mr_albundy

EssentialStill new to harmonics. Seeing this late but this looks like bearish crab that formed on the 30M. If it is or was it confirmed.

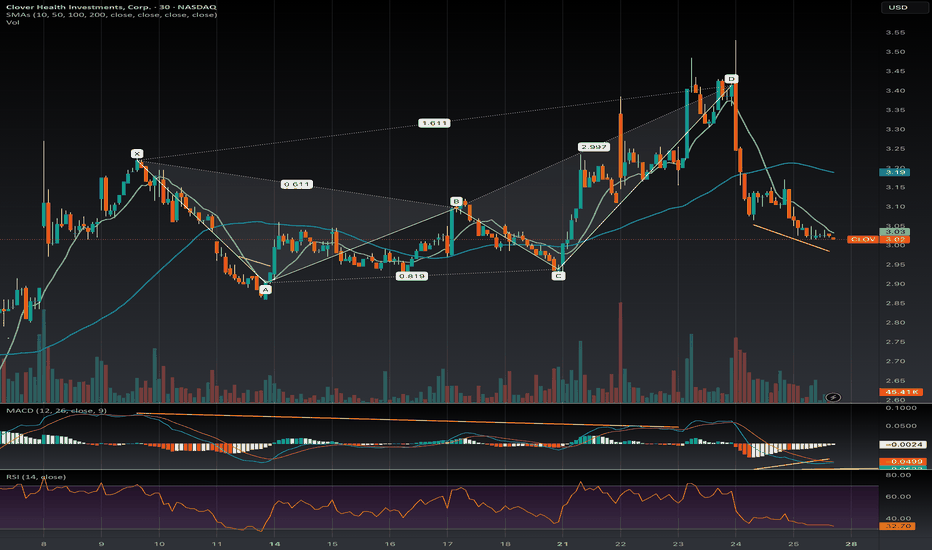

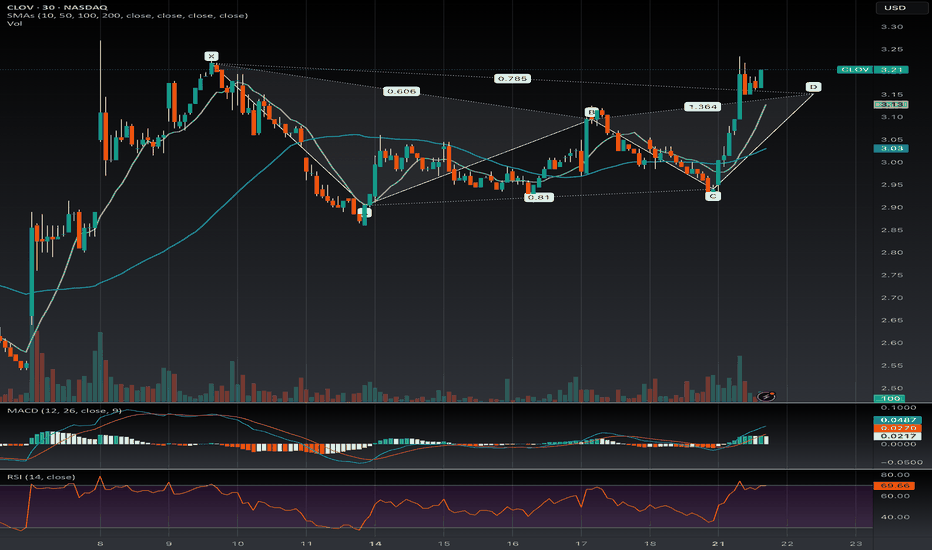

NASDAQ:CLOV is forming a Bearish Gartley pattern with the D point projected at $3.10, nearing a potential reversal as of Monday, July 21, 2025. The RSI at 68.46 is close to overbought territory, adding support to the possibility of a bearish move if confirmed below $3.10. Keep an eye on a break below $3.10 with increased volume.

Clover has had strong downtrend movement on no news. Bullish divergence is forming on the 30M. If divergence confirms possible test of 50 SMA and consolidation before we see the next the next trend. Retail trader discovery of Counter Part Health's partnerships with Humana through subdomains could put a potential bottom and reverse the trend prior to earning. But...

Clover health is bouncing back from a healthy reversal after a nice bull run. Classic bearish divergence is forming on the 1 hour time frame. If a short term reversal occurs this could be the last time to accumulate shares below it's current price.

$CLOV broke the up sloping trend line. Seems as though more distribution is a head in the short term but we do have bullish divergence forming on this 30m.

On the 30m a short term Bearish Divergence is upon us.. also on the 1H... in the bigger picture time frame it is developing bullish signs... market direction dependent..

Looking at the weekly I noticed this slow bearish divergence building. The only moving averages that seemed to match up of where it could possibly dip to if there was a crash as Michael Burry or other mention would be that red 180 directional line. All signs point to some sort of real correction if not a crash in the coming weeks if not months.

Looks like SPX is having trouble getting into that ATH box... weakness is starting to develop w/ Hidden Bearish Divergence on the 1H. Also Russsel 2000 IWM has a head and shoulders forming...

Someone recently asked for my fib chart on $COIN ... Fib is based off of one of the first list prices that was put out.. at around 250... then it's swing high on the day of opening. Interesting how accurate price dropped to the .618 ... my white line is what i think it's going to when market corrects and the dust settles..

CLOV short term classic bearish divergence on the 4H.... market is shit for small caps and spac's rn... where will this lead us past support?

Classic Bullish Divergence on the daily.. We're back in this up sloping channel.. Barrel posted on twitter audit of finances will be done today and they can file forms to come current with OTC market next week. Take caution though as market is choppy and OTC's seem to follow w/ it.

Classic Bullish Divergence on the 30m.. if it can break out of this downtrend, potential for a move up to resistance

Classic bullish divergence on the 30m for this earnings call that is about to take place..

Looks like Fisker is wanting to fill that gap at 17.50 ish .. Still looking for a good bounce on this up sloping demand line then bounce back up to the 20's

SPAC's have the same trading cycles. Right now we're in the cycle after the Acquisition news sell off. This is the area where price is finding support and eventually a selling climax area. IMO CCIv has not found its preliminary support before hitting a selling climax at the 21-23 range. ( Research Wyckoff Method )

4h hidden bullish divergence... waiting confirmation. What's weird is that my chart's MACD is very different with ext hours on and off.... had to leave exthours on for this also .. Some new site came out with this Analyst price target of ONTX: stock Reiterated by H.C. Wainwright analyst, price target now $7.50...

Last week I charted what could have been a sell the news trend reversal as most SPACS sell off upon news of acquisition. CCIV sold over pretty hard in after hours on the first day of news released of official merger w/ Lucid. Pretty sure we're going to see this bounce around the 20's then accumulate like most space prior to merger date...