motleifaul

Having taken the profit of y short Idecided now to take a little long position. The upward movement since April 4th has been sufficiently retraced and the After-Easter corrective decline could not continued up to now. We are holding above the MA. I don't expect to much but I see the chance of a retest of the Mid April highs or even the March high again.

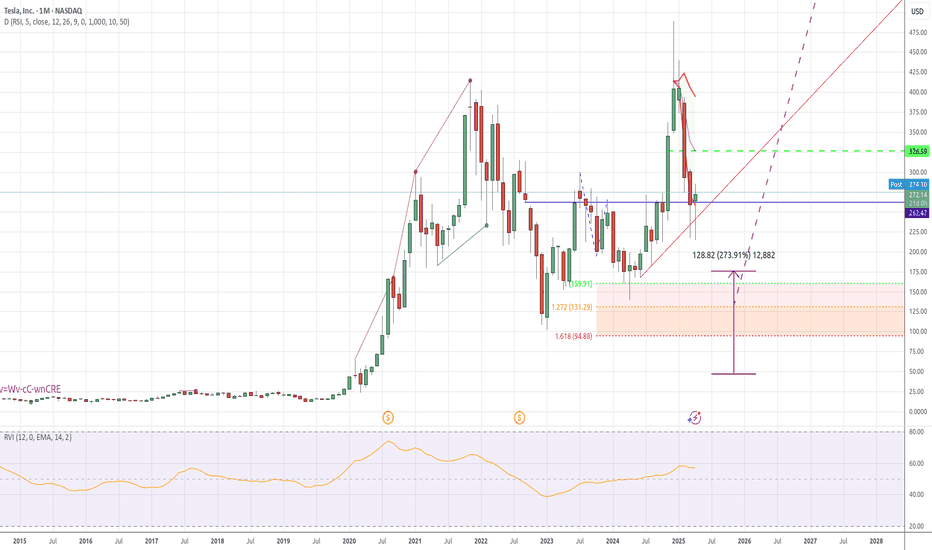

We are close to the price low since 2020 now. This may seen as an important support. But the momentumis still high enough so that it may take time to build a bottom here. Before a major attempt to correct upward the lows at around 190 will likely be tested.

Since February we saw an impressive decline.This seems to have found its bottom now. The past 2 weeks looked like a bottom already and this wwek's rise seems to confirm it.

After the November/December high it had looked like a coming correction. But then the February saw the price bounce back towards a new high, As the price had not been corrected for 10 months this may bee seen as an exhausting spike. The market is long and no new players may come in. The spike may have exhausted and a profit taking may set in within the next few weeks.

Yesterday's spike and the 3 days long lasting rise have been retraced today. The expectations have risen the past 4 days and we may expect a new test of the March high now at least.

We are holding above a 2 year old resistance. It had extensively been exceeded in November last year and as fast retraced this year so far. This looks as we have reached a level of market balance now. The candle stick Hammer may now hammer out this resistance as the new long term bottom.

We are testing this weekly to the 3rd time now. For almost 1 month we cannot overcomethis top level. Supposedly Ali Baba has forgotten the passwort to escape the cave and the treasure is overbought.

Today's engulfing red candel has wiped out the doubt that yestrerday's small red candle may finish the fall already. Today's trading day has closed the downward window opened yesteray as well. Thus it may be seen as an independent new bearish signal. The Star of Tuesday and the more the Shooting Star past week as well as today's engulfing candle plus the window...

For 2 1/2 Weeks we have been trading within a range of 19 % with no direction. Today we have exceeded the range together with the broad market. As we had declined for over 1 month this may be seen as the beginning of an upward correction. The window that had been opened at March 5th has been closed today. Thus may be we we will see a littledecline first to retest...

Almost 22% in 1 rush in 1 week is a lot. The window is wide open. Wether we may close it is in the stars. But an attemptto do so may be well expected.

After a drop of over 40% within 1 month it seems to be time for a recovery. The present low has been tested 3 times now and a failure to fall through now can be seen as a signal for an upward test at least.

For weeks we are testing this level now but cannot break it. Due to the large drop since January I consider a corrective rise as more likely now.

The current levelhas been serving as support and resistance multiple times beginning May 2023. As we had our peak in November and lost over 40 % since then we may now build a bottom here and start recovering. However it is not excluded yet that we may test the quadrupel bottom which we have tested since September 2022 again. In this case we may be stopped out and...

If the week will end at this aproximate level we will see a complete inside bar. I consider this as a sell signal. I thinkthat there is no doubt that the time is ripe for a downward correction anyway. Within 1 1/2 month only we have risen for over 80 %.

We have been broken through the low of October/November 2023. In January we did not succeed yet but now we have managed to. Hopefully we can remain under this support until the end of February. But anyway the break is a short signal and the present attempt to retrace upward may be seen as healthy profit taking of weak hands.

The outbreak on Wednesday sems to have been a false one. After the inside small candle yesterday this is confirmed by a Hanging Man today an a falling ADX.

For almost exactly 5 years this stock is rising. It is a pitty that I didn't buy in February 2020. Well, meanwgile we had 2 major corrections but no real correction since November 2023, a parabolic rise a year later and an exhausting rise since January. The latest may be seen herolding a coming correction of which I think that it has begun now.

It may be a beginning declining rend now. We have seen a lower top on Friday and falling daily highs since. To confirm this we have to fall below the Tuesday low now. The krypto mood is a bit weak now, so that a test of this Tuesday low is likely at least.