miiroj

EssentialCracks in my system - Re entries and on weak swings. - If stopped out, the book stipulates, Don't take a re-entry. What did this kunt do with ETH last night? He re-entered a short. - Be content with a weekly 2%ROI objective The Leader says. What did I do? again, had more than the weekly objectives met and somehow found away to messing up. A note to myself. This...

I've had 3 in the last 3 weeks. Popcat *can't trace the ROI info* back in July. Hype -2.4ROI Eth -1.7ROI What's common with them? Chicken out on the first move and taking the second waves. Fear when I should be puling the trigger, Second attempts are hurting me.

Pengu broke a swing on the daily at equilibrium. I am interested in a long position if it retraces back to OTE.

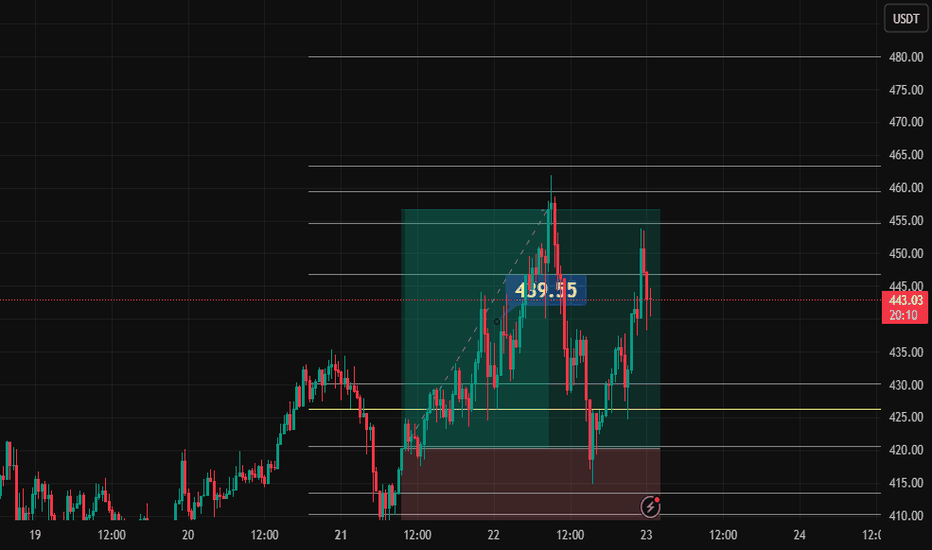

Looking for a retracement, we have double bottoms and double tops and then see London and NY trade to Sunday high.

Next major resistence if it forms a daily higher low is right into the trend Fib ex .62. Interesting to watch where ETH goes next.

As I waiting for a formation on a high probability short swing to form, Am looking to play a degen long into a short zone and short the market lower between Asian and London session. I won't have the same Idea for NY. If it trade NY, I will coin a thesis based on the close of London structure. Otherwise I might wait through Friday or the weekend or whenever for...

Whereas I have been a little single on my futures account, I earlier too a leverage position on hype and it's standing stronger than the spot positions I took over then weekend.

Like all the others, I am looking for a pump on virtual to grow that spot. If look closely, I fomo in. Let's see what happens in by the end of the week.

I got an entry on Fart. It traded below the last 20day DR and it could trade through external liquidity. I wanna use this opportunity to grow a 1/4 of my spot with this week's price action.

I am looking to grow my spot with a 10-20% move on wif this week if it takes the external liquidity. I took a position on yesterday when it traded at the equilibrium of the 2 day range

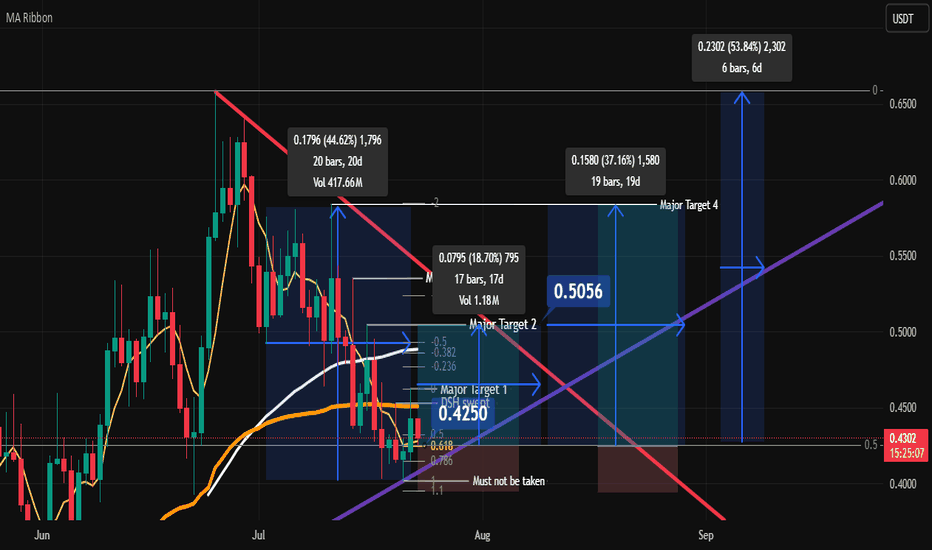

📘 Can SYRUP Do 18% in 18 Days? Or 37% in 40? Spot Trade Journal Entry: $0.4250 Target 1: $0.50 (+18%) Target 2: $0.5830 (+37%) Target 3 (Grand Slam): $0.6575 (+50%) 🧠 Idea Behind the Trade “1% a day can change my life.” Holding goal: 18% in 18 days, or 30–40% in 40 days Possible extended hold: 50% in 60–90 days ✅ Entry Confluences ✅ Daily close above 5-day...

Well, I have my SPOT chips on that. I wanna hold on to that in the next 15 days. That is Untill 7th August.

Will London or NY bring Virtual to me at .618, 10PM-Midnight - My trading window? If it happens, I won't look at any other pairs.

1% a day can near 400% my life. I Spot Longed BTC looking for a 1% up, might take awhile but, BTC is king, I will wait. and when it hits, a couple of memes have retraced on the daily, I will be looking for more riskier memes for a higher %pump.

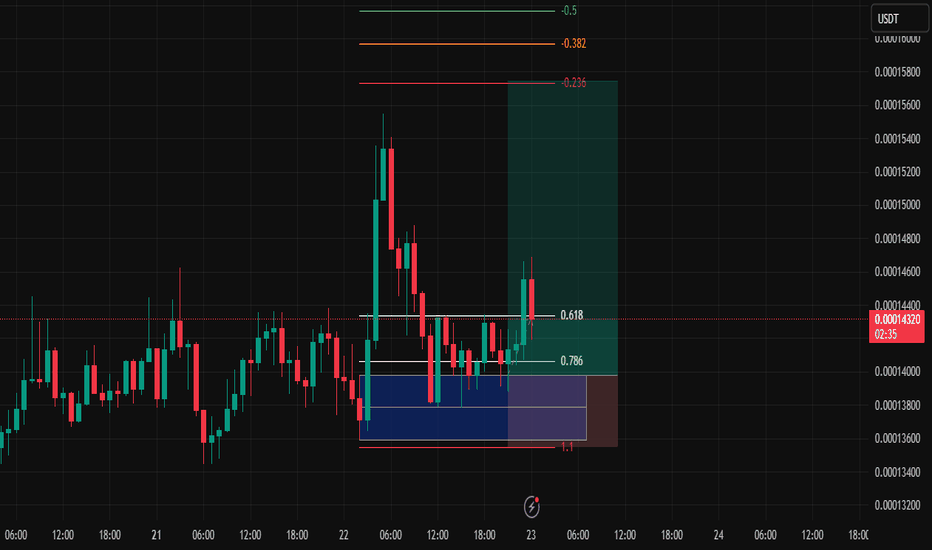

📘 Week 2 – Trade #4 Strategy Journal | Futures Account** Asset: \ BINANCE:FLOKIUSDT Timeframe**: 1H Entry Type**: Order Block (below the 0.786) --- 🧭 Context This is Day 4 of my live journaling and strategy publishing process. Normally, I don’t trade on Mondays or weekends—but recent schedule shifts had me checking the charts over the weekend and saw some...

Trade Journal – TAO, Pengu & the Elusive HYPE Date 23/7/2025 I don’t trade on Mondays—by design. But today, I honored that discipline *mostly*… with a few strategic pivots. TAO: First Move, First Lesson I took TAO on Spot early Monday, planning to hold until weekend highs. My bias? After that weekend pump, I expected Monday’s session to seek out those...

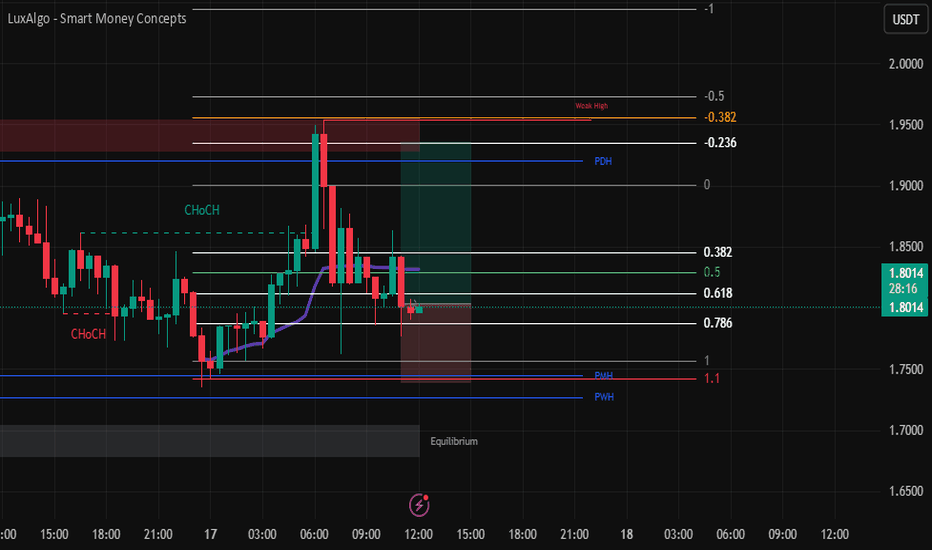

📘 Daily Trade Journal – Thursday, July 17 1. Trade Overview - Asset:-SPX - Direction:** Long - Entry Time:** After 10:00 p.m. (Vietnam Time) - Timeframes Used:** 1H, 30m - Bias Origin:** Bullish market structure continuation with recent change of character --- 2. Trade Idea (Before Entry) I came to the charts shortly after 10:00 p.m. PopCat had just wicked...