prashant_1209

PremiumWhat an amazing and clean chart this stock has got. Few perspective - Stock Price Momentum: The stock is trading above its 5, 20, 50, 100, and 200-day moving averages, showing strong upward momentum. Volume & Performance: Past 1 month: +26.58%. Past 1 year: +125%–137%. Outperforming the Sensex, especially in 2025. Breakouts: Currently consolidating...

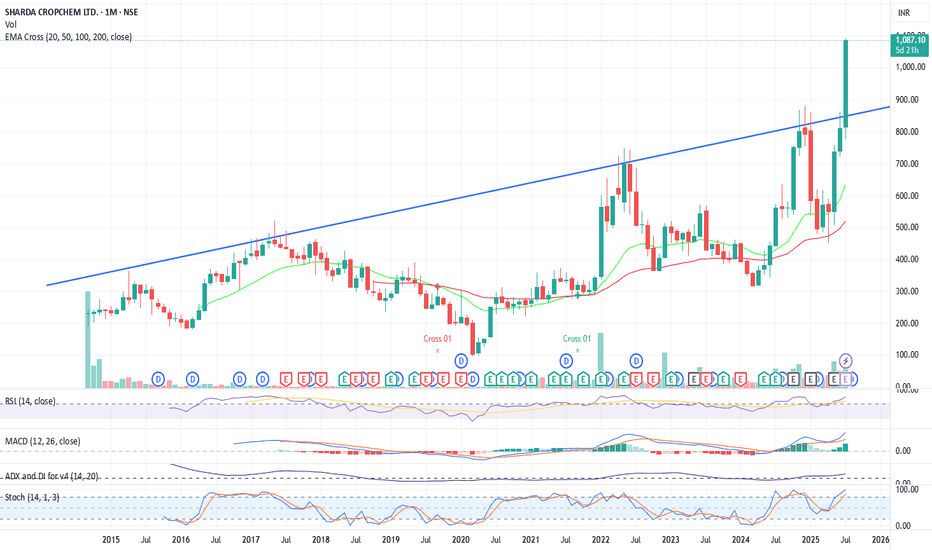

If you have been going through my post so far, you will understand this chart easily. This is no brainer chart - one line explains a lot and that too on monthly chart.... Give your thoughts / comments, what do you think and how you interpret.

IXIGO (Le Travenues Technology) Stock Analysis Technical Chart Analysis Key Observations Strong Weekly Breakout: The stock has surged past previous resistance levels with a sharp upward move. The current price is ₹219.88, near its recent high of ₹229.96. Fibonacci Retracement Levels: The price has decisively cleared major Fibonacci retracement levels (0.236,...

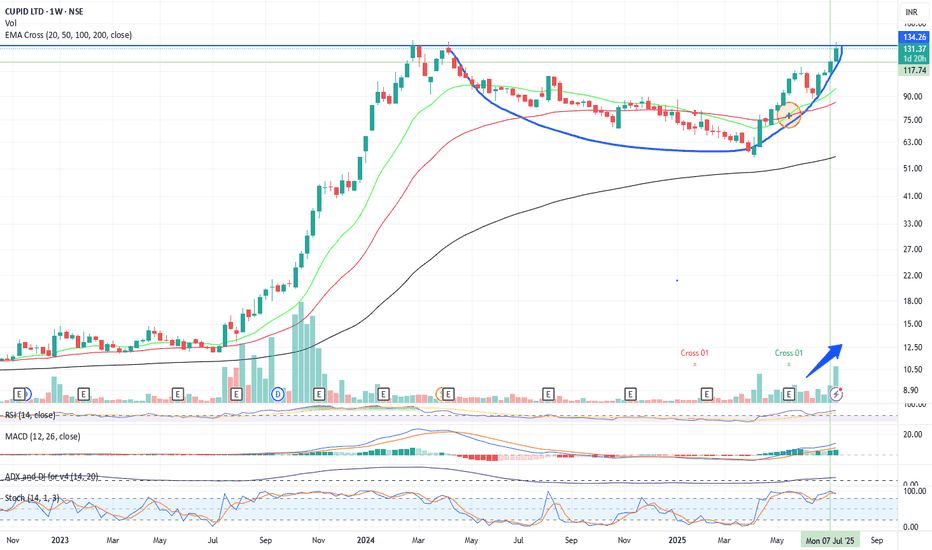

Tactical (Short-Mid Term): Wait for a confirmed breakout above ₹134–135 on strong volume before initiating new positions. With high RSI and Stochastic, expect potential short-term pullbacks. Strategic (Long Term): If the fundamental growth and profitability remain intact, Cupid Ltd. remains a compelling long-term hold. Consider accumulating on dips or after...

BOSCH Ltd demonstrates a strong bullish setup on the weekly chart, making it a compelling investment for the next few months. The breakout from a cup and handle pattern, supported by volume and momentum indicators, suggests the stock could outperform in the medium term. Consider a 3–6 month investment horizon, with ₹35,000 as a key support and ₹38,500–₹40,000 as...

The combination of a strong uptrend, bullish momentum indicators (RSI, ROC, Supertrend), price action above key moving averages, and positive analyst sentiment all point to a bullish outlook for Acme Solar over the next few months. These technical factors suggest that the stock is likely to continue its upward trajectory unless there is a significant reversal in...

Prime Focus Ltd’s stock shows strong technical momentum on the monthly chart, supported by high volume, price above key moving averages, and positive price forecasts. Fundamentally, the company’s leadership in media post-production, expanding digital solutions, and improving operating margins underpin its growth potential despite some profitability challenges....

The weekly technical chart for IDFC First Bank (NSE:IDFCFIRSTB) indicates a positive outlook for the stock due to several key factors: Strong Buy Signals from Moving Averages: All major moving averages (5, 10, 20, 50, 100, and 200 periods) are signaling a "Buy" on the weekly chart, reflecting strong upward momentum and trend strength. Positive RSI and MACD...

Jio Financial Services stock shows strong potential for growth on the weekly technical chart based on multiple technical indicators and moving averages signaling bullish momentum: Strong Buy Signals Across Moving Averages: All key moving averages (5, 10, 20, 50, 100, and 200-day SMAs and EMAs) are indicating a "Buy" or "Strong Buy" signal, reflecting sustained...

Trent India Limited is attractive for mid to long-term investment because it combines strong financial performance, aggressive growth plans (especially through Zudio), a diversified retail portfolio, and solid backing from the Tata Group. The company is positioned well to capitalize on the growing Indian retail market, with positive analyst outlooks and...

Maruti Suzuki India offers a strong long-term investment case due to its dominant market position, steady earnings growth, strategic focus on EVs and exports, and healthy financials. While there are near-term margin pressures and industry growth challenges, these are largely seen as temporary, with the company poised for sustainable growth driven by new product...

Endurance Technologies presents a compelling investment case due to: Consistent revenue and profit growth with improving margins and strong cash flow. Strategic expansion in Europe and into EV-related products, positioning it well for future automotive trends. Healthy return ratios and dividend payouts. Reasonable valuation considering growth prospects and...

Zen Technologies has demonstrated remarkable growth, with its stock surging over 60% in the last month and more than doubling in three months, driven by strong demand for its anti-drone systems and positive defence sector sentiment following recent India-Pakistan tensions. The company reported robust Q4 earnings with a 189% jump in consolidated net profit and a...

Fine Organic Industries' weekly higher highs over the past few weeks is driven by strong revenue growth, full capacity utilization, strategic expansion plans, favorable analyst outlook with rising target prices, and solid financial returns—all contributing to positive market sentiment and sustained buying pressure on the stock. Strong Recent Price Performance...

Himadri Speciality Chemical is on the verge of a breakout driven by strong quarterly and annual financial results, strategic expansion into high-growth sectors like lithium-ion battery materials, positive technical indicators, and a historically favorable seasonal trend in June. The company’s robust operational performance, healthy balance sheet, and...

ITC making consecutive 3 months higher high, early sign of cup formation and target is for cup breaking out point as golden ration of Fib. retracement. FMCG Sector turn-around and poised for growth. Multiple sign clearly indicates that ITC is picture perfect chart for growth. Low cheat option, may turn around and ready for cup formation.

Cholamandalam Financial Holdings Limited (CFHL), a marquee name among India’s top 5 NBFCs by market capitalization and a key entity within the Murugappa Group, continues to demonstrate robust financial health and growth momentum. As a Core Investment Company registered with the RBI, CFHL offers a diversified portfolio of financial products and risk management...

The chart presents a textbook breakout setup, exhibiting a classic cup formation with a low-risk entry point. Key observations include: Channel Breakout Level: The price has decisively broken out above the channel resistance at ₹810, confirming bullish momentum. Fibonacci Retracement : Using the swing low at ₹627 as the base, the price is now advancing towards...