Those who have been following the Portfolio we are building on Tradingview will know where we are in the current Gold move (see attached ideas as we are not going to cover this here). The upside in Dollar is here till Summer meaning we have a sharp leg to the downside in play for Copper. Gold has already moved first, and here expecting copper to start moving as...

Here we are witnessing a very interesting move taking place for the Turkish financial system. After finishing a clear corrective ABC sequence since the August highs we are now in the early stages of an impulsive move to finish the more broader 5th wave in a very large sequence. For those tracking the updates in USDTRY in the previous charts (see attached:...

From the previous idea (see attached: "Russel leading the consolidation pack") you will know that Russell in many ways has been acting as a leading indicator for US Equities. This is interesting timingwise, especially when the break to new highs in S&P and NQ occurred was not comparable in Russell. So here we are now only needing to track the 1480-1475 region....

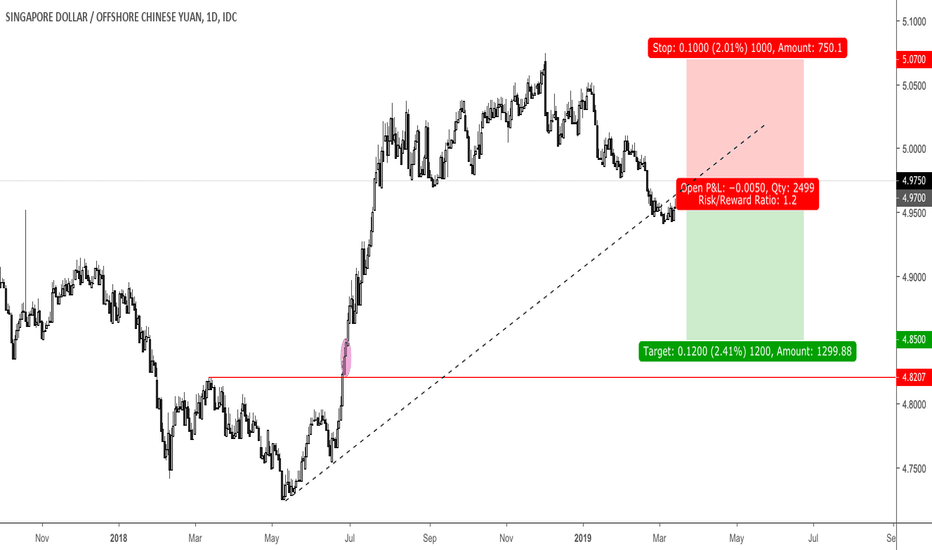

With large account deficits, disinflation and widening interest rate differentials there are many reasons to not be bullish China. Whilst on the political side there is a desperate need to keep CNY stable and stronger because China needs to attract capital inflows for the second half of 2019. Why? Because they are trying to facilitate the process of...

After previously tracking the reversal (see attached: "Another key reversal in play in USDRUB") finally the break of 65 has come. From a technical standpoint this was important as it unlocked the 62.5 lows. Russia has been one of the out performers on the currency board so far this year and I continue to see scope for more gains, irrespective of the very near...

What are we trading here? Norway is outperforming in the G10, unemployment falling while inflation exceeding expectations. As a result, interest rates are moving in favour of NOK. The hawkish surprise earlier in the week from Norges Bank suggested that more hikes are necessary has been supportive of the currency. A key risk is Oil prices holding firm around...

Here we have a very wide ABC in play with the C leg finishing at 7.25 - 7.28. From a technical perspective, the market has presented a flawless 5 wave impulsive move with a three wave retracement. Those who are betting on the upside will be coming in here at the 50 and 61.8% weekly retracement levels at 5.09; and we can expect a continuation. There is scope...

The pot bubble is going to burst. From the technical perspective we are pulling the trigger here after retracing 61.8% of the initial leg to the downside from the highs. For those who believe in the bearish story for the industry, now is the time to get back to work on the sell-side. More and more funds with large central books are starting to open up positions ...

=> Here we are isolating the Yen once more and expecting a worsening outlook of US assets to continue which will raise the prospect of asset repatriation out of the US. Whilst risk may be rebounding temporarily as the FED attempts a dovish shift, and US-China trade tensions are likely to continue de-escalating, USDJPY will still like remain on offer amid broader...

On the monetary side, Fed taking the spotlight so let’s start digging into the details… Expecting the Fed to lower the “dots” signalling one hike in 2019 … a “one and done” approach. June seems unlikely now as the Fed has started to focus on inflation to keep equity markets happy. My base case is for a hike in December meaning the dollar looks underpriced at...

Here we go again guys you know what to do....same plays from the loading zone...by now I hope most are locked and loaded in full positions. Unfortunately we have more Brexit politics in play with PM May sending a letter to the EU council asking for an extension this morning. From good sources the EU will accept on the assumption May can get her deal through...

Soft macro data from France continues... Markets are likely to want to test ECB willingness to shift into easing mode again so the downside risks for 1.09 remain in play for EURUSD. This will carry the rest of the EUR board. A quick move in play here to kill the week off as we start the initial stages of a test in the lows at 0.745. Best of luck all

Now is a good time for a quick chart update ahead of the BOE and Brexit countdown. PM May playing politics with a "Queens Gambit"….by asking for the short-extension till the end of June she is trying to force MPs hands to vote for her deal... Options from the EU are still either for (short) Mid-May or (long) lasting into 2020. The risk scenario which will send...

The previous idea "Strengthening the immune system" received a lot of traction and it is time for a quick update here ahead of the vote in HoC today. Volatility remains very high in the cross, and after the sharp drop overnight the ladder has been cleared for a move back through resistance at 0.8670. Watching this very closely and we have the potential for a...

Here we are tracking a very similar move to before (see attached: "GBPJPY Shorts on Hourly Chart") on the hourly as bulls become exhausted and unwind their positions for the triple whammy votes this week. Brexit continues as the driver of Sterling for now, on the UK side we have more votes coming next week so eyeballing a test of the lows beforehand. For those...

Here we can see from the Elliot wave perspective a good example of an expanding leading diagonal. The market is aligned for wave 3 in the sequence to the downside. From a catalyst perspective, we have a vote on the support of an Art.50 extension today from HoC. This is likely to be approved by the UK today, what is not so clear is whether the EU will allow...

As expected… PM May defeated on her Brexit deal. Although a smaller margin than the first time, with highlights coming from David Davis switching sides and a softer Jacob Rees-Mogg. Round 2 is in play for the House of Commons tonight. The house are voting on whether it supports leaving the EU without a deal. Markets are overwhelmingly expecting this to be...

At this point markets have priced in the support for a Brexit extension of at least one-quarter. The votes today and tomorrow are unlikely to affect EURGBP significantly. We are still tracking the same break to the upside that we have been for the past few weeks. There is a chance of a small move lower here with the headline on the extension of A50, however,...