mmdcharts

PremiumI have been paying attention to these charts because it shows that after the outbreak in one country is over, the stock market is back on its track. I witness an end of the Downtrend for SPY, NKY, HSI, and STI. Hopefully soon Composite is about to end its Downtrend.

Hopefully, people who recovered from the virus will exceed people who passed away.

Yield Indonesia Bond 10 Yr is not touching Support at 7% but potentially Breakdown Support and continue to fall to reach 6.5% (at least). The Yield is still in Downtrend since Oct'18 at 9%. The downtrend is confirmed after the Yield broke Support at 7.2% on Oct'19.

POWR has broke Resistance at Rp1,000 on Sept'19. At that time, POWR has confirmed Bullish Reversal pattern (Double Bottom) which indicates an Uptrend to at least Rp1,200. POWR has reached the target (at Rp1,200) on early Oct'19 but then since it is an early Uptrend, I predict POWR will continue an advance to strong Resistance at Rp1,400. POWR is now in the late...

Malaysian CPO is in Uptrend after broke Resistance at MYR2,300 on Oct'19. It almost reaches the closest target at MYR2,700 but there is a fair chance it soon falls as Technical Correction. The Technical Correction that might occur to at least to MYR2,400 - MYR2,500. Any movement beyond MYR2,400 should be suspect at the end of Uptrend. Since Malaysian CPO is...

US Government Bond 10 Yr Yield is set to move Uptrend after Broke Down Trendline at 1.7% and about to break Resistance at 2%. After the Yield broke 2%, the Uptrend at least to 2.6% is confirmed. US Gov. Bond 10 Yr Yield indicated Bottom when it failed to fall or even touch Support at 1.3%. On Sept’19, the Yield only reached 1.4% and then started a rise. That rise...

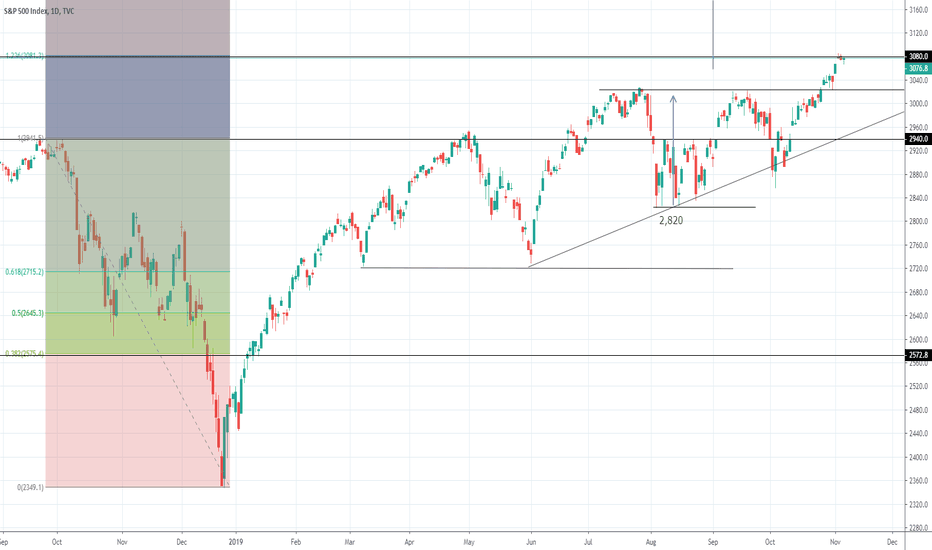

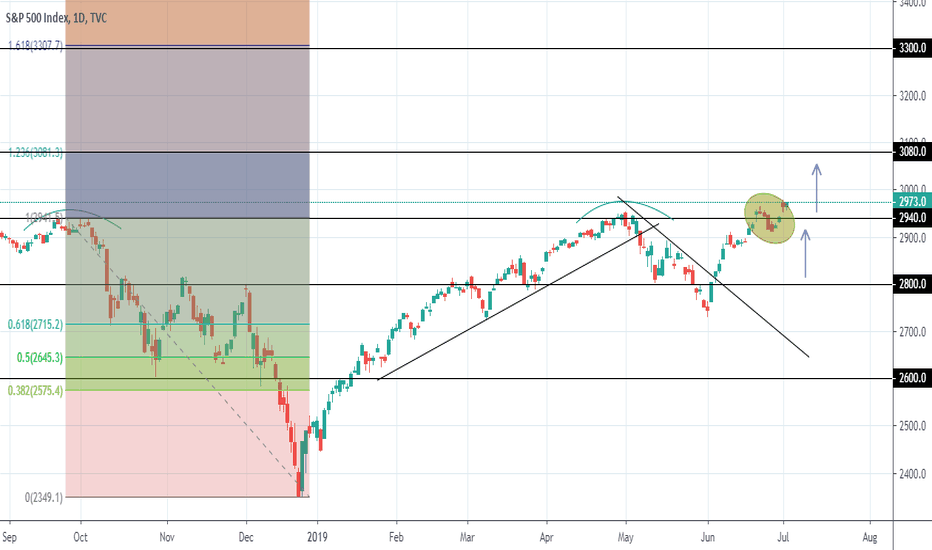

S&P500 has started Uptrend move to 3,300 after it broke Resistance at 3,000. However, in the short term (3-4 weeks from now), S&P500 is at risk to fall to the now Support at 3,000. This movement is named Throwback and is very common after the asset has broken the Resistance. Since the VIX is very low, I am more convinced of the S&P500's Uptrend. See VIX chart...

ID10Y ends Pullback by falling from near-Resistance at 7.45%. This is one of the characteristics of Pullback. A pullback is also a confirmation that Downtrend is imminent. I predict ID10Y will continue its Downtrend until it reaches 6.5%.

PWON is potentially forming a Bottoming pattern around Rp580 - Rp600 to end a downtrend since Jun'19 at Rp825. PWON has to broken out Rp650 to begin an Uptrend move to Rp850. If PWON break Support at Rp580 then PWON might continue to fall to Rp450.

S&P500 broke Resistance at ~3,000 and now it is continuing Uptrend to 3,300. S&P500 has formed a Bullish Continuation pattern since Jun'19.

The spread between Indonesia Bond 10Yr with US Treasury 10Yr reached the highest level since the end of 2016. The spread is now at 5.8% wherein the beginning of 2018, the spread is only at 3.6% and 5.4% at the beginning of 2019. The latest increase of the spread (since Jul'19) is caused by the falling of UST 10Yr at high speed (from 2.1% to 1.5% in just a...

Yield SUN10Yr berpotensi melanjutkan Tren Turun menuju 6.5% setelah Breakdown Support di 7.45%. Kenaikan Yield di bulan awal April 2019 dari 7.45% menuju 8.2% terlihat sebagai Tech. Rebound yaitu kenaikan ditengah Downtrend (Tren Turun). Oleh karena itu, dengan Breakdown Support di 7.45% yang terjadi dipertengahan Jun'19 lalu, Yield mengonfirmasi Tren Turun dari...

Meskipun 77% emiten - emiten di NYSE mengatakan laporan keuangan 1H19 tidak sebagus estimasi para analis, namun S&P500 Breakout All Time High dan mengindikasikan melanjutkan Uptrend setidaknya dengan potensi kenaikan sebesar 11%. Penurunan yang akan datang patut dipertimbangkan sebagai Technical Correction namun bila S&P500 turun di bawah Higher Low terakhir...

FX_IDC:USDIDR I predict Rupiah (USDIDR) might keep depreciating to more than Rp14,300/USD. If Rupiah Breakout Resistance (Rp14,300/USD), then the possibility of Rupiah strengthening to Rp13,600/USD or any level below Rp14,000/USD is vanished. Rupiah will be on the verge to keep weakening to its lowest level at Rp15,300/USD. Rupiah must move below Rp14,000/USD...

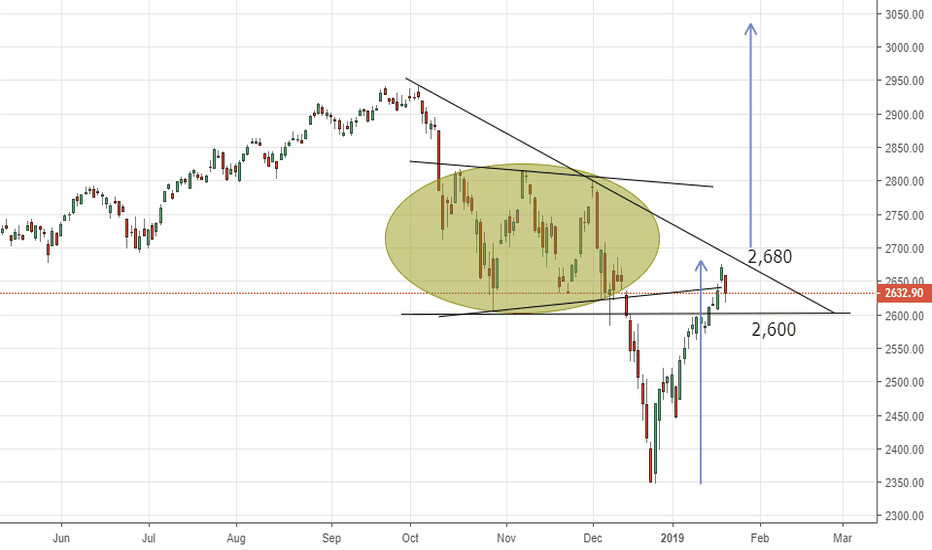

S&P500 could end Downtrend that has begun since Oct'18 by Breakout Down Trendline at 2,680. After Breakout, S&P500 might begin Uptrend to reach 3,000. In short term, S&P500 may fall as Tech. Correction 2,600. Should S&P500 stay above 2,600, i'm pretty sure there is a high probability S&P500 would rise and Breakout 2,680 and start Uptrend to 3,000. The timeframe...

USDIDR could move to Rp14,900/USD after finishing consolidating around Rp14,300 - Rp14,400 for almost a month. By moving above Rp14,000, USDIDR is continuing "Uptrend" to at least Rp14,900 (above highest level at Jokowi's administration at Rp14,800). The depreciation this time might as well bring Rupiah to touch Rp15,000/USD.

USDIDR could and might touch Rp14,800, highest level during President Joko Widodo administration. There is a possibility Rupiah go beyond Rp14,800 and reach Rp15,000 but i predict it won't happen since Rp14,800 should be a strong psychology Resistance. However, Rupiah should move within a range of Rp14,300 - Rp14,600 for the rest of 2018. Rupiah should...

ANTM is about to finish Bullish Continuation that should lead ANTM to Rp1,100. ANTM need to Breakout Rp920 to validate the pattern. Another fall to Rp840 - Rp850 is still acceptable and within the pattern formation. Be careful when ANTM falls down to below Rp800.