perezliz37

PlusStrategy: Eagle Trap 🦅 | Bearish Confirmation 🔻 🟡 Current Price: $13.58 🔻 Trend: Bearish | Rejection at FBB 200 + Unfilled GAP 🗓️ Earnings: This Week 🔍 Quick Breakdown (35-criteria system): ✅ 32/35 bearish criteria confirmed 📉 Weak RSI, bearish MACD, trading below MA50 and MA200 📉 Rising volume on red candles ⚠️ Unfilled gap at $16.15 📉 Institutional outflows...

Entered at $22.55 after full validation through our 28-criteria system. ✅ Strong earnings (positive revenue growth & stable forward guidance) ✅ Dilution concerns cleared (no new share offering) ✅ Breakout confirmed above VWAP with clean pullback ✅ Accelerated momentum and rising premarket volume ✅ Healthy RSI (no overbought in 4h or daily chart) ✅ No major...

Cadence ( NASDAQ:CDNS ) is reporting earnings tomorrow before the market opens, and honestly… this one might surprise. Last quarter they not only beat expectations but also raised guidance — that’s no small thing. Since then, the stock has been consolidating nicely around the $160 zone. The chart looks solid: low volume pullbacks, RSI cooling off, and MACD looks...

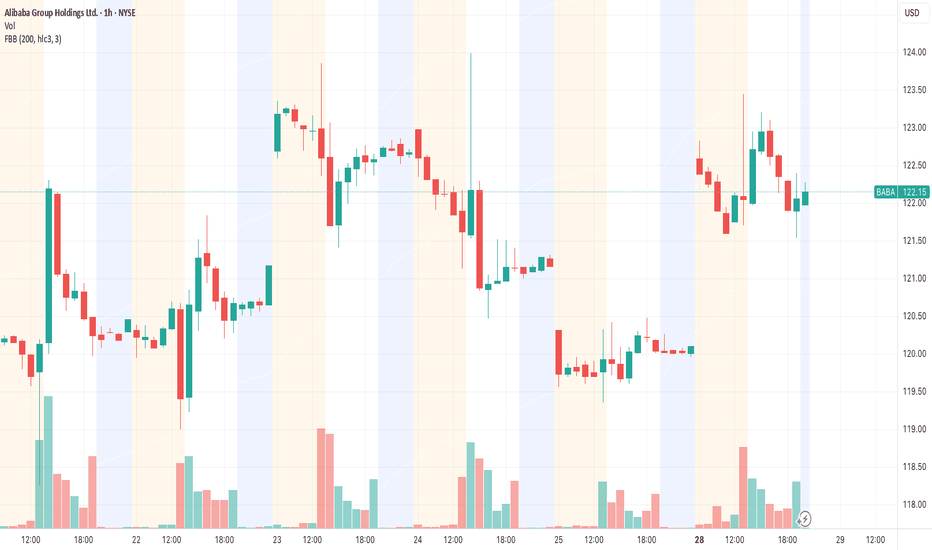

It’s been hitting the $125 wall since May and just can’t break it. This last bounce? Weak volume. No real buyers stepping in. RSI is already stretched and there’s no accumulation from big players. If it loses $120 with conviction, we might see $110 or lower. And let’s be real — China’s still struggling and the narrative isn’t exciting anyone anymore. I’m eyeing...

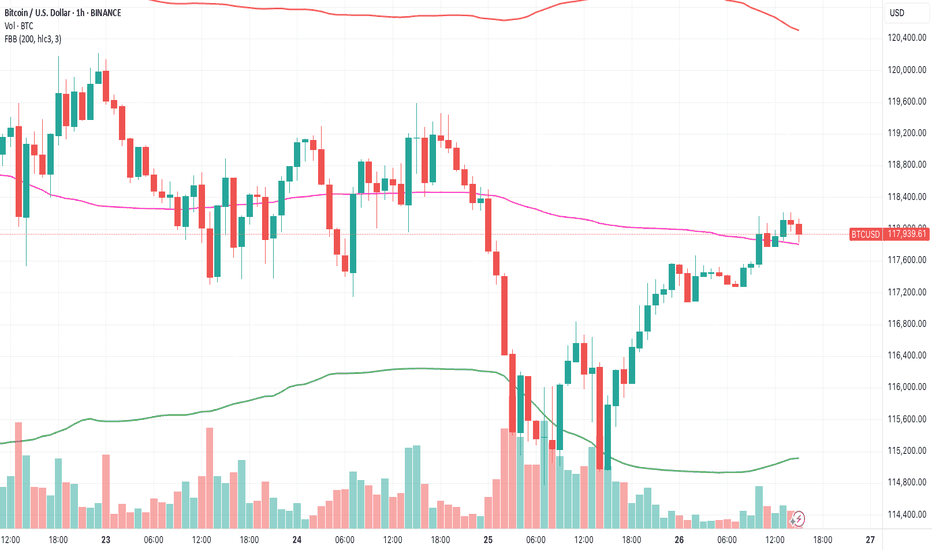

btc i think it's going up... not just 'cause the technicals look good, but 'cause big funds are already expecting crazy prices. blackrock, fidelity and others have mentioned btc at 150k or even 250k in a few years. and if they’re saying that, it’s not just talk... it’s 'cause they’ve got info most of us don’t. plus, there’s less btc after the halving, and ETFs...

so I’ve been watching the markets for a while and honestly this new admin is doing something that many didn’t saw coming. it's not even a full year yet, we’re still on Q3, but the impact on the economy is starting to show. what really gets my attention is the tariff collection, it’s been really high and from what I see it’s even generating some kind of surplus in...

Oracle (ORCL) just hit its limit. The bullish momentum is gone — RSI was over 70, Bollinger Bands were stretched, and there was no volume to back it up. No fuel left. It’s now pulling back right from the 0% Fibonacci level, confirming the move. This looks like the start of a technical reversal. Keep an eye on it.

Tesla's acting weird, but to me, it looks like it's just loading up. Every time it hits that $320 zone, it bounces back hard. That’s not random — there’s volume, and it’s holding that level with respect. If it breaks above $330 with solid volume, this thing could easily hit $356 or more. And with earnings coming up and all that robotaxi noise Elon keeps teasing…...

Nike hit us hard… and that needs to be said too. I’m not going to sugarcoat it: we entered a PUT before earnings, and we lost. We had over 20 criteria from our “Eagle Trap” system lined up — high RSI, a sharp rally with no solid fundamentals, declining sales in China and the U.S., weak forward guidance, low volume, and too much hype on social media. Everything...

With everything going on between the U.S. and Iran, I thought BTC would hold up — maybe even rally. But nope. It's dropping. Hard. While gold and the dollar are climbing, Bitcoin is acting more like a risk asset than a safe one. And honestly, that says a lot. I’m not saying Bitcoin has no value — I actually like it. But when there’s real fear, real war, the big...

This isn’t just another strike — this is serious. And yeah, it’s going to hit the markets hard. Oil is going to spike. It already is. If the Strait of Hormuz gets blocked or threatened, we could easily see prices go above $100. Gold is going up too. It’s the safe haven when fear is real. This isn’t about technicals — it’s about capital flying to safety. Now...

Hi Traders! I’m spotting something interesting on Oracle: A sharp overnight sell-off left a price gap around $202, suggesting potential for a quick correction to fill that zone. The RSI has dropped from overbought levels into a neutral zone near 50, signaling waning bullish momentum. What to Watch: Will ORCL tap that $202 gap soon? Could the RSI stabilize at...

Oracle (ORCL) just completed a parabolic +20% move. Now it's flashing clear signs of exhaustion: Bearish candle forming just below the EMA21 RSI spiked above 80 and is now curling down Volume is fading while price stalls Long upper wicks = visible selling pressure This setup fits perfectly with my strategy: “The Eagle Trap” 🦅 — designed to catch short-term...

I'm currently watching Adobe (ADBE) closely ahead of its earnings report scheduled for June 13th. The setup presents a compelling two-phase strategy that aligns with both technical signals and the macro narrative surrounding tech stocks and overinflated expectations around AI. 🔵 Phase 1: Tactical CALL – Pre-Earnings Momentum We're seeing a familiar pattern emerge...

Tesla closed at 300.63 with a strong 5.42% jump, but the rebound looks more technical than solid. RSI is at 43.90, still in bearish territory, and the stock hasn’t recovered from the recent drop from 360. The 305–310 zone is key — if it fails to break above that with volume, it might drop back to 280 or even 260. On top of that, the growing tension between Trump...

Broadcom (AVGO) – Pre-Earnings Analysis: Bearish Setup Amid Market Euphoria | PUT June 21 Broadcom (AVGO) is set to report its quarterly earnings on Thursday, June 6th, after the market closes. This analysis outlines a potential short-term correction based on a confluence of technical signals, overextended sentiment, and sector precedent. 1. Market Context AVGO...

Idea linked to NASDAQ:AVGO – Full structured breakdown for the week ahead This week I’m deploying a mixed options strategy based on high-probability setups and strict risk management. We’re combining a bullish CALL play on NASDAQ:AVGO ahead of earnings, with three tactical PUT ideas on companies that meet our 20-point bearish checklist across technical,...

Today we closed two well-timed trades: Zscaler (ZS) and Costco (COST). Both were selected using our 20-point technical and fundamental criteria, with entries planned around earnings and macroeconomic momentum (including today’s GDP release). ✅ ZS gave us a solid return of ~$74, boosted by strong revenue growth and an optimistic outlook. ✅ COSTCO, a...