ramkdlr

Rangebound since 2021 Showing signs of accumulation 📦 Cheap on Price-to-Book basis vs peers Low public float → can move fast on news ⚡ Bull factors: Undervalued vs peers (DLF, Godrej Prop) Reviving real estate sector in Tier 2/3 Rental income to kick in from Omaxe Chowk 💰 Debt reduction plans are underway high debt is a concern & project delay may be a...

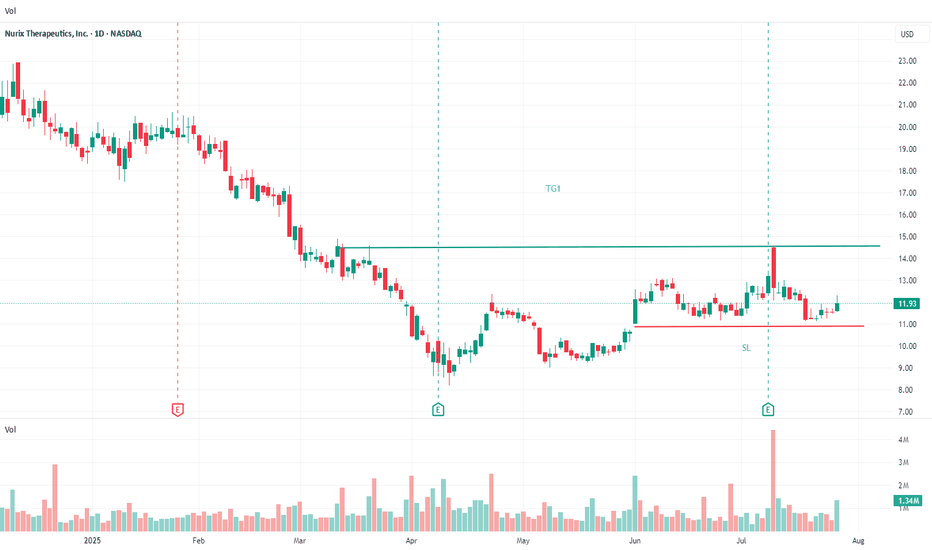

🧪 Pipeline Progress (as of latest update): NX-2127 & NX-5948 in Phase 1 🔬 NX-1607: Promising early clinical data in solid tumors Multiple preclinical programs in immuno-oncology and autoimmune space Down ~80% from highs (2021 biotech bubble burst 😬) Consolidating near lows — potential bottom fishing zone 🐟 High short interest = possible squeeze setup...

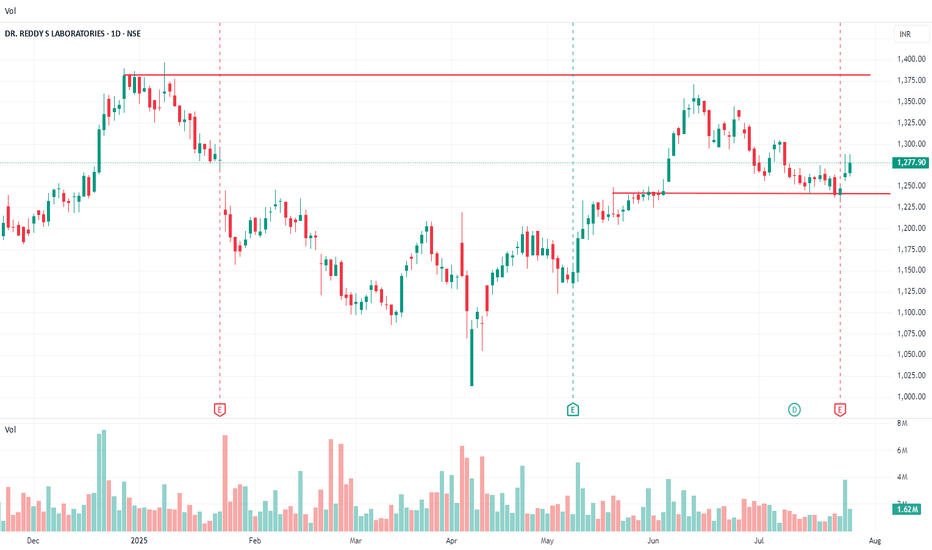

Revenue: ₹8,545 crore (~11% YoY increase) Net Profit (PAT): ₹1,418 crore (~2% YoY growth) North America generics revenue declined ~11% to ₹3,412 crore due to pricing pressures, while Europe surged 142% YoY Consensus estimates (SimplyWall.st): Average target at ₹1,289, with bullish/bearish range ₹1,660–₹990. Growth forecast modest (~2.9% revenue CAGR through...

Revenue: Still in early-stage / pre-revenue phase Heavy R&D spending Backed by over $1B in funding Valuation during last private round: ~$8.5 billion ✅Strong partnerships (Toyota, Hyundai) ✅ Dual-market presence: US + China ✅ Leader in AV permits in California ✅ Advanced AI and simulation tech stack PONY is a speculative play in the autonomous vehicle space....

Keep a close look in to the support zone and the RR ratio favours a long position .keep a strict SL for short term and re-entry for longer term .

Keep an eye on the chart consistent support from buyers may prompt this to a new unchartered territory sooner.

Texrail on the verge of breakout keep in your watchlist for long entry.

Stock had given a breakout after a long pause.Keep in your watch list for long entry.

Oversold area and expected to good return in near future.Technicals favour entry for long

Short term bounce back expected from the current lows.

Modest performance and reducing selling in Pricol.There may be a turn around in the trend soon add to your watchlist.

Positive results of jun24.stock looks oversold and institutional increased stake in previous quarter expecting a bounce back soon. keep strict SL.

Selling gets absorbed and a pull back is due.Will keep for long term and average on downside.

Keep in your watch list. Those who are ready to add more near 518 can keep a long view on the scrip.

Technical Indicators are directing a pullback from the current lows.

Looking for a reversal from the current position as the stock is oversold.Keep in your watch list.

Selling looks over for now can retest the previous high.

A retest of resistance may happen today along with new new ATH if successfully crosses the resistance level. A wait and watch moment.