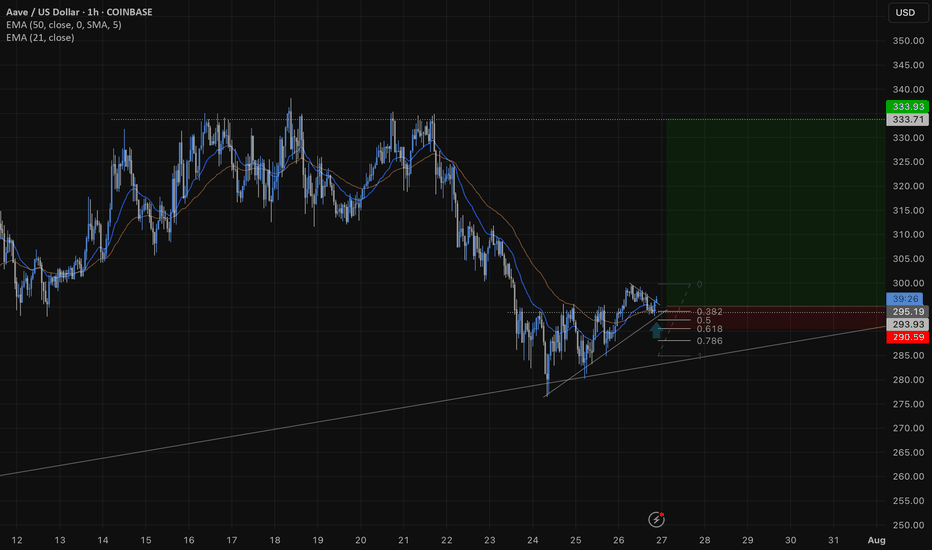

Taking Walmart long here, got a nice ascending triangle on the daily. We have 4 nice rejecting from the bottom trend line with nice consolidation on the daily. This was a 1h wedge and played it pretty aggressive expecting a break to the upside. I could have waited for a 1h break giving me more confirmation but I like the daily and the.

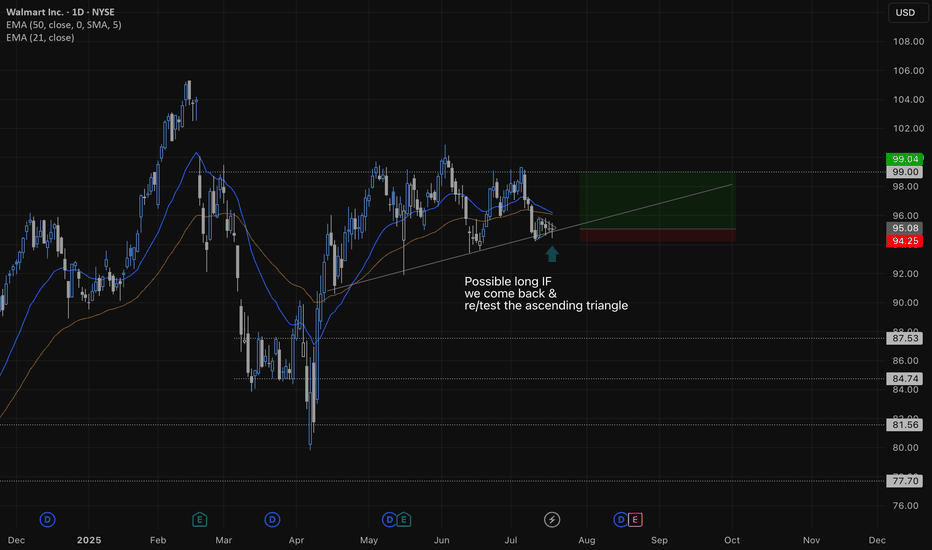

- Inverted Head and Shoulders on the daily - Price is re/testing the neckline of the H&S - 20ema is now trading above the 50ema (good indication of a possible up trend starting) - Stop loss below the higher low - take profit around 0.35 possibly higher

SOLANA is setting up for some potential good buying opportunities - 122.00 is a STRONG Support & Resistance area - We have a potential inverted H&S pattern seen on the daily and 4h - Will be looking for a Higher High on the daily and a Higher Low using my fibs for an entry. - Ideally I would like the H&S to play out and take a trade once price breaks the...

-Playing Costco long back up to 985.00 near the recent high's. -Weekly charts looks great, price rejects the weekly 20ema very nicely whenever we pull back to it, also have some decent support at 910.00. -The lower time frames ( 4H / 1h ) just broke out of a wedge pattern to the upside, we are currently starting to see a nice push up and will close the day very...

-Could see XRP reach all time high's here, we are currently in a descending triangle pattern testing the 4h 50ema (price seems to pullback to the 20&50ema's on the 4h and continue to the upside) -Could either play this at the break out and play to the blue zone (or keep adding to your long term position) -If you do not want to play this aggressively you could...

-Potential long on Cardano, price has been moving up on a solid up trend seen on the 1H and 4H, price likes to dip back in the 20/50ema on the 4h (Price is currently testing the 4h 50ema) and create some pattern we can capitalize on to get an entry point. I recently took one that was a H&S on Saturday for profit. -price is in a decent descending channel so I...

Playing the Head and Shoulders Pattern. Looking to play this back to the high's around 0.46000

- Nice head and shoulders pattern on the 1h with a break of the descending trend line and re/test of the 1h 20ema and .382 fib levels - Entry came on the 15 minute time frame where a small ascending trend line formed. - Playing this to possibly 1.1500 with a stop loss just under the HL

Taking Ulta on a debit spread 392.5 - 395.0 Expiration date 12/6 -Daily chart had a break and re/test of an ascending triangle testing the daily 50ema and Fib levels. -Lower time frames were also in an ascending triangle and I took the trade at the bottom of the trend line paying the break out. -More so playing the patterns here, price is not really trending...

Simple trend trade on MSOS Great Support / Resistance around 8.80 testing the daily 50ema and Fib levels. 4h & 1h time frames you can see a wedge patter form, waited for price to break the 1h 50 ema and placed an options trade. Expiration date 3/15 bought at $10 and selling at $10.50.

AUDNZD Long on an SBO -Daily made new HH's followed by a HL breaking out of the descending trend line -Broke the Daily 50ema and now testing it as support (also testing the Weekly and Monthly 50ema) -Testing out .50 Fib levels - MACD looks to be heading to the upside - On the higher time frames you can see the weekly and monthly we broke out of a much larger...

EURAUD Long: The daily chart price is in an overall up trend with no signs of slowing down. Price broke above the 1.61800 resistance which can be seen as a clear S/R line in the past. With AUD pairs looking weak from a technical stand point I felt there was enough evidence to take this to the upside. The daily is currently consolidating which usually happens...

-Daily is Testing the Daily 20 and 50 ema area -Daily is in a clear up trend making HH / HL -MSTR is highly correlated with BTC and Crypto in general which is currently in an uptrend as well -Entry came at the break of the 1h wedge -The wedge pattern could also be taken as a flag which is a reversal pattern (in this case going long) -MACD -Price is testing a...