oopsyco

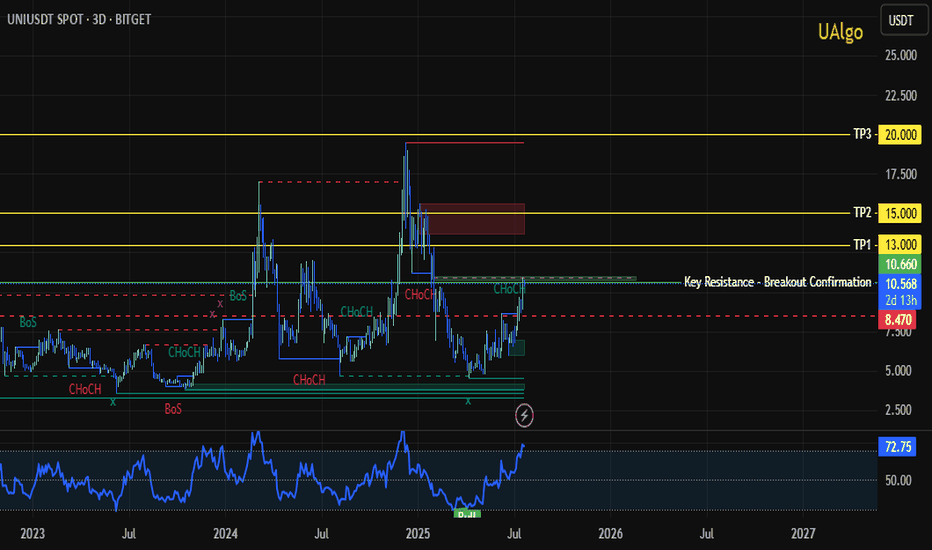

EssentialConfirmed Structural Breakout – Swing Targets + Fibonacci Extensions - With alignment across technical structure, product roadmap, on-chain adoption and regulatory tailwinds, UNI has a clear path to re-test its ATH around $45—assuming the market stays bullish and upcoming catalysts deliver. 🔍 The asset UNI/USDT has just broken out of a multi-month range between...

WIF (Dogwifhat) Time frame 4H - Just swept the upper liquidity, It’s now heading down to target lower liquidity. Potential entry zone (OTE): between $0.73 and $0.68 Stop-loss: below $0.62, under the liquidity zone Targets: TP1: $0.85 TP2: $0.905 (previous liquidity sweep area) TP3 : $1.059 TP4 : $1.10 ⚠️ Macro caution: a single tweet from Trump could...

This setup is based on a multi-factor method combining structure, RSI level, liquidity zones, and active narrative catalysts. 🧠 Method used: • Identified a potential double bottom on strong historical support • RSI < 40 on 12h TF → ideal zone for accumulation • Price compression near key support levels • BTC correlation checked (neutral to mildly bullish) •...