que

As we head into a New week, why am a bull on this one is that investors are eyeing the Rate-Cut Fever: Traders are pricing in a September Fed cut (~90% probability), which weakens the dollar and boosts gold demand Tariff Turbulence & Safe-Haven Flow: U.S. tariff policies—especially recent drama and subsequent exemptions—have kept gold in investors’...

From June till now, we’ve been in a range-bound market, with multiple failed attempts to break lower. But now we’re seeing higher lows forming, and price is bouncing off my fvp zone @ 1.36600 . So if the Fed stays patient and oil stays weak or sideways, USD/CAD bulls have the upper hand. I am expecting a bearish retest soon to develop @ Key Bullish FVP Zone:...

As we begin a new week, I see the bulls coming in and grabbing the unmitigated liquidity @174.440 handle. My advice to fellow traders is that if the ECB stays hawkish or the BOJ remains dovish, EUR/JPY has room to stretch higher. Watch Euro inflation numbers, BOJ yield curve control updates, and U.S. data spillovers. Buy @ 173.15 TP 1.~174.440

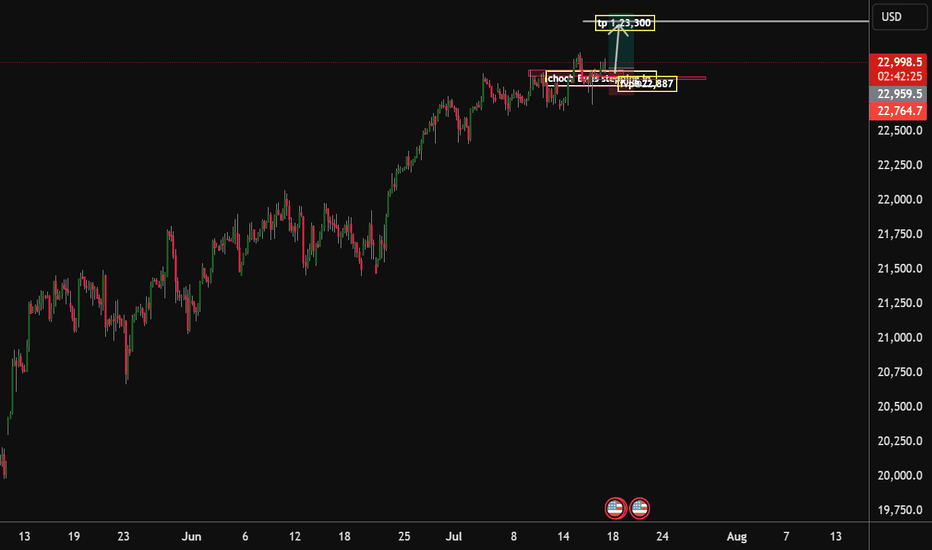

With the choch on the market structure and with Key data released on Thursday, reflected strength in the U.S. economy. Stocks rose this Thursday, buoyed by fresh economic data reports and a slew of corporate earnings releases. The tech-heavy Nasdaq Composite has advanced 0.4%, and quarterly earnings reports released this week have exceeded Wall Street’s...

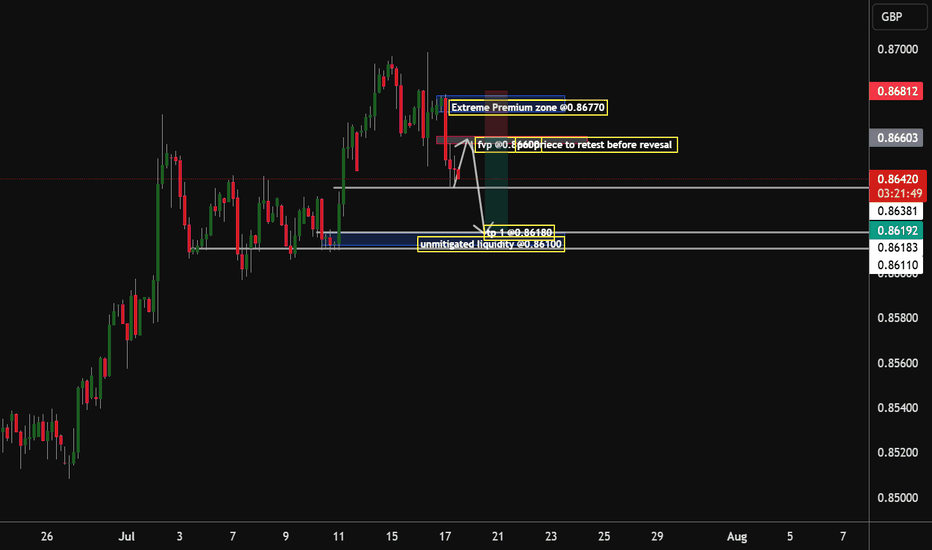

By early next week, my analysis according to the market structure being formed suggests that the institution that drives the market will have to be dovish on this pair, as there is unmitigated liquidity awaiting to be grabbed @ the 0.86100 zone by the end of next week will have to see that zone being mitigated Tp 1.0.86180

Crude oil extended its rally to over $76.5 per barrel, the highest in five months, as worsening geopolitical tension threatened the supply of energy from the key region. Israel and Iran continued to exchange missiles late in the week. President Trump struck a hawkish tone against Iran to maintain the possibility of US involvement, which would risk global conflict...

as we start the month with trade wars which the cable possibly will not be part of, optimism has grown around a potential Ukraine peace plan reinforcing Britain’s support. Sterling also has gained strength from the expectations that UK interest rates will remain higher for longer. Bank of England Deputy Governor Ramsden highlighted that persistent wage pressures...

The ECB is set to deliver another 25 basis points (bps) cut after the April policy meeting, reducing the benchmark rate on the deposit facility to 2.25% from 2.5%, with the disinflation process remaining on track. That being said, my Short-Term Outlook: Euro Likely to Decline Lower interest rates reduce the returns investors can earn from euro-denominated assets...

U.S. oil prices have extended their losses this Wednesday, plunging by more than 6% after China just announced it has raised tariff trade duty on goods from the United States from 34% to 84% starting 10th April in response to US President Donald Trump's tariffs, including a cumulative levy rate of 104% on Chinese imports. Traders are now remaining wary of...

The Bulls have started taking a breather on the precious metal XAU/USD and will retreat to its first support by early Next week, which would be the $3,000 mark. Once surpassed, the next stop would be the February 20 daily high at $2,954, followed by the $2,900 mark. Conversely, Gold rising above $3,050 would pave the way to challenge $3,100. hoping that my...

for Mexico, Canada, and the U.S. due to the turbulent rollout of Trump tariffs, which has created significant uncertainty for businesses and policymakers. Concerns over inflation in the U.S., which were already growing, have intensified, making it more likely that the Federal Reserve will hold off on policy changes for the foreseeable future. Meanwhile, the risk...

As we close the Month, of March, we will have to see EUR/USD Bears Trying to mitigate the 1.05000 zone as the Fed is in no rush to cut interest rates soon. The major currency pair thus faces selling pressure as the US Dollar (USD) strengthens after the Federal Reserve (Fed) expressed in the policy meeting on Wednesday that interest rate cuts are not on the table...

Expectations that US President Trump will impose tariffs on copper, a move that would pressure the limited capacity of local smelters. The President signed an executive order to initiate a review of copper imports after noting he would tariff the metal in an earlier speech before Congress. These signals suggested that levies would be imposed later in the year,...

As we close the Month so are the Bears there will be a retest @0.89800 to the upside as the bulls will try and retest this Key area But early Next week will see exhaustion from the Bulls and the bears will come in and push the Price to our unmitigated liquidity yet to be reclaimed @the 0.87900 handle Tp.1 0.87939

US President Trump renewed his threats to impose tariffs on Canada, noting that the latest delay was only for ‘30 days’, and is set to come back into effect next week. the loonie is under pressure as policy concerns continue to weigh. that being said, I am expecting this week or early March for the bulls to come in and dominate the @1.4500 Fair value area Before...

As we close the 1st month of 2025 so is the Aud/jpy formation of a Bearish cup & handle formation further clarifying that the Bears are still in control of the pair hopefully by early Next Month of Feb we might see the pair seek to liquidate the zone analysed @91.200 as major players try and push the price all the way down to our unmitigated zone @0.92075 1st Tp...

Nonfarm Payrolls soar by 256,000, far exceeding the 160,000 forecasts and reinforcing labour market resilience. the data helps the US Dollar retain its gains with the Fed likely to continue gradual cuts later in 2025 if inflation cools. that being said, I am expecting the Bears will try as of early next week, to push the price all the way down. the targets that I...

it will be quite interesting to see the formation of the bullish cup & handle signifying that we will be coming in a whole new month to a new bullish structure formation in the next few days as we enter August it will be quite interesting to see the Bos and Choch to the upside if I were an institution I would be preparing to be a bull and ride it out up that I...