Watching how GDX reacts to $20.50-$21.30 level to see if it can move up on 5th wave in the medium term. Long-term chart is quite confusing. Wave 2 looks quite complicated, has potentially to not be done and retrace almost all of Wave 1. See how it performs in the Med term to see which way it will go. The metals (GC, SI) are pulling back which can coincide with...

Copper has been range bound for the last 7-8 weeks. Waiting for it to either break above or below this range, it should be a pretty powerful move once it does. Above opens up to 3.19 level at least. Below, it could go back to 2.7760 (50%) retrace or further, all the way down to the rising trendline that started in the early 2000s

Watching closely to see if Platinum continues its move up. into a 3rd wave from its low of $770. It is hitting the bottom of significant resistance. Instead of the 3rd wave, the pattern could be an A B C from its low. If it pulls back below 878 it would be a good sign that this could very much be the C-wave being completed and it will target new lows

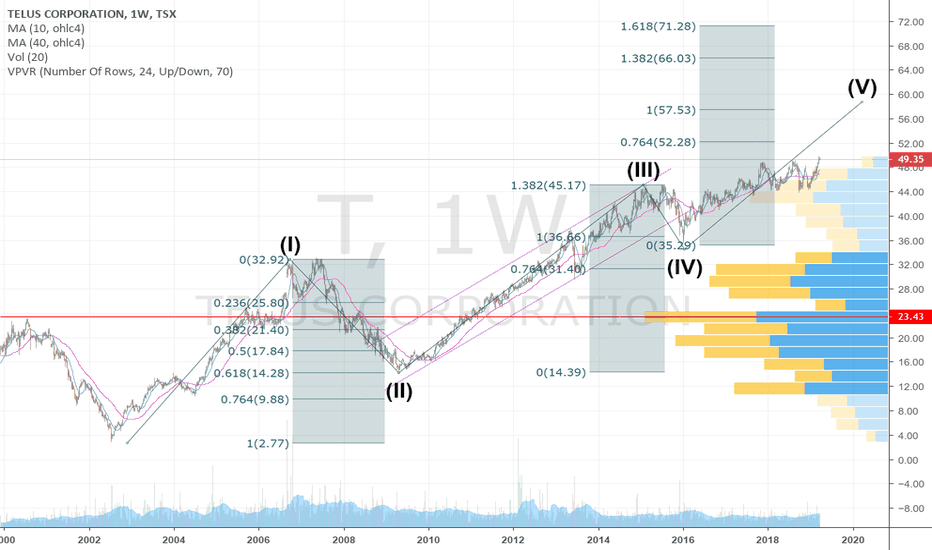

Wife asked me to analyse a company someone told her about. This is a more straight forward chart 5 wave move, looks like Telus is moving into a Wave 5 targeting $55-60. It been on a 17 year bull run (pretty amazing) that could be on its final legs

Finishing off a triangle for 4 and heading into wave 5? must break above $59-$60 in short term

First wave complete, then a flat, now about to launch into full wave 3 Short term must see 5 waves up and get to at least $25.8-$26. Longer term target 1.5-1.618 extension of the first wave

Does anyone have an opinion on DGC and my analysis? DGC looks to have completed a major corrective wave from 2011 to end of 2013. Since then its been forming what looks like a leading, contracting diagonal (Wave 1 of a new major wave). I'm still quite new to EWT, but my understanding is that the corrective wave after a contracting leading diagonal can be quite...