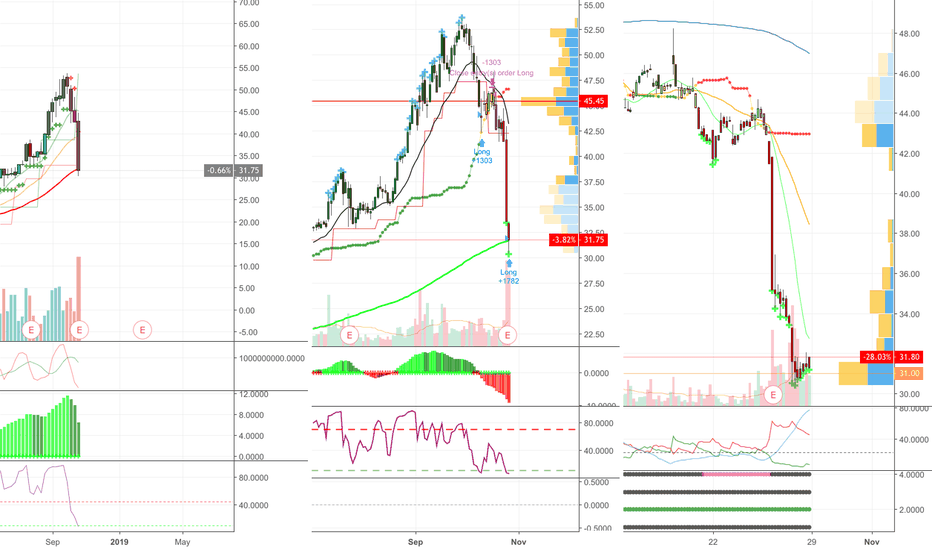

It looks like JD has alternated between missing earnings and delivering a big surprise. With the stock down 50% from the top, we think it's about to pop to the $29 Fib line - even up the $32 200MA in the next few weeks.

TGC is building a base higher and we expect another pop from this coil.

We only had such subdued historical volatility less than 10 times since 2012. 90% of these instances were followed by a massive rally - one was different. Are we about to see it again or is this time different?

We're noticing a downward slanted h&S Top in AAPL. The proverbial apple is about to fall from a tree

NVCR - Novocure - oversold on the weekly and oversold on the daily. Could setup for a nice bounce back here!

We're seeing some oversold bounces for Medicinal Marijuana and Energy.

This is a great step forward continueing our narrative that the bear in bitcoin is on it's last legs and a new bull market is about to resume!

This is a pure technical play. Stops at 3704 satoshis - 15% below current price. Target 6000 Satoshi

We're still in a normal volatility bear market but also seeing some of the sell signals extended and we seem to be due for a reversal - can we push higher and get a new bull market?

hi all, as we suspected - the signs of a new bull market have subsided and our systems triggered short on Sunday. Will this be the last leg of the push where we crash to $4,800 or will we find some support in the $6,200 area and bounce before the final crash to $4,800? Let's analyze...

In this video we look at the 2013 and 2014 crashes and what were the preceding and succeeding market conditions -- and what that means for us now in 2018... A new bull market has started - but the risk to roll over into a crash is still there.

We're consolidating below the highs. We can push to 280k level.

We are consolidating right below the resistance. Declining volume. Expecting a push higher into the next resistance - around $75.