the pair still had the power to move higher from a small correction. I feel we should be adding to the shorts, or SELL a new position at current levels. Strategy SELL or ADD @ 0.8700-0.8740 and take profit near 0.8545 for now.

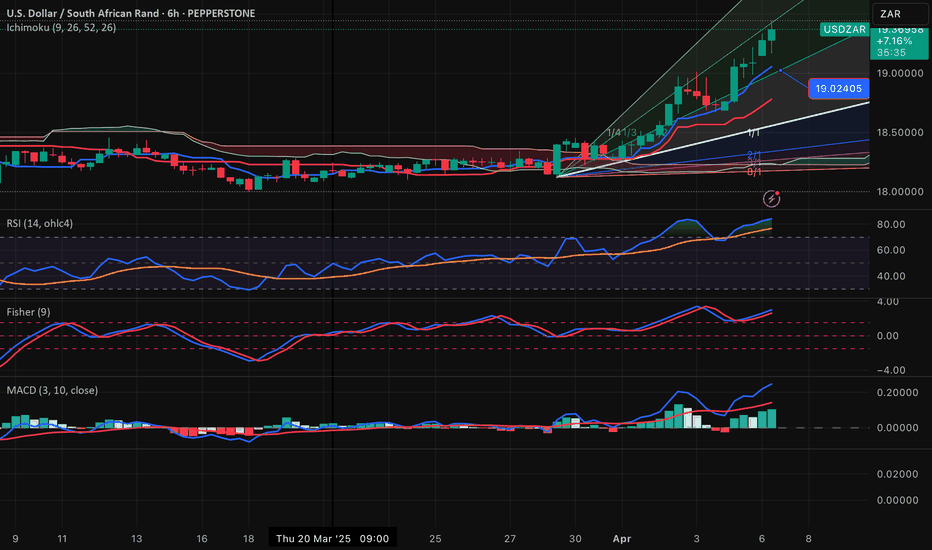

The pair is in an complex frame, whereby part is move lower longer term, but shorter time frame it is buoyant in character. We should see higher levels near 19.4500 again I feel. Strategy BUY @ 18.9575 - 19.0200 range and take profit near resistance 19.3300.

I am not super convinced, and same as yesterday, am not committed to a trade in the pair at this moment in time. However, the pair looks a bit better BUY now, and I feel there is some potential for recovery from the current levels. Overall still pressure judging 12 hourly chart. Strategy BUY @ 18.8000-18.8350 and take profit near 18.9850 for now.

The pair has been forming a potential "M-top" which usually signifies a larger decline over time. The neckline is estimated 2.0790 area, and it means we should be confidently trade below this level to validate and confirm the pattern. The overall objective may be near 2.0000 again. Strategy SELL between 2.0800 - 2.1100 for a profit objective let's say 2.1050.

It feels we are near the end of the run for the short-term and who knows, for the MT as well. It is overextended, even though we had some interim corrections, the overall correction has not taken place as yet. Strategy SELL @ $ 3,200-3,25o and take profit near $ 3,097 for now.

The move lower was expected and I have exited 19.0000 when it tested. it went further south, and this is normal behavior, but I feel comfortable to exit and remain on side lines cuerrently with the pair. If one wishes to trade: 1. strategy BUY near 18.8850 - 18.9100 and take oprofit near 19.0450 2. strategy SELL @ 19.0500-19.1150 and take profit near 18.8750 for now.

Fundamentally we understand the selling pressures on USD and technically also had confirmation for that as well. now we are very oversold (and even before), and since we cannot know the exact lows, we should carefully implement BUY strategy that survives. this is an individual choice and strategy. Strategy BUY @ 99.20-99.60 and take profit near 101.57 for now.

I was unable to update my yesterday's SELL idea, but overall no change to the believe that should continue to see a proper correction in the short-term. Strategy SELL @ 19.3000-19.6000 (wide ranges of course) and take profit near 19.0275 for now.

the pair had a bullet train spike upwards, and it has overextended itself above the regression channel. i feel we are over the top of what the short term value should be. Strategy SELL @ 1.1410-1.1470 and take profit near 1.1127 for now.

Some weeks back I had posted a monthly chart with a viewpoint of a likely S-H-S top formation, and that at that time the right shoulder still suggested we would see 19.3500 or more. Now we have formed this right shoulder pattern, and likely some more consolidation adding to the shoulder. The overall view is long-term a larger decline to unfold and a break of the...

The pair's range has been large, and judging the regression channel, we should see reasonable move lower over time. For now, there is still upward pressure existing, but if we are able to remain or sell between the 19.45-19.65 range, eventually a return to mid-channel level 18.9500 seems feasible. Strategy SELL @ 19.4500-19.6500 and take profit near 18.9750.

The pair as some others are battling to survive. These markets are great and once can create good value quickly. I feel this pair is very oversold and we should see a good pullback coming sessions. Strategy BY @ 08500-0.8545 and take profit near 0.8790.

The pair still has moved higher, but it does not deter us from adding to SHORTS... the pair is overbought and correction is needed. Strategy SELL @ 0.8600-0.8635 and take profit near 0.8478 for now.

The pair no doubt has been pushed lower on US recession fears, and changes in Yields. However, it has gone to far and too quick to my liking and feel we should have some corrections in the coming sessions. Strategy BUY @ 145.10-145.40 and take profit near 147.57.

No change in view, even though markets are severe, and a lot of extreme moves. The overbought status still is valid, and I feel we will see low 19.00s again.\ Strategy SELL @ 19.4750-19.5500 (or if lucky this morning above 19.6000 which I did sell). Take back @ 19.0750 for now (or first stop 19.1750).

The pair has spiked extremely, and now we are in a very overbought zone again. The RSI is extreme, plus GANN angles are steep too.. Strategy SELL @ 19.3500-19.4000 and take profit near 19.0450 for now.

The correction went to far to $ 3,068 but feel we will have another go towards $ 30,30 test en route 2,978. Strategy SELL @ $ 3,110-3,130 and take profit near $ 3,007.

The pair corrected from the lofty heights, and now we are settling around the 18.7250 -18.7500 area. I feel that we are positioning to re-test 19.00 area. Strategy BUY @ 18.7250-18.7550 and take profit near 18.9950.