PLTR has been on a rip, but not without periodical 20-30% dips along the way. The way MACD is extended, it will not be surprising to see a somewhat meaningful pullback to start the wave 4 correction. Wave 2 was around 30% and lasted around a couple of months. Wave 4 can be quick and deep or can be a triangle that will take some time to resolve. Either way, I will...

If we see a higher high on PLTR above today's high at $98.29, then this might confirm wave 1 of 5 of Intermediate wave 5. Some bullish divergences should propel price a bit higher to confirm the price action. Wave 2 should create an inverted head and shoulder look as a classic pattern. PLTR creates strong wave 3 price action and shallower wave 5. So, I will be...

My primary count on TSLA is still bearish. On my primary view, this move is supposed to be wave Y of Primary wave 4. If that is still in progress, then the current consolidation is only wave b of Y and TSLA should fall back more towards the lows of $100 area. But we cannot ignore the other side altogether. In this alternative view, Primary wave 4 was complete...

The move up today looks very encouraging, but we only have a 3 waves move so far. Price broke above $7.39, which is a good sign, a higher high. Now price needs to stay above $6.67 and complete a full 5 waves sequence. Even then, the danger might not be over until price breaks above $8.24 and better yet, above $8.86. I will be ready to get my bag filled on wave 2...

This is my less severe crash idea. We should get one more lower low in this count to close out Wave 2 of the intermediate degree. The low of $6.22 is not very clean and the recovery since then is also quite choppy, suggesting a final flush out. My previous count expects a worse case. This one is a bit more hopium induced. If I am totally wrong and the long-term...

The recovery so far for SOFI hasn't been that great. After breaking key support of $10.44, price is trying to bounce back. Last week it tried to get over the resistance at $11.65, but stalled. So far, this recovery is a 3 waves move. It can go higher, in fact, I think, the first A wave is still in progress. We should see B and C waves after this ongoing wave...

Sunday night drop broke below $6.36, invalidating the minor wave 2 count and confirming that Intermediate wave 2 is still in progress. This price action can be a triple combination WXYXZ pattern. Now, good news is, this should be the last C wave leg. Bad news is it can still drop quite a bit more before the intermediate wave 2 is invalidated ($3.26). Even though I...

Friday drop came about a hair length from invalidating my current count. But a strong reversal is keeping it intact still. We do not have a full 5 waves moves up to confirm a wave 1 yet. So, it is possible that Monday might sell off again and invalidate this count. If we lose the minor degree wave 2, then it will mean the Intermediate wave 2 is still on going. It...

Wave C of 4 is ongoing and quite emotional. Wave B didn't quite get high enough, so chance of a larger C wave is high. This could last for a few days to a few months depending on how long this trade shenanigans continue. But, ultimately I don't think this will be a permanent situation and once things settle, markets will recover strongly. The underlying economic...

AT&T is not something we see in the finance news that often nor has the sexiness of the Silicon Valley names, but, since July of 2023, this company has been on a tier. Seem like the new CEO knows what he's doing and combined with missteps from the competitors, T has seen a 100% move up from the bottom. At the moment a bounce is most likely incoming along with the...

At the moment I am tracking a massive ending diagonal pattern for SPX that started Back in March 2020 after covid crash. The recent correction looks very oversold, and a bounce is due if not already started. I am looking at weekly RSI reading to get some resistance at 50 level if this is a dead cat bounce. Looking left, every time RSI fell around 40 level, it got...

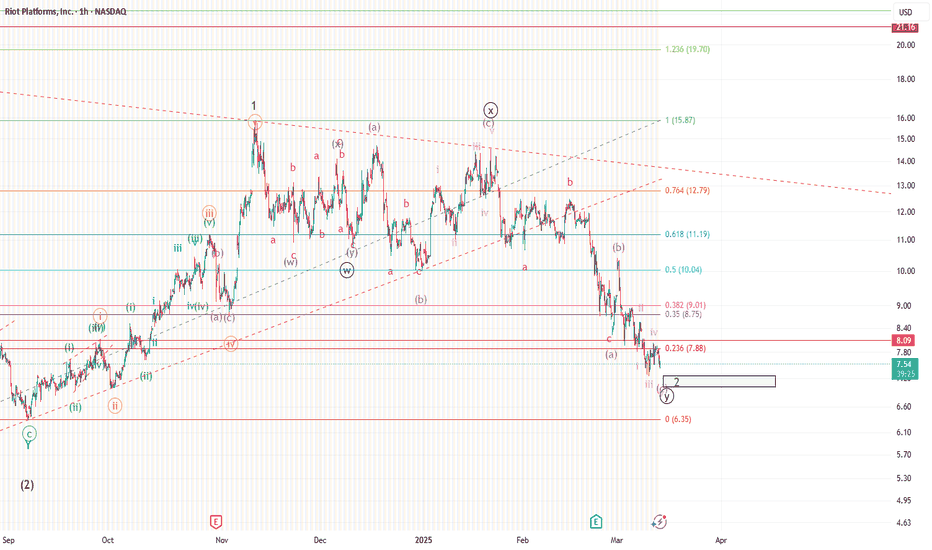

RIOT and any other miners will follow the direction of bitcoin, but all markets in general are looking close to bounce. How far it goes remains to be seen, but for now looking for the turn in the box area.

This weekend looks like the crypto God candle weekend for the majors. Doge is also looking strong, but chance of it being part of the US strategic reserve is slim to none. But, when tide is rising, it doesn't matter. Right now, the challenge in front of doge is to get out of the downward channel, and fast. The price action has two bullish scenarios left. Depending...

AMD has not been able to keep up with NVDIA for about a year. The year long decline is about to approach a critical support area. $93.12 is the line in the sand to invalidate the expanding diagonal structure to complete minor wave 5. If this level breaks that will mean AMD is still on minor degree wave 4 and is in an expanding ABC correction. Unless this turns...

The recent crash has everyone running for the hills. People forget Bitcoin is not up everyday and it also doesn't stay down forever. With the amount of selling, it is time for a bounce in the upcoming week or two. At that time, we need to see if the bounce happens in 3 waves or 5. If we see a 3 waves move, then the selling will most likely get more intense. For an...

As NVDA is eating all its competitor's lunches, INTC seems to be the one left far behind than the others. It has a lot of work to do, and the playing field is only getting rougher with tariffs, reduced demand and increased costs. Once a PC powerhouse, is now the producers of the lowest performing chips with higher prices and no one seems to want; unless heavily...

Right now, it is very difficult say if the Feb 3 low is THE low. So far, the move up looks like an abc zigzag. If that is the case, then we should see one last move down the swipe the December low, shake out all stop losses and start the real wave 3. Price can still move up towards $14 and make another lower high and then crash again. But, if price keeps makings...

Sunday flash crash of the markets after the trade war announcements has made things rather interesting. So far, the uptrends have been intact, but some very important support levels have been breached temporarily; for all important markets, including the ES, NQ, BTC, Gold etc. For Doge, there are still a couple of bullish possibilities out there. Until price goes...