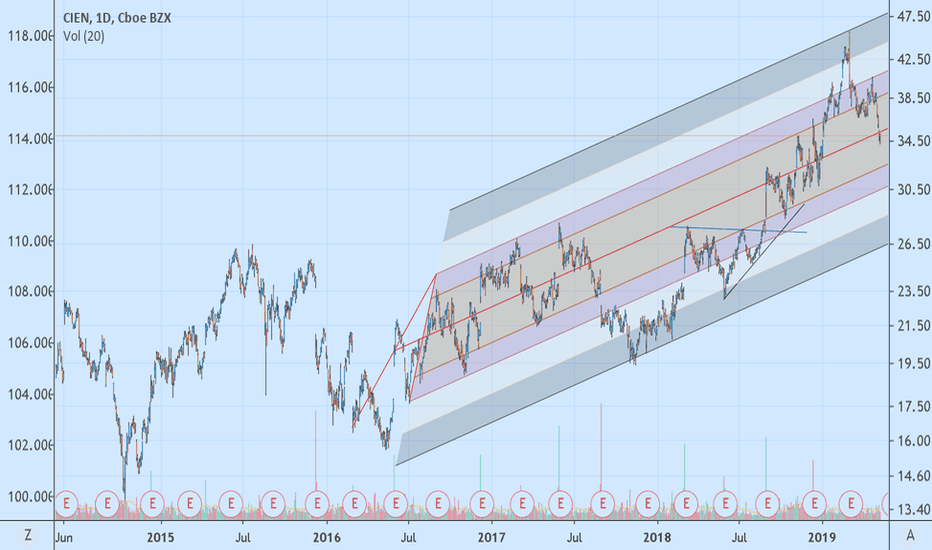

Although the short term signal is SHORT, look for a reversal to LONG around $31. When using Modified Pitchforks, it's important that the projected lines provide multi-sigma coverage of the linear regression slope. In the case of CIEN, a Modified Pitchfork from the 2017 lows provides almost perfect symmetry and gives the trader several levels to trade Ciena. ...

Excellent consolidation breakout from a pennant with confirming volume.

NASDAQ:EQIX Love this stock, growth potential is unstoppable, 20% corrections are great entry points, also falls on Fib Retracement line

With the direction decided, this will be a wonderful burst of volatility.

Stock is very strong relative to overall market. Closed September '15 gap on Tuesday's huge downside gap. The gap suspiciously followed a strong earnings number and a positive value deal announced. Institutional ownership very strong and a lot of fund money wants in but there's very little stock available. Tuesday's conspicuous gap to the downside is possibly a...

Massive long-term reversal, bullish sector development, benefiting from lower crude prices, improving earnings, yield plus capital upside. Trade at a very low Forward P/E. Long-term (9 month) target is 54.50