oe123

Now that you have your July rally with price deep in supply, the only question is will we see the rally extend past supply. I believe we will. Look for price to reach 8400-8600 approximate before a reversal to the downside and a continuation of the downtrend which by the way will be your greatest opportunity.

Price headed towards supply keeping in mind pullbacks and trading ranges. Look for price to make it's way to supply similar in the fashion in which price left on 2018-06-10 marked by the brown arrow on the chart, a nice long bar. In some cases two medium length bars in a row or 3 short bars in a row or any combination thereof. You'll know it when you see it. Once...

Your July rally comes early. Look for price to either break through this supply area and continue up or sellers will dominate at supply. If price breaks through supply look for 8601 approximate. Also notice the nice long bar on 2018-06-10. Now look at todays bar. As mentioned before, the rule is, price will often return to supply the same way it left on 2018-06-10.

What you have here on this day is buyers buying into supply where you want to be a seller. It's a mistake. When price gets to supply like you see here only one of two things will happen. Sellers will dominate as they should and take short positions. On the flip side if buyers are successful and break through supply and price rises it may be to the next supply zone...

This is to show you a nice example of sellers selling into demand. Notice the nice long bar on 2017/07/25. Not enough sellers for buyers that day and price rose. Now notice the price activity for this evening. A nice long bar now returns to the demand zone. Prices returned the same way they left on 2017/07/25. This is important because this is exactly what...

So here you go. As mentioned earlier, refer to post dated 7/4/18, when price hits a supply area sellers will take control and if successful price will again decline. And that is what happened here. Remember supply zones represent sellers and demand zones represent the buyers. For those who took the trade in the supply zone and went short, you have done well...

On the chart. Price is currently in the first supply area. Typically sellers will go short in supply areas. If successful you will see prices head back down. If not price will break through the supply area and continue upward to the next supply zone. If price should head back down from zone 1 first before heading upward, this can act as a pullback before resuming...

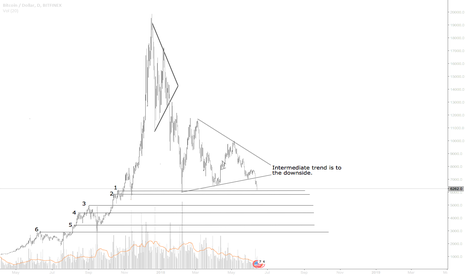

Price fell deeply into target area 1. Look for either a pullback before further downside price movement resumes or look for the current price movement to continue it's direction downward to price target 2 at 5701 approximate.

A close up of the chart reveals a bearish pennant in the making which means a bias to the downside. Look for price to break support of the pennant and close under it or back into the pennant.

This is a follow up to the previous post. Today's price action completely fills the gap. Price initially breaks the support line of the wedge pattern on the chart. Then you see price dropping down without any pullbacks or small rallies to fill the gap in the soybean meal market. Beautifully executed, beautifully accomplished.

Be aware that there are price points even lower on the chart than what I describe here that will absolutely be met. These lower areas I talk about are demand levels. Price will always return to supply and demand levels, it has to do with unfilled orders. That's all you really need to know about this unless you choose to study it. And when does prices return to...

Price target 1 reached in beautiful fashion. Depending on the amount of capitol you have to invest and are trying to invest for your future, allotting some of your money for each buy-in at these declining prices is an opportunity for you. You could buy, transfer your coin to a paper wallet and let each transaction sit until it is time to cash out at your...

levels 1-6 are pricing areas to watch for. BTC is stair stepping down in bearish fashion. Those pricing areas will be met either with pullbacks, rallies, trading ranges or will trade in a relatively straight down fashion so watch for this and observe. There is nothing but opportunity here to either profit with short positions for traders or for low entry buying...

Gaps can and do fill at some point in time. The rule for gaps is that they always fill. Sometimes it takes a couple years, a few months or days and every timeframe in-between to fill gaps. Once you study a chart and get a good feel for a particular market you'll have a good idea of when gaps fill. One thing you can do is to look back at the chart as far as you...

Nice break out of the wedge. Be aware of any pullbacks, rallies and trading ranges on the way down. Remember gaps always fill at some point. On the chart you have an area where prices gapped up and caused a blank spot on the chart. Notice the place on the chart marked "Gap." That is the area that will fill. A short position could be considered from the current price.

Let's recap on a couple of patterns. The pennant is often used as a continuation pattern in price. Here you have two of those. The pennant is comprised of two things. A pennant and a pole. In each example you have a beautiful break out forming the pole of each pennant. Price continues in an upward fashion from these two formations. These patterns have formed up...

Short plays to consider. Remember pullbacks in price activity and take advantage of those if you want to go short or add to existing short positions. For those waiting on the sidelines to enter at very low prices, you'll have an opportunity to do so. Ethereum is going much lower allowing for a second chance to establish long positions in the not so distant future....

On the chart you have A rising wedge. From the wedge look for price to break the lower support line of the pattern. You also have a little bit of divergence of the rsi and price meaning price is moving away from the indicator. This suggests a weakening of price. Look for 93.4 and 93.0 to start. May be a small swing.