Looking at USD/JPY we have a potential resistance forming with price unable to break this level. Confirmation of rejection could see a short entry, whereas breaking and holding above this point with a retest could see price head above 149.00.

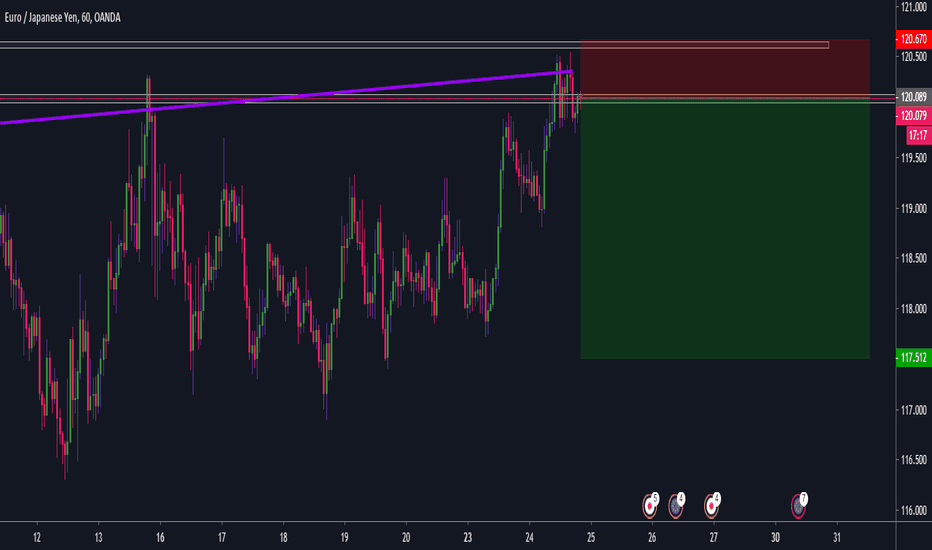

Further to the EURJPY posted earlier, the trade did not get triggered. We have a better entry here and using the Neural Network levels we can see price should start to drop here. Conservatively I would aim for 80 pips initially and expand the TP depending on the trade. Trade now triggered for me personally as I am happy with the risk level.

Looking for a breakout of the triangle here and with CAD being extremely weakened due to oil price war and other economic factor I would assume an upside to this pair. I would not be placing a buystop but waiting for confirmation to enter.

EURJPY looks to have ran out of steam here and a close below the resistance would trigger a short entry for me. Trend line of best fit looks to be holding and a parallel channel shows several touches. I would be confident in shorting EURJPY before we see any further extension upwards or further retest.

AUDCAD Long Trade Setup for the week 09-02-2020 Looking to take a long trade at the support once confirmation of price reversal. If price breaks this level we will see a downside of AUDCAD and I would look to short once price had cleanly broken and retested.

1:20 Risk Reward, very resilient support, confirmation would trigger our long trade, looking for potential retracement to the 61.8% fib level. We would look to take partial profits at the 31.8% and 50% Fib Levels. A break of this key support and failed retest would nullify this trade.

On 9th January I posted a trade idea for USDJPY Short, unfortunately I had a lot of my charts scrubbed due to advertising a free telegram chat. Looking at UJ today I can see the trade would be 185 pips in profit. A break of this important support and a retest (to confirm resistance) would see a continuation downwards and a retest of the 145.600 area support. I...

EURJPY could break previous resistance and has some room below to fall. Short stop loss means nice risk:reward. Would take profits at around 20 pips and move SL to Entry and try to ride further. As always Run with the Bulls and Hunt with the Bears! Veela

USDCHF Forming double bottom and we have a 61.8% Fibonacci pullback level of 9800 from 9660 to 10027 The selloff has posted an exhaustion count on the intraday chart A Fibonacci confluence area is located at 9810 We have a 61.8% Fibonacci pullback level of 9800 from 9660 to 10027