rahul4526

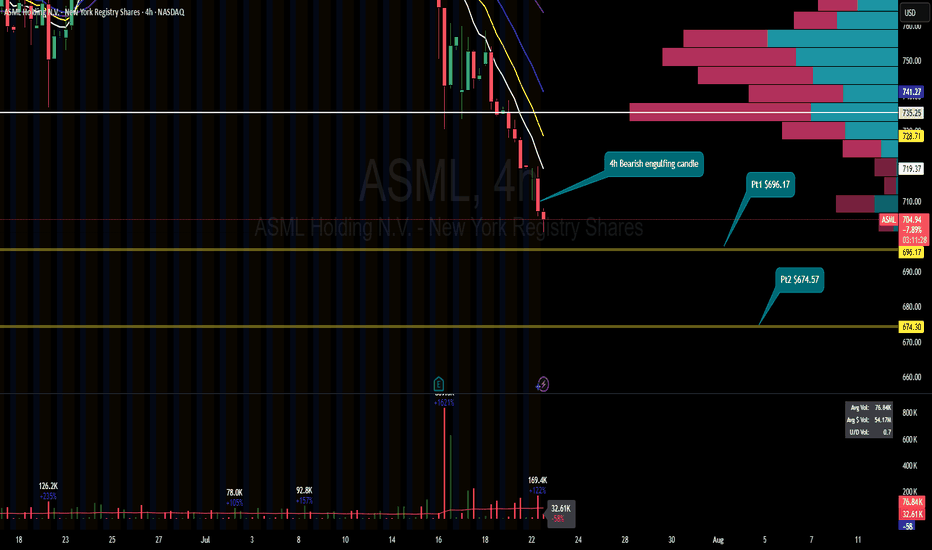

PlusNASDAQ:ASML after earnings it has been loosing some major support levels. Currently we had just 4h bearish candle. Looking for some gap fill to $696 and $674.

NYSE:HIMS daily with bullish engulfing candle. $58 pt is for gap fill.

NASDAQ:SBET after initial spiked up it has sold out. But now is in accumulation phase. Weekly tf had HVE candle which shows pure accumulation. Also weekly ema looks coiled for move up. My pt is $40 on 2 weeks horizon.

NYSE:NOW had failed breakdown then bounce at 50ema on daily and it had recaptured 8ema and 21ema on daily. Gap fill target remains to $1114.

Trade of the week: NASDAQ:TSLA (Short) Current price: $346 Entry Trigger:$339 Stoploss: $353 Call option: NASDAQ:TSLA $300 put expiry 06/20 at $4.45(*1 Contract only) Thesis: NASDAQ:TSLA is in daily uprising channel aka building a wedge. NASDAQ:TSLA last week made a doji candle on weekly often that leads to reversal. You may take this trade at entry...

NASDAQ:APP double bottom on daily here. Also It has relative strength compare to the market. Putting nice bullish pennant here. As long as $358 doesn't break we can see $390+ in upcoming week here.

NASDAQ:COIN putting bullish triangle pattern here and it has support now at 21 ema. This looks ready for move up. Bullish pattern forming here. Also CRYPTOCAP:BTC proxy name with better risk/reward here.

NYSE:CVNA Macd almost flat on weekly. It's entering the volume gap here. Also RSI and William% range is giving bullish divergence. First pt is $155.90 and second pt is $220.00. This targets are based on weekly TF.

NASDAQ:PANW currently above daily resistance level. It has earnings gap filled to the upside. MACD is almost flat also RSI and William% range showing bullish divergence. at the same time it's entering volume gap. My pt for this chart is $357.

NYSE:LLY has been capturing obesity market with monstrous growth. Currently it's entering the volume gap. RSI and William% range now showing bullish divergence. My pt is $870.

NYSE:NOW has flushed down with NYSE:CRM earnings but has recovered quite nicely, Building out the base from $700 area. MACD also curling to the upside with william% range and RSI showing bullish divergence. My pt is $737.

When I do TA I don't like putting too many indicators. Indicators are probability and nothing else. Too many indicators = too much noise. Anyways we are getting straight in details. The recent trendline on daily from bigger picture is held as support on broad market selloff. Also if you see the MACD on daily it just turned to the upside so putting an additional...

NYSE:ELF clearly breaking out from base here. MAcd has turned to upside with William% range and RSI showing bullish divergence to the upside. My pt is $202 with volume gap above.

NASDAQ:ENPH starting to move off here as seasonality kicks in as for all the major solar names. It is breaking out of daily resistance and closed above last Friday. Targeting $140 which is major overhead resistance. Also it is nearing volume gap above ranging from $127~$130.

Price has been consolidating between $615~$620 range. Last week price has been managed to close above $620. It showing bullish divergence on RSI and as well as William% range. $640 should be possible near term target as price will be moving though volume gap.

NASDAQ:TSLA has been in consolidation between $170~$175. Last Friday it managed to closed at $177 giving a signal that price is now in breakout. Macd at 0 signal to upside with RSI and William% pointing rising bullish divergence. The first target is $193 .

This is my first thesis based on TA. The trendline held support on daily and MACD is starting to curl to the upside. On the first earnings this stock has made quite the move to upside ranging from $75 to $164. I am targeting $117 as long as earnings are in favor. On the other hand, when the stock made 52 week high market has anticipated that the corporate will...