namastay

Increasing price action with horizontal-to-bearish RSI movements. I'm ready for another wave downward, perhaps in conjunction with the stock market when the next unemployment report reveals just the staggering number of consumers who will be tightening their belts.

With the delayed then delayed again earnings report, and a release of news today on selling of their stake in Whistler to ACB, I have to ask myself "Why? Why would a company take this sort of action while preparing a balance sheet?". This setup could be the “fake and break” where large funds have pushed a stock to new highs, sucked in the retail crowd, and could...

The next few days are critical for CRON as the MO deal will signal to the shareholders where this company is headed. Either way, any dilution or sentiment thereof could trigger this thing into correction territory. Looks to me like we've had 2 waves thus far within a larger cycle present since the inception of the ticker. I'll trade the reaction either way, but am...

A late rally in the day occurred after the congressional hearing on bank access began. The outcome of this hearing was unfortunately dubious. I think tomorrow’s action will be largely following the general market trend plus the CGC action, which could go sideways again if they cancel one another out! Be careful, enter positions wisely and be aware of all the...

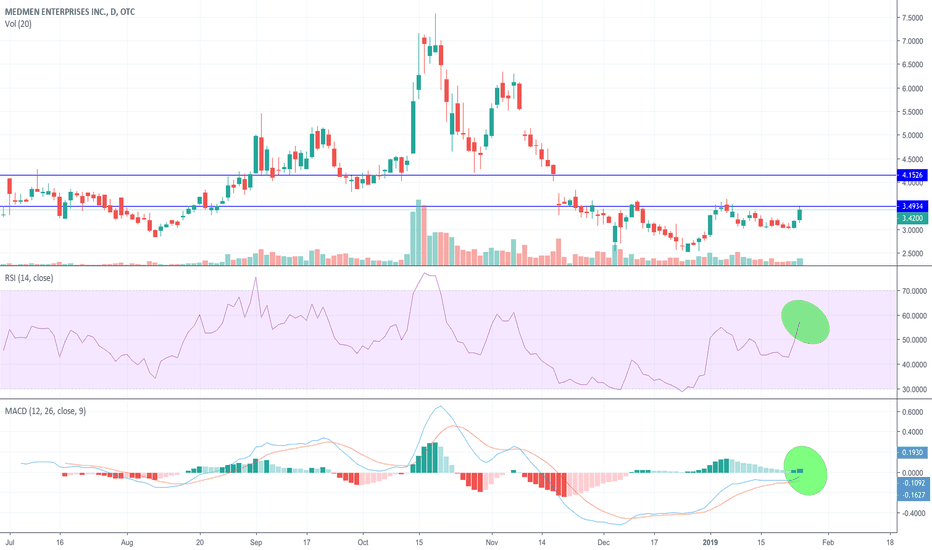

Looking for a fill the gap strategy this week on MedMen and watching premarket activity in the entire sector to take picks. I'd watch for profit taking after retail longs over the weekend close out their positions. Dip-buy that morning panic folks! So long as the market holds strong through the weekend this could be an epic week before major earnings reports. It's...

This could be the first leg of a bearish divergence, with multiple signals showing signs of buyer exhaustion. The hype that pushed CRON to these levels violates all fundamentals, and was doomed for a sharp sell-off. The MACD is diverged on the daily, and without a catalyst would signal a further sell-off. Ichimoku base-line was breached today and the small gap...

I see a pop in CGC on the horizon. A clear bull pennant is forming, which is a great side for CGC longs. Worst case scenario, today's action causes a pull-back and a gap-fill for further consolidation prior to earnings. This quarter's earnings are incredibly important and the major players will all soon be revealing their first recreational sales data. Medical...

For those holding swing positions it's a bit of a guessing game at the activity tomorrow. Volumes are heating up, and tonight on Cramer he called out CGG, but also said it was overpriced to buy. I'm looking for some panic selling in the morning and a potential pull-back in the worst case. However, in this sector as far as I can tell sentiment is driving this...

The launch of the tZERO token cryptocurrency has only been trading for a few days. This is a strong catalyst event, as speculation directly in crypto assets has produced huge % gains. Indirectly speculating through buying OSTK is a way into the crypto markets without as much risk. The RSI is not oversold, MACD on the daily chart shows a strong green candle with...

In my opinion, ACB is a buy, at least in the short-term. RSI is not overbought, and sellers have taken profits with selling pressure falling the past two days. MACD is wide open with a lapse in the overall volume this week, so I think tomorrows action will determine the direction. I think there's room to test the previous 7.5 area-high, with a history of value...

Tomorrow tells the tale with mixed signals on the NBEV chart. The 1-day MAC-D crossover signal could trigger a sell-off, unless significant buying pressure erupts pre-market to bell. If enough pressure, I'd see us testing the $7 level. If we are able to break it, there's room for more. I'll be watching pre-market activity and allow the first thirty minutes or so...

This is a weekend where uncertainty precedes. Potential for a 3.75 up-swing is historically present, however recent draws were un-exciting. Cold snap could definitely continue into late January, so I'm really interested in seeing how far up the bulls will be able to push this Monday evening into Tuesday morning for the open. It all depends on the draw, but HDD is...

Tesla has a history of huge drops on negative news, quickly followed by 10%, 15% rallies. Looks to me like a bottom was hammered out and there remains the potential for further decline. I'd expect history to repeat itself and a retrace to occur in the next several weeks.

Currently super overbought on the 1day RSI, and a reduction in overall weekly volume on the MACD. Looks to me like a potential capitulation period, followed by a further retrace within the overall up-trend. Especially if market sentiment continues to shift with China trade talks. Could be a great week coming up ahead and plenty of room for day-trade/swing-trade...

Today's trading had a hard pull-back after a 7% run-up. We're on multiple days green, with an exhaustion candle on the day. The wick is pointing upwards, which could signal continued volume and price momentum. Volume was HUGE in the last hour of the session. Will be intriguing to see what this does tomorrow!