A good time to update the AUD chart-pack after the updates from a dovish RBA. Soft on wages and consumption with emphasis on outlook reassessment in Feb. Unless we see the domestic story pickup dramatically in Australia it will continue to keep AUD stuck in low gear. Support is found here at 0.685x and sizes I’m seeing should be enough to carry us towards the...

A very simple trigger for those wanting to cover some shorts from the initial elections entry; the key 1.315x support is holding and pressure has been completely absorbed. We are trading the bottom of the clearly defined range from the elections; 1.315x <=> 1.355x and markets rather than going overboard on risk will want to keep their cards closer to their...

Korea's economy looks set to be forming a meaningful floor in Q4 and with a helping hand from a temporary pause in protectionism we should see KRW remain in bid for the first half of 2020. For the domestic story, Korean exports have fallen which spilt over to the demand side. With this in mind, should the USD devaluation / reflationary theme pick up pace for the...

GBPUSD rejected at 1.35xx which acting as major resistance after the country went back on the leadership merrygoround. Here actively selling into all rallies in GBP crosses, although there is a caveat to Pound shorts in the immediate term. With Johnson and a ruthless Downing Street in full control of the press and hitting the “right” headlines the positive...

For those tracking "GBP Fast Flows" and "UK Election" coverage this will apply as we do a deep dive into the technicals of the swing positioning. This will serve as a live example and reference chart in the future for some of our scaling techniques and conversations. In any case let's first start by reviewing the highs we are positioning around on both the...

...That was it for the day on the FX board. Highlights going to EURUSD chopping through the 1.11xx handle and continuing its slow grind higher. We will need assistance from European macro numbers to make the move impulsive in nature (no surprises today’s PMIs suggest some early signs of stabilising). Services continue to do the heavy lifting while manufacturing...

A rather quick update here as markets find a floor rate differentials as widely anticipated. It is no surprises for those following the chart previously: For the technicals, those with a background in waves will know this is a textbook example of an ABC correction after a 5 wave sequence; Things are a lot clearer in the FX board as we begin the flows in...

With Fed & ECB cleared a good time to update the EURUSD chartbook: We have positioned live in two textbook cases: For the technicals EURUSD remains rangebound till we break above the highs. Only a close above will suggest a more important base is in place and upgrade my thesis to a conviction. Plenty of resistance...

After a week of very narrow range trading in XRP, we close the week with support holding and demand starting to show up. What will matter the most for XRP for the remainder of this year and into the first quarter will be how BTC developments play out. My view is that a reflationary theme via USD devaluation will carry the flows for 1H20, and if this view gains...

For those tracking UK elections we have important updates on the opinion poll front, despite manufacturing declining further Pound will only move on election polls for the coming weeks. Here is a snapshot from the latest Westminster voting intention polls were released over the weekend: - CON = Conservatives, LAB = Labour, LDEM = Liberal Democrats, BREX...

UK Election Chartbook With longs already getting nervous ahead of the exit polls, let's get started by digging deeper on the political side first...For all those tracking and trading the main event this evening we have only two realistic scenarios in play which makes capital flows easier...

After months of choppy waters, finally bulls are emerging from beneath the woodwork right on time to position for 2020 flows. For all those tracking the current leg in Gold by now it should be crystal clear: Those momentum traders will know the highs will be eclipsed over the next few sessions, generally prefer buying dips. What I am most impressed by is...

BTC - Choppy trading persists - a touch of excitement as we break back above the prior downward sloping trendline from last week, however the market is mindful that $ shorts are becoming more widely expressed and I am awaiting the spillover into BTC via the next key risk driver. Expecting BTC dips to continue to be met with demand/covering interest and a close...

In a nutshell, I am expecting Copper to keep Chinese Equities afloat and recover Q120 with less uncertainty via fiscal policy and a rebound in exports. For those following the latest Hang Seng / Copper chart: For the macro side, CNY will find a strong bid via trade tensions easing as we move into 2020 US elections. China's outlook for future generations is...

A timely update to the US10Y Yield chart as we breakout with November highs in scope. We will not be covering US fundamentals here today and instead will focus on key technicals in play. For the flows in our map for today and the rest of 2019 we have the key levels in play (highly recommend adding all to charts): Steel Support => 1.65 Strong Support =>...

After getting the breakout we were tracking for in USDJPY we are now back and revisiting our infamous "Loading Zone" area at 109.3x right in time for BOJ to maintain the status quo. Outside of a knee jerk via risk I expect USDJPY to hold 108 - 109 range until we clear BOJ next week. Odds of Japanese rates being taken further into the red is declining, meaning...

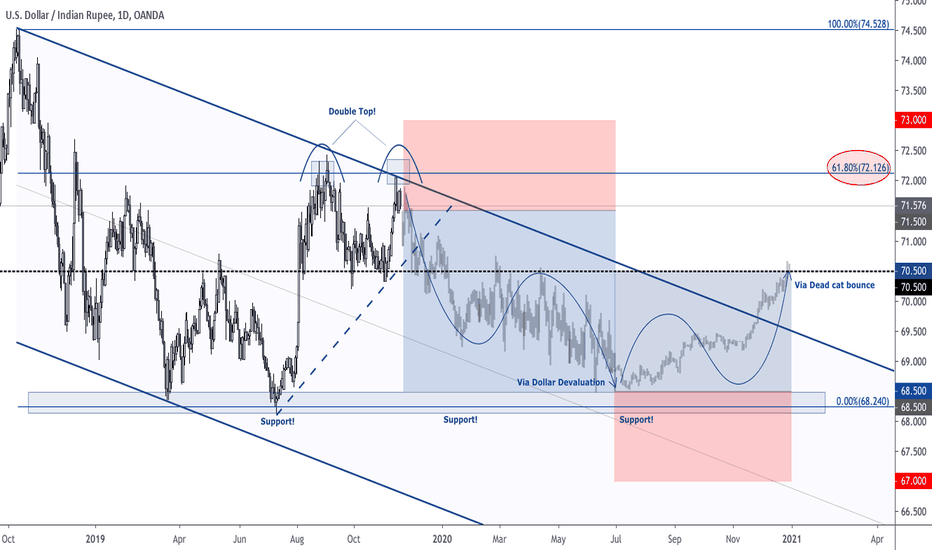

Here we are tracking the 2020 macro map for USDINR, a high yielding EM currency. The expansion in volatility here will come from CB coordination, and being short USDINR which generally would also support a view for better risk appetite means it acts a great portfolio hedge for those looking for high carry. On the INR side, macro figures are starting to indicate...

A very good time to update the Gold chart after clearing inflation and FOMC yesterday. As widely mentioned in the latest macro update in the institutional room: " Here tracking for a slight uptick in inflation but nothing out of trend before the spotlight is turned onto forward guidance with Fed and 2020 dots. I expect the dots to tick down whilst leaving 2021...

![ridethepig | UK Elections [LIVE COVERAGE] GBPUSD: ridethepig | UK Elections [LIVE COVERAGE]](https://s3.tradingview.com/c/cZEkRhfo_mid.png)