Because of the fomo of fed rate cute wedsnay, there might be a buy oppurtunity in wall street and big banks around 1500 dollar. At 20h wednesday after the fed rate cut ; there be automatically like always a drop and probably back to scenario 1500; after tha there might be a big buy oppurtunity. Have a nice trading week

When there is uncertainty around the wordl people tend to use their money into safe havens like eur/jpy and usd/jpy I think it's a nice oppurtunity to trade on this pair because also there will probably be a fed cut, so people can put their money on safe havens. Don't put your money when there will be a recession in US because this won't work as hard as gold...

When we trade with the eur/jpy, you must think about safe haven; so in this case we see now a rejection and going to 123. 000 In my opinion, it can first go to 1.23 000 and after it's can break the trend line, it can go behind of fall back under Have a nice and trading week Always learn on demo before you go live

GBP is about to break out if they leave Europe, but that won't be easy. It might first go to 1.28 000 and after it can pull his 3d swing pull back to 1.25 000 Let's say that there will be a solution for Brexit and they go out from Europe. First it need to break to 1.27 942 to reach 1. 40 000 I used price action bars; it tells weekly that there is a blue...

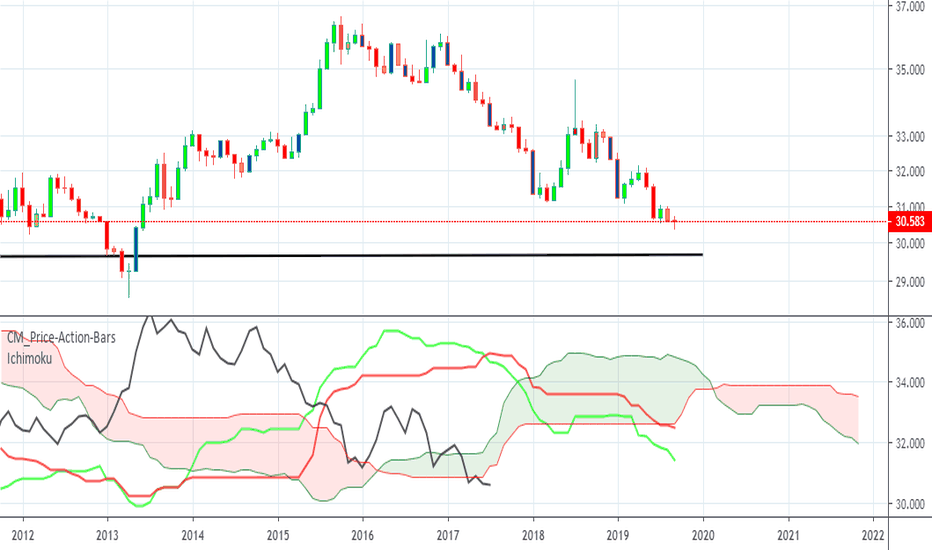

USD/THB is going back to his support around the area of 29.70000 Good reasons that could happen: 1.: europe holidays are done and people are start working=less money circulation for their tourists 2.: fed has pumped money into their monetary system to prevent recessions 3.: price action bars tell you more than just the price. Have a nice and risk management week Hola

If we see back to 2017 there is a gap around 1.07700. And you know what to do with a gap ? Just make it simple as it is, it need to fill it back. If it hits there the eur could rise from that point to a new bull starting in 2020. or end of 2019. have a nice and risk management week.

This monday we could see a rejection around the area of 67.000 and on tuesday after the 4 hour chart we could see high buying oppurtunity to 68 000 and after to 69 000 and 70 000 A rate cute means the australian dollar getting cheap so we buy more. Watch always out, forex can be risky especially when it's pumped fake money from the fed this month. Have a...

aud/nzd need to go back to his resistance around 1.1000 We see an out side bar monthly(orange bar, that means it goes higher to his colour green) In a 4 hour chart I see a dragon fly, so it's definetly a buy oppurtunity.

GBP is falling against JPY but it first need to go back to his resistance around 138.000 We see shaved bar (blue one) that means there will be a further down after it get's back to his resistance

Silver will hitt 21 dollar per ounce, after retested the last gap , there is a new gap. If China buys more silver tonight we could reach 20 dollar per ounce. If China doesn't buy and short ; then we will retest the last gap around 17.300 and 17.400. Have a nice and risk management week

Gold is defenitely in a bull run but we're coming in a rejection place where there can be a up and down side between 1479 and around 1459 per ounce. I can see that trade war tensions isn't yet over and rise up gold to a new high. The American Fed is now pomping money and Trump send some monetary troops to Saudia. It's possible that American Fed could buy big...

When we see a orange outside bar, we will make definetly make a higher bar for next month. There is a rejection at 1.2700, after this there will make a lower bar. Buy till 1.2700 first and after in the long term it can go to around 1.3000. Have a nice trading mont. Greetings Hola

What do you think about my first analyse ?