naryaaa

Getting ready for a lower high to be made, looking for shorts

Break and Retest play on higher timeframe TP is a bit far and I am uncomfortable, once price moves in my favor either BE or TP hit. 2 entries 1st entry market order on 1H after seeing bearish rejection to upside 2nd entry sell stop on 30M bearish candle following

Long on GBP/USD S/R setup SL below prev 30M Candle

ABC correction is seen after 5 Elliot waves, after point (C) has made retracement to .618 fibonacci level instead of continuing the downtrend it broke above orange trendline. Previous bullish candle has relatively high volume. High volume of sellers at .618 of wave (C) indicating downtrend to resume however, were overwhelmed by buyers pushing prices further up,...

Setting multiple TPs. Setting tighter stop loss at below minor trend channel as price is in higher part of a bigger trend channel on higher timeframe. Weekly S/R (10,850/11,525)

Looking for profits in the next impulse wave on the 1 hour chart. Final TP is at upper trend channel however, setting multiple TPs. Stop loss set below previous swing low (2 swings acting as support) Price is testing the dynamic support on trendline. Weekly S/R (113/137)

Indonesian stock market looking bearish overall. Not looking for buy/long setups. Waiting to see how it will test the ~6,000 level

Long on ascending triangle forming. Higher timeframe (weekly) shows strong resistance on Fibonacci levels.

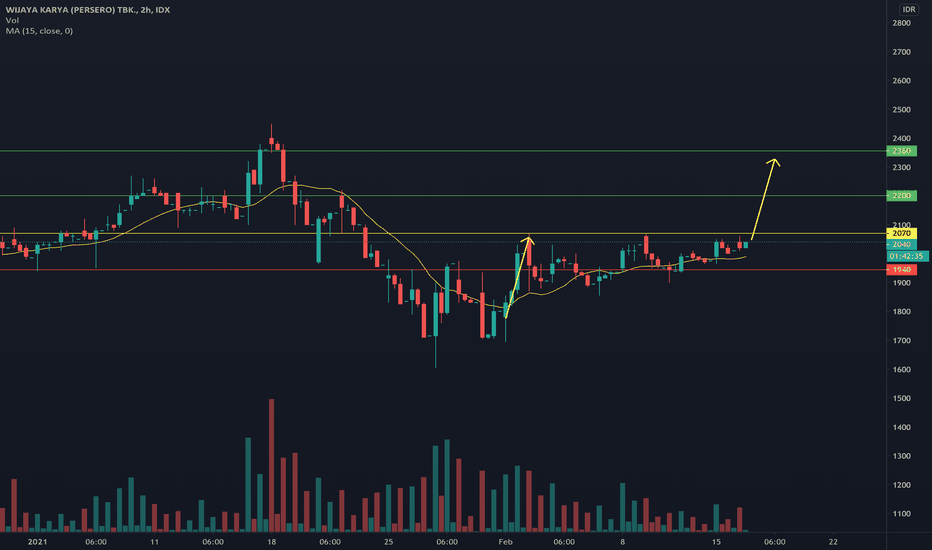

Possible long on inverse head and shoulders breakout. Selling pressure coming in at TP.

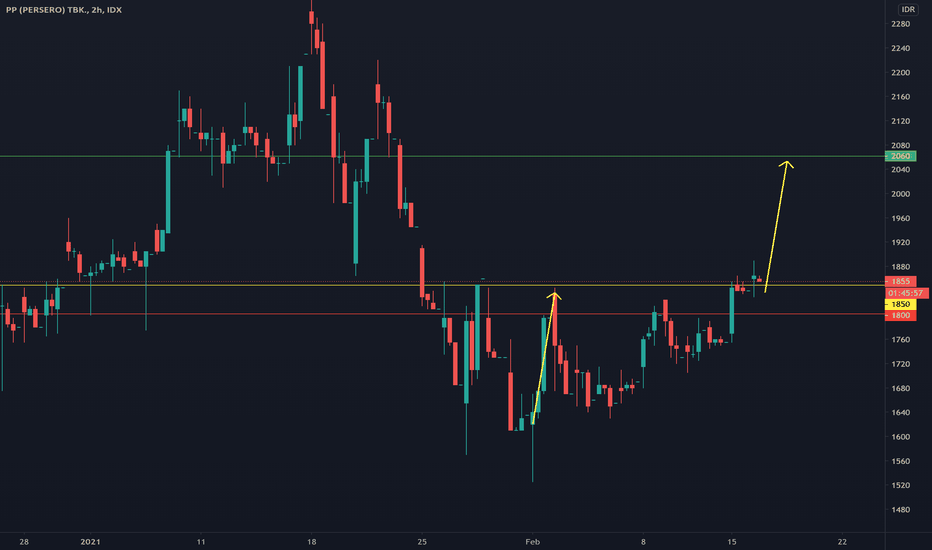

Ascending triangle forming, long on breakout although possible selling pressure coming in at first TP

Not much selling pressure once breakout is possible, waiting for confirmation