redwingcoach

Long today after the close at 210.40. Historically, ADI has been a top 20 performer for my trading system, so a 1 week slump doesn't faze (NOT phase) me a bit. Long term, it has a dazzling track record for what I do, so short term struggles just look like an opportunity for me. Historically, this particular setup is 359-1 (the one would be a trade from late...

If you've been following me for any length of time, you know what a trader-crush I have on TSCO. The success I've had with it over time has been about as good as any stock I trade. This is a sad chart, when you look at it. There's really nothing here that screams buy right now. But the chart doesn't tell the whole story. While I'm not using my typical algo...

Today was a rough day for the market, but rough days are opportunities. Days like this require confidence in what you do, though. For me, confidence comes from data. Could there be more downside ahead? Yep. Taking the time to mine data to understand whether what you are doing has been successful in past circumstances where corrections have been involved helps me...

I am on record more than once here saying that I don’t like trading stocks without long trading histories. I stand by that “rule” but on this occasion, I’m going to break it. That lovely uptrend is only part of the reason why. NYSE:CR has only been publicly traded since the spring of 2023. It has produced some of the best results in the entire spectrum of...

As a short term mean reversion trader, I don't like charts that go straight up. Since late April, that's what META has done. With just a small pullback from its recent highs, this is a spot where if the trade works, it should work quickly, playing off the stock's recent momentum. But if it doesn't pay off quickly, the risk is that I'm getting in near the top of...

As mentioned in the text box, this setup has done very well in the last 12 months with EA. But in addition to that historical performance, the uptrend since January is still intact, and the recent April pre-breakout highs are now acting as support. The idea here is a quick flip, though I may or may not use FPC on this one depending on market conditions. If the...

Step 1: Zoom out on the chart for CASY. Please. Feel free to scroll back all the way to 1984. I'll wait... That view alone tells you all you need to know. This is one of the prettiest charts you'll find anywhere on Wall Street. Not flashy, just relentlessly and consistently profitable. If I make money on this trade, the credit goes to the stock, not...

There's nothing particularly pretty about AAPL's 2025 chart. It's in a solid downtrend since the start of the year, losing 24%+ this year. However, a recent higher high and higher low since the April 8th low, and support from the April 21 pullback low close by gives me a little hope that a quick snapback is potentially in store. Potentially grabbing the...

Nothing special about this trade except that it was one of only 6 large cap stocks that registered as a buy for me today and was the best of the bunch, technically, imo. Historically, the returns here are only about 20% better than an average market return per day, but using this trading technique, it has never lost money - 1027 wins, 0 losses (real and...

TTAN is a stock that just went public in December, so take the results below with a grain of salt - these are not likely typical (magnitude-wise). That said, I'm using the same entry rule I've used for many other trades lately with good results. While this is the first time I've actually traded it, the trades I'd have taken on this ticker are shown by the...

This is unusual for me, and full disclosure, I am not personally trading this. I don't short on margin and the spreads on puts are a little too wide for my liking. So think of this as my musing on a market that I think is still overbought from last week. I get why it has been running - yield is tantalizing in a struggling market, and monthly payouts even more...

CBOE is a stock that has held up unusually well during the tariff tumult lately. It's not that surprising - they benefit from all the hedging that everyone is doing with options. It hasn't really done much substantively since September, call it a 7+ month consolidation after a 75% run-up from March of '23 to September of '24. That "nothing" is something for the...

People get panicky during corrections. Understandably, it can be nerve-wracking watching that stock you were sure was going up, going down. With the short term nature of the trading I'm doing, I don't worry that much, and especially when the corrections are garden variety ones. ROST is down almost 10% since Dec 5th. That's a normal correction, especially for...

I don't care what your trading strategy is. In the end, if you're going to be successful at trading, it's about putting the odds in your favor. In my case, I like to put the odds WAYYYYYY in my favor. NASDAQ:FAST is one of my top stocks. Out of over 1,000 trades going back to the month before Black Monday in 1987, it has only produced 3 "losing" trades, and...

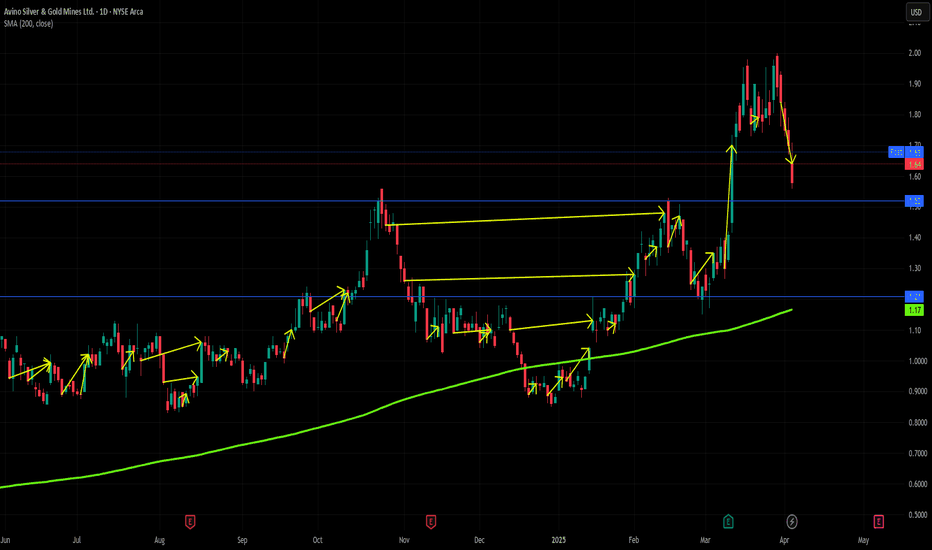

In times of duress (and we can all agree this qualifies, I think), go back to a classic - the 200d MA. Not many stocks these days are trading above their 200d MA. Fewer still are in a business that is a built in hedge for inflation. I think these tariffs will be even more inflationary than they are recessionary and gold itself isn't quite a buy, so it's this...

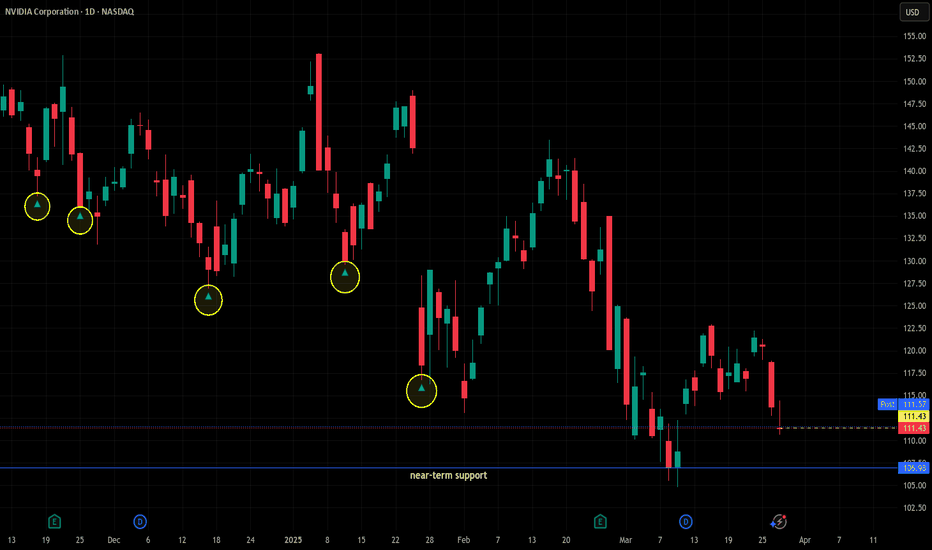

This is gonna be my 6th long idea on NVDA since Mid-December. Sorry if this is getting boring, but if it keeps working, why stop? It's not in a great pattern, but then again it wasn't the other 5 times, either. It has been in a downtrend since early December, but even stocks in downtrends don't have to go down in straight lines, and that's what I'm counting on...

As those who follow me know, NASDAQ:MSFT is one of my favorite stocks to trade. It boast a return/day held that all-time is about 5x the average daily return for the market. I've literally never lost a trade involving MSFT, and I don't think this will be the first time. I'm fully expecting this one to take longer than the 9 trading days average, but it could...

It's been a while since I posted an idea and to those who follow me I am sorry/not sorry. I didn't post for a few reasons: 1) I know that there are people who trade my ideas despite my warnings/disclaimers and I didn't like how the market was acting for the last couple of weeks (rightly, as it turns out) and I didn't want anyone else to get caught up in this...