palmereldritch

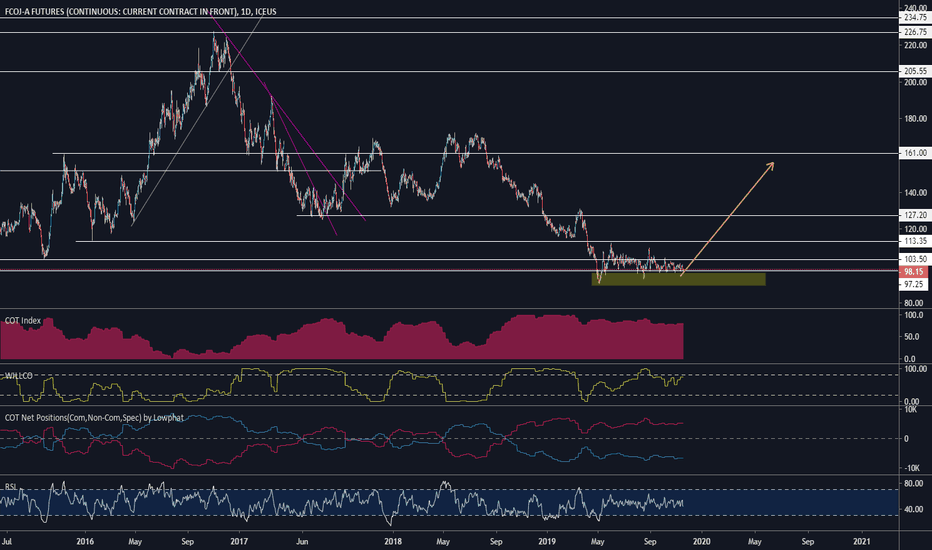

EssentialComments: After huge drop we have very good cot with very good technicals Cot 3y: 67.6 Cot 6m: 100 Rsi: daily bullish divergence Price: double bottom on multiyear low support Entry: 25.4

Comments: this play can be rushed, because the levels of both cot indexes we monitor are still low. We want anyway to enter because: - the speed of the drop was very fast (price % change / time of the change in weeks) - net position change speed was very fast (net position % change / time of the change in weeks) - for the very good r/r at this price level Cot...

Comments: 5 years in a row this pattern seems to play out very well. Top in may/june and drop there after. Cot 3y: 80.1 Cot 6m: 100 Rsi: daily bullish divergence Price: good multiyear low support Entry: 331.3/4

Long at 65. Commercials been accumulating

16.49 Entry on multi year down trend If resistence is broken possible downtrend continuation for huge R/R First target around 10% In several weeks COT index at 156 weeks should go to zero

major support resistence. I am anticipating a cot index of around 100 possibly in a couple of weeks. Riskier tha usual from fundamental stand point but very good potential entry point for major trend reversal

Long from 1.6 - 1.8. If broken hold half position until 2

cot commercial net short very interesting position. RR very good

Short cot on soyoil, 35 at linear trend, 39 average down on log trend. around 10% take profit

A warning is that NG is very volatile and COT is usually late in forecasting the movement. We want nonetheless to combine as well some technical analysis on a very important multi decade support level. R/R very favorable

All metal (gold, platinum, silver) market is pointing short reversal

technical entrance on weekly long term trend

Look at daily for entry. With divergences if possible (RSI, STOCH, etc..)

Comm net long Highest recorded. Possible major up movement Commercial net log shows divergence with price usually means accumulating while price stagnant anticipating a movement in that direction