Wheat futures (ZW) have cleared a zone of resistance with a 4.6% one day move. As tracked by the WEAT ETF, current price seems to be heading for a retest of the 200 Daily SMA (currently at $4.90). The 200 Daily SMA has reversed previous attempts to break out in October 2024 and February 2025. Will third time be different? Note that this ETF reached a high over...

Wheat futures (ZW) have cleared a zone of resistance with a 4.6% one day move. As tracked by the WEAT ETF, current price seems to be heading for a retest of the 200 Daily SMA (currently at $4.90). The 200 Daily SMA has reversed previous attempts to break out in October 2024 and February 2025. Will third time be different? Note that this ETF reached a high...

Closing UNG short at 9.1% profit. UNG has dropped to an area that may provide some support for a period of consolidation.

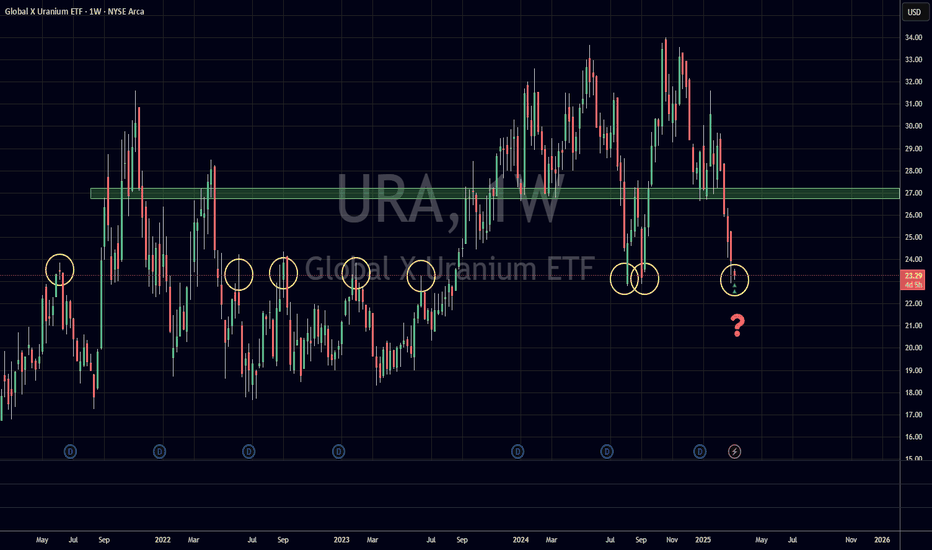

URA has hit the ~23.00 level. Since June 2021, the 23.00 level has provided resistance or support to URA 7 times, as shown by the yellow circles on the Weekly chart. Entering a Long position with a upside target to another area of previous support and resistance at the ~27.00 area (green rectangle). Price Stop: $22.00 Time Stop: 3 months.

Looking for a quick drop in UNG to the middle of the rising channel in the 20.00 to 20.25 area. This is a quick spec trade. Stop loss at 24.50.

UNG has hit the designated target designated on Dec 20, 2024. Though there is potential for further long-term upside, the price has now reached previous previous high set in May/June 2024. As well, it is at the upper end of a parallel channel as shown. I am closing the position at a profit of 37.6%. I plan to re-enter if/when price hits bottom of channel,...

The WEAT ETF has been building a base with an accompanying increase in volume over the past two weeks. First resistance would most likely be the 200 DMA.

Updating my previous long trade initiated when UNG broke through the 200 DSMA two weeks ago. At the same time, the 200 DSMA turned upwards after having been in a downtrend for over two years. Note also the huge increase in volume since the 200 DSMA was breached. My current target is former tops formed in May/June 2024 in the 21.00 to 22.00 area. (I would close...

UNG has now closed above the 200 Simple DMA for the last five days; a feat last achieved over two years ago. As well, the 200 SDMA is also turning green, indicating possible long-term bullish momentum. Next resistance is around 17.00 at previous swing high. A breach above that should clear the way to price discovery at 21.00 area.

UNG is testing the 200 DMA resistance for the 7th. time since May 2023. A successful daily close above the 200 DMA should lead to the next level of resistance at around $21.

US Oil has broken through an 13 month uptrend with force. Possible negative impacts on Energy stocks, XLE, and Loonie once trend is confirmed.

May be decisive break or failure today after Fed speak.

Based on my previous, long-term chart, I would expect a retracement of the steep drop over the last two months to at least the 33% Fib retracement (~1.2900). However, given the political turmaoil that has driven this drop, I am placing a close MANUAL stop to a close below 1.2300.

After breaking clean through a 2 year, multi-week TL (yellow line) with no resistance, USD/CAD is now approaching a multi-year (green)TL stretching back to September, 2012. This, I believe, should provide some resistance, and an opportune place to cover anyone who shorted the pair in the last few weeks.

This should result in a bounce back up to at least the Fib 50% mark of the recent drop (~1.136). Long term, given the negative impact of dropping global oil prices on the Canadian Economy, I expect at least some consolidation over the next few weeks.