This is the explanation of supertrend I wish I had seen ages ago. Great trading tool, but with caveats.

Market Outlook Scenarios 1. Delayed Correction : Despite near-term volatility, markets reach new all-time highs before experiencing a significant correction. Bear market conditions likely emerge late 2025 or early 2026. 2. Imminent Downturn: Current downward momentum continues, approaching bear market territory (-20%). At that point, we'll need to reassess...

I wanted to build something less choppy and more actionable, so there you go.

Always hard to see which stage a stock is in. This is a tentative way to define it

I examine here some confluences and draw a hypothesis that AI is in a bear market and may remain in it for a bit longer.

I created this indicator to make life easier when using anchored VWAPs and ended up finding out that it's a no brainer.

This is the 4hr chart for SPX. The red dotted line is where the 200d SMA is sitting at the moment. Either we go through the SMA level and flip it to support for cheering Bulls or we complete that bear flag and continue the correction for cheering bears. That gap was rejected two times, including today. No bueno. What are you betting on? 🐂 vs 🐻

I examine the SPX and conclude the chances are higher than most people think

I examine the Qs and provide some key levels to watch.

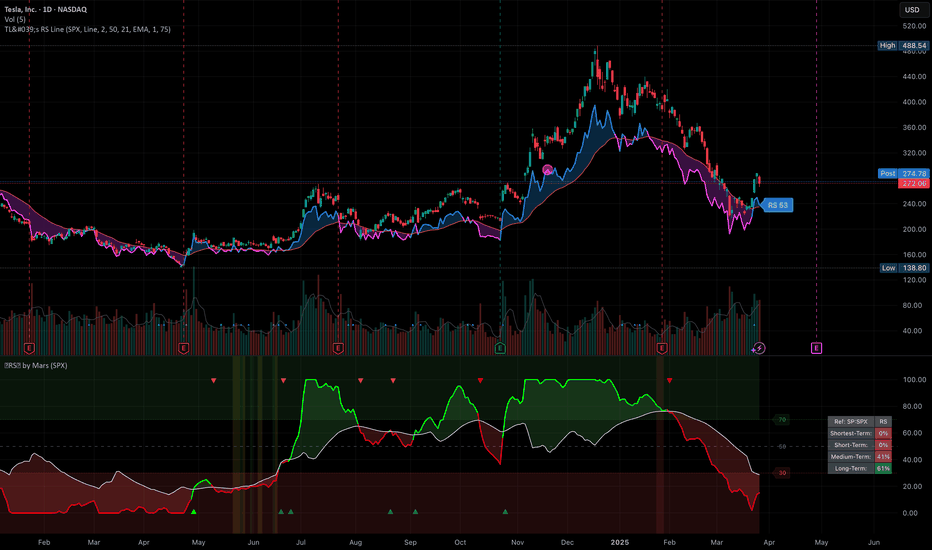

I examine the latest action which doesn't give me hope that it found a bottom just yet.

I will be watching this closely as it may be getting ready for a breakout

Bullish about the business, but the chart is really an ugly one.

Trying to remove the hard work of selecting multipliers for your anchored VWAPs, I came up with this idea of a AVWAP band and built an indicator for it.

I examine an interesting pattern on the monthly chart

I start from a naked chart and show you why I think we are going lower on the SPX.

Having as a background the video that I just shared about the SPX and the chance that we are in a controlled correction as opposed to a healthy pullback, I am raising stop losses in all my positions. Here's an example with HIMS.

This is a beautiful Cup & Handle pattern on a high quality GROWTH name. I say it reminds me of bitcoin because before BTC's last breakout we saw a very similar pattern. Wait for the breakout of that handle and enjoy the probable ride.

It might be a bit early to call this a bottom, especially given the unpredictable market, but I’m noticing a few key signals aligning: The 8/21 curl following a double bottom A break above the 50-day SMA occurring on a red day like today Momentum shifting positive and being released from a squeeze That said, stay cautious—this setup has tricked me before.