Gold has printed a hammer on weekly. As expected, last week stopped the bearish momentum. I believe Gold price will revisit weekly Bat's reversal zone at 1341 at least. So we can try to scalp LONG with care. Entry is when we break top of weekly pin candle at $1301. I have identified three targets: TP1 = $1310.68 TP2 = $1320.68 TP3 = $1341 - automatic exit...

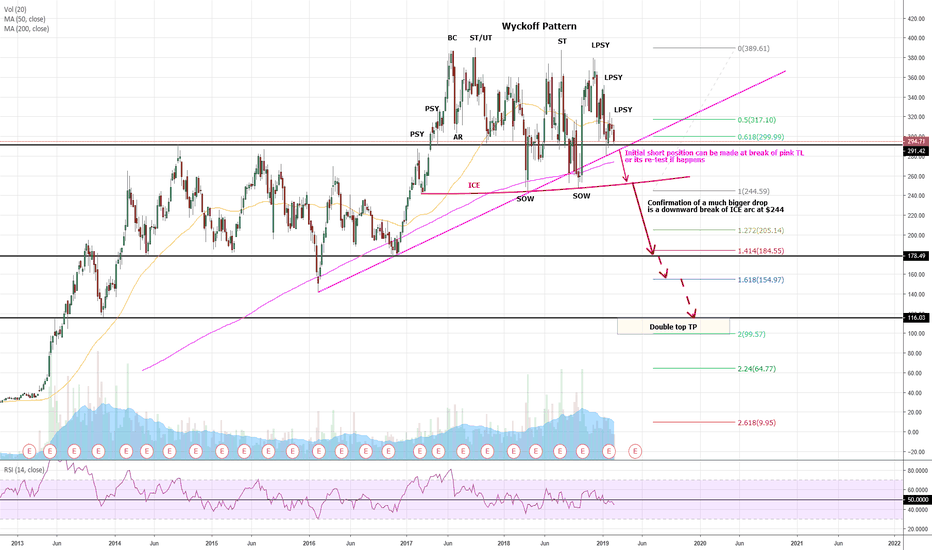

Boeing (BA) have being printing Wyckoff distribution patter for long time followed by an Island Reversal pattern. I believe it is at the beginning of a lengthy down trend.

USDRUB failed to make higher high in December which shows weakness for the pair. It also coincided with Bat Harmonic pattern which produced a sizable drop. Currently as price progressing down we can identify a development of a potential Gartley harmonic pattern with PRZ at around $64. On Friday Feb 22 price closed below daily 200SMA which suggests lower prices...

WTI had a significant rally after bottoming in Dec. Many traders wonder if its time for a sizable correction or if this bounce is over. I believe that there are evidence on charts that suggest rally to continue at least to $63. Details are presented on this chart. I CANNOT suggest to enter new long position here at the top of rising wedge but if you already long...

EURUSD Pair is completing falling wedge pattern. The opportunity to go LONG is here on a little black 5th sub-wave. Break of big blue wedge will confirm CORRECTIVE rally toward 1.20 ish. I will update this idea with precise target when necessary break outs occur.

Hi friends, First of all I would like to say that I am BEARISH USDCAD pair LONG term. This idea is to try to execute a LONG SCALP catching safe portion of retrace move of initial drop from resistance. Or resistance re-test if you will. I have identified a POTENTIAL bearish Bat pattern and today we broke its B point which allows us to trade BAMM move to...

Last week we had a weekly shooting star at Bat's PRZ. This is promising development for Gold bears but it still needs a confirmation by closing next week below last weekly candlestick. This is a RISKY trade since we just hit PRZ and going through initial profit taking after sizable rally. Target price 1 for initial re-trace will be $1287 - 0.382 fib and TP2 if...

This is a complimentary idea to my existing Harmonic analysis idea about DXY. I still believe DXY is short mid-term and requires a deeper correction after 2018 rally.

Tesla (TSLA) was printing Wyckoff distribution pattern for a while now. Almost 2 years. And it is finally entering its last phase with downward trending Last Points of Supply (LPSY). The break of pink TL on a chart, followed by break of ICE has a very high probability which gives us an opportunity to SHORT Tesla. This is a long term trade but promising very good...

CPG (Crescent Point Energy) oil producer was beaten down over the years. I believe company has a lot of value and severely undervalued even at current WTI prices. Chart analysis shows that most likely CPG is likely bottoming. It producing Broadening Formation pattern accompanied with weekly RSI divergence on a high volume after very long trend down. This is the...

VET Gartley on monthly is getting confirmed. Coming rally should be promising around 30% gain. There is also a potential double bottom happening but it is too early to say. Note, price may (or may not) spend more time at these prices before taking so this trade requires a lot of patience and proper money management. Consider it as long term trade. While holding...

While we are waiting for bigger retrace in of a big rally on weekly TF we can try to scalp smaller moves as opportunity shows up. on 4h TF a small Bat pattern emerging and may give us an opportunity to trade its BAMM move (or conventional double bottom). Entry is on a break of B point as show on the chart. Exit is automatic at 1343. I am bearish gold in...

NEM is in the process of printing Bat pattern still incomplete but we can try to trade B->D move which is often happens. Since when I am writing this idea price already broke B point I have to frame it with two entries. Entry 1 (preferred) - we see daily pin of high volume so there is a good chance of B point line to be re-tested. Wait until it is tested and see...

DXY has been distributing sideways for a long time and I believe its due for a bigger correction of the major rally in 2018 (Elliott Waves Y wave of WXY). I have outlined my Harmonic analysis of confirmed Gartley on daily TF. Although, by the time I am writing this idea it already made initial reaction I strongly believe there is still room for a bigger drop....

BTC is printing Adam and Eve double bottom pattern and may produce a sizable rally if $4240 is broken. This rally is limited by: a) broken trend line - so it is just re-testing it before further drop. b) broken descending triangle bottom line at $5800 I have outlines exit points on a chart. Entry is at $4240 break and re-test. Keep in mind that bullish trend...

Here is my EW count for silver and correction target. I am long Silver after hitting this target.

Here is my EW count in Gold and target for correction. I am long after reaching this target.

Exhausted GDX has broken its $25 support today in last minutes trading. Tomorrow on June 22 it will be trading down. $24.08 is the most likely target for tomorrow. We may break it on Friday if UK vote to remain in EU. Major miners I track gaped down today and behave much weaker than yesterday. Most of them painted inner bar today which most likely will be...