mhyoung00

Price has been dumping since Aug 2020, but we can see that it has formed a falling wedge, all along the last bull run. Price is currently near to the origin of the pump and we can see that price formed a base (1.845-1.67) above the previous Significant Resistance level. On top of that, we can see some manipulation on the 2.11 price point where price seemed to have...

Price held at the 1.35 support zone for the past 2 months and wasn't able to breakthrough (also potentially serving as the 2nd touch of a trendline) . As for now, we can see huge pump, breaking the previous bearish engulfing. Overall we can see that other REITs have showed upside movements as well. Ideal position would be a retest on the pump, but price may just...

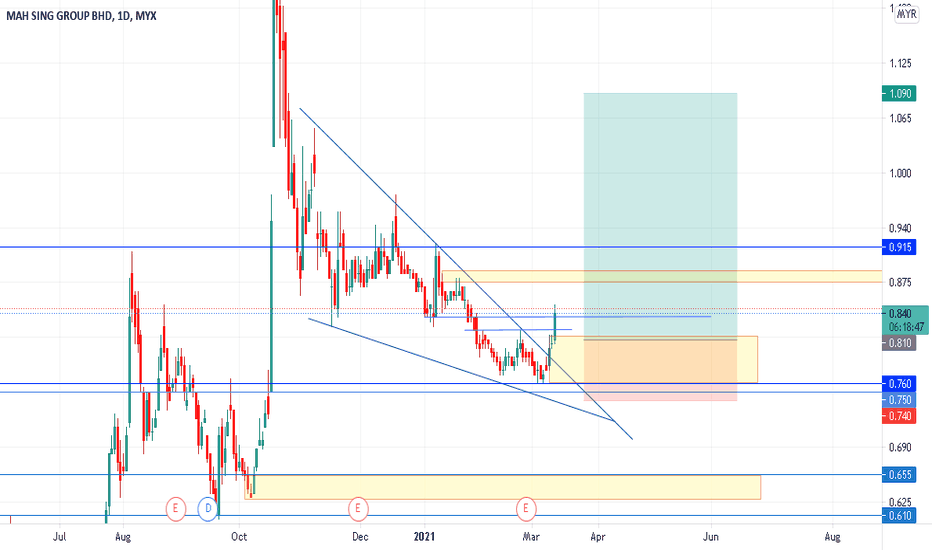

Huge compression (weekly), H4 bearish engulfing cancelled, price has made RBR in attempt to breakout alternative zone would be 0.655 onwards *DYOR on fundamentals MYX:MAHSING

Price has slowly formed into a symmetrical wedge (also a two-way compression here) since December and has made a mild break downwards. Yesterday, we can see some rejection on the 0.14 gap. Price likely to pump soon, still waiting for it to reach the nearest solid demand zone (0.125). Another potential entry zone would be 0.105 for a RBS setup. FIB levels matched...

several REITs have shown upside movements this week. Currently on IGB it has formed a ascending triangle, awaiting breakout and retest to make sure that its not a false break. *DYOR on fundamentals

Supply is currently compressed, H4 formed a Bullish Engulfing . Might see a breakout soon. Alternative scenario would be a triangle breakout to continue its bearish trend , making a new low. *DYOR on fundamentals.

Supply is currently compressed, might see a fake break on the multiple support line, towards the left shoulder level. Trend is overall bullish judging by the amount and size of bull candles. fib 161.8 matched for extra confluence. *DYOR on fundamentals. MYX:ECOWLD

Price recently broke out from a Weekly Wedge and immediately retested on a key level. It has also formed a bullish engulfing on H4 during the retest, and price is now retracing back to it. Fib 161.8 matched for extra confluence on first pullback zone. *DYOR on fundamentals.

Another possible re-entry zone in this big bear move if you've missed the first one. RnR of 1:4.5, possible to scale positions further down towards the next buying opportunity, depending on further price action as well.

As we can see, the candles have never been able to close past the 0.625 price point since 7/9/20. If we have a look at the monthly chart, we will see a big bull candle which we can mark as the anchor of the rally, aka dominant/anchor candle. During early January, a bullish engulfing was formed at the 0.635 price point on the weekly timeframe, followed by a retest...