quantguy

PremiumOil has found support at 88.74, and prices did not last in the high 80's for long. We saw an immediate pivot from this level and have solidified the 90's once again, breaking through 90'06, our next technical level, with ease. We should see some ranging from here between 90.06 or 88.74 and highs or our next target of 92.03. The Kovach OBV is still very strong,...

Stocks have tested the upper bound of our range at 4580. We anticipated the S&P 500 to hold the range between 4440 and 4580 in yesterday's report. We currently appear to be running into resistance, but there is a vacuum zone above to 4632 if we are able to break through. The Kovach OBV has picked up, but does not seem to match the strength of the rally, so...

Litecoin has retraced sharply from highs at $141. We smashed through the first level of support at $134, but have found footing at $130, exactly as we predicted in the reports yesterday. From there, we saw a nice pivot back through the vacuum zone above $134, but are unable to test $141, and likely will not for now. It appears that we are forming a sideways...

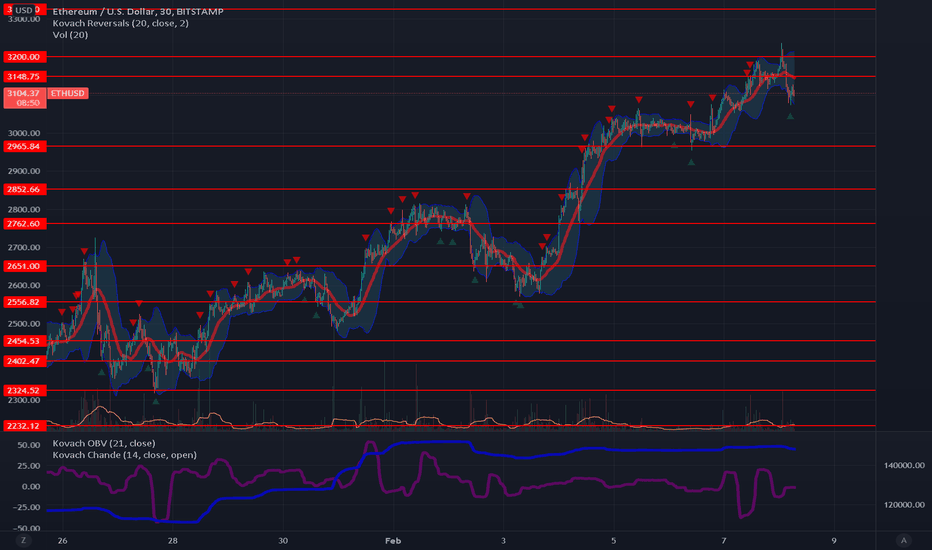

Ethereum has retraced after rejecting $3200, exactly as we predicted here yesterday. After a sharp rejection at $3200, we were able to find support just above our level at $2965. We are seeing good support at $3K or so as confirmed by green triangles on the KRI. Currently, we are attempting $3200 again, but are facing some resistance just under it, at $3148. ...

Bitcoin has retraced from highs at our target of $45K. Exactly as we anticipated in the reports yesterday, we are finding support in the $43K handle, with two strong levels at $43.1K and $43.8K. The Kovach OBV has dropped off, and was not too strong too begin with, signalling skepticism in this rally. We are still not convinced Bitcoin can hold these levels,...

Oil has retraced a bit further after a sharp rejection from highs. This is a reasonable technical retracement, bound to happen after such a prolific rally from the low 80's within less than month. We are seeing support at 88.74, confirmed by a green triangle on the KRI. The Kovach OBV is still strong, but has leveled off. This is another sign that the price...

Stocks have broken out from their consolidation pattern we discussed yesterday. This breakout was a bit disappointing, as we were unable to even test highs at 4580. We met resistance just shy of this level at 4545, where a red triangle on the KRI is confirming resistance. The Kovach OBV is almost completely flat, despite this small rally, which does not give us...

Litecoin has ascended quickly from the low $100's to our next target, proposed yesterday, of $141. We blasted past resistance in the $130's, and soared through the vacuum zone above to hit this target. A red triangle on the KRI is confirming resistance at $141 for now, and the Kovach OBV has turned over sharply. At this point, we can expect continued support...

Ethereum has continued its ascent from the low $3K handle, after solififying value here from the $2K's. We are seeing quite a bit of resistance from $3200 as predicted in these reports many times. We are seeing some red triangles from the KRI suggesting resistance here, and if we are unable to solidly break $3200, then $2965 should provide support. If we...

Bitcoin has pushed through resistance in the 43K's to hit our target of $45K solidly reestablishing value in the $40K handle after spending quite a bit of time in the $30K handle. The Kovach OBV has turned bullish, but does not quite match the strength of this rally, and appears to be suggesting some weakness. If that is the case, then we expect support from two...

Stocks are ranging in the value area we identified yesterday, currently finding support at 4440, the exact level we called out in these reports. We are holding a narrow range between 4440 and 4545. Volatility has consolidated considerably, and we are forming a sideways correction, possibly a triangle pattern. The longer that ranging will continue, the more...

Gold has continued to rally, breaking out from our range between 1795 and 1815. It has hit our profit target of 1826, which we predicted yesterday. We are reaching resistance here, confirmed by a red triangle on the KRI. However, 1815 is providing support as confirmed by a green triangle on the KRI below. If momentum continues, then our next target is 1836...

Litecoin has made considerable gains since our last report. At the time, it was ranging in the low $100's, with support from below by $105 barely hanging by a thread. We were able to smash through the upper bound at $114, which had provided resistance all last month. From there, we were able to break out even further, breaking resistance at $120, then $124. ...

Ethereum has rocketed from the upper $2K handle to solidly regain the $3K handle. We have blasted past $2965, the last level in the $2K's and appear to be attempting to establish value in the low $3K's, with support from below at $2965 and resistance from the first level of the $3K's at $3148. The Kovach OBV is pretty strong, but a bit flat for what you would...

Bitcoin has smashed through the $30K's and reestablished the $40K handle. We saw a sharp buying spike on February 4th, which sailed through the vacuum zone and solidly broke our first psychological and technical level at $40.0K. After that, we were able to ascend further, breaking $41.6K and $41.9K, two technical levels that have provided prohibitive resistance...

The US dollar has fallen further, but has found support at the last level of the 95 handle at 95.26. We do appear to be finding good support here, with a pivot back to 95.58. The rally looks pretty weak and we are encountering resistance confirmed by a red triangle on the KRI. If we see a further selloff, then 94.97 is the next target. If the DXY can break...

The S&P 500 has retraced a bit after breaking out to 4580. This is a significant target which must be solidly broken if stocks are to consider new highs again. There is a vacuum zone above this level to 4632, which is our next target. However, we are seeing a corrective phase after the push from the low 4200's, with a retracement to support at 4440, the exact...

Bonds appeared to be making an effort to attempt higher levels, with a bull wedge pattern forming with an upper bound at 128'10. However, we broke down from this pattern, smashing through the 128 handle into the 127's and then some. The next level of support at 127'22 did little to provide support, though we finally bottomed out for now just above 127'08. ...