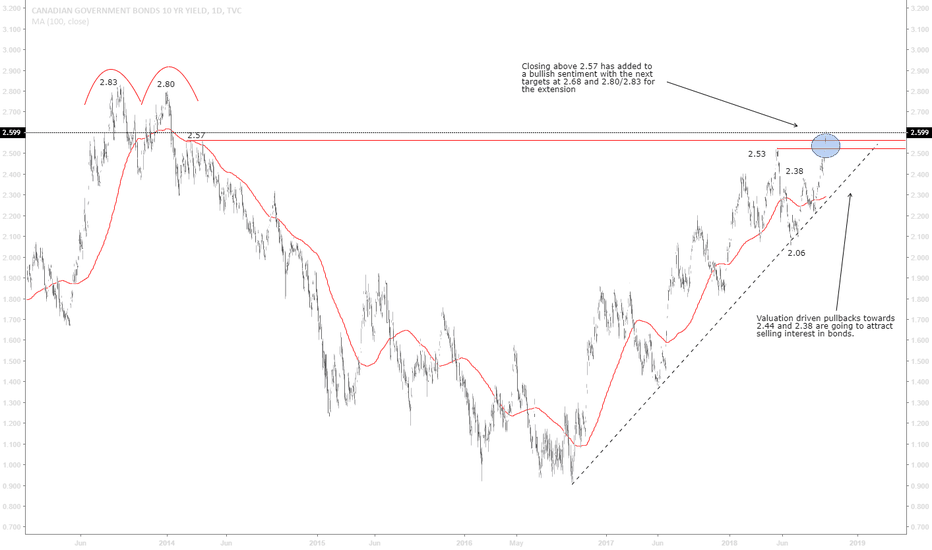

=> Global yields are on the move as we all know and have been expecting for since the beginning of the year. => Here in Canada we can see the same scenario playing out as we break above a 4 year high and unlock 2.80/2.83 for a test. => This is a major turning point for the global economy and we are witnessing it live here on tradingview. Highly recommended for all...

=> Here we can see TY1 futures forming a topping pattern and testing key support levels... => With smart money scared of inflation returning bonds continue to be sold. This may be marking the top for the Equity markets. => Expecting a very active quarter ahead as we reach the end of the road on QE in Europe and with yields continuing to rise in the US we are...

=> Yields are creeping higher one more time and we are starting to see major moves across equity markets as a result. => Smart money is afraid of inflation returning and therefore selling bonds is the go-to. This is causing yields to rise and because we are reaching the end of the road on QE, Central banks won't be buying bonds anymore and want to diminish their...

=> We still maintain our USDCAD short position from earlier in the week and recommend selling all corrective rallies here ahead of the BoC rate hike widely expected this month. => Although the rate hike is expected this trade is far from crowded and we see incoming data to keep the BoC on track with tightening monetary policy. => Odds of any hikes are close to 90%...

=> Those who have been following our telegram or tradingview charts are aware that we have been tracking the recent leg of weakness in CHF. => We caught the bottom of this recent swing and as we continue to rip higher the odds a high for a test of the 1.0060 highs. => Dollar is remaining in bid via yields and we see this continuing for Q418. => GL all tracking NFP...

=> Here we are eyeballing a break of the long term trend line since 2015 finally unlocking 114.xx and 115.xx for a test.(edited) => With NFP today expected to overshoot we are going to see further USD strength and as a result the highs here remain naked for a test and sweep. => If we can comfortably take the 115.xx we are going to start tracking 2016 highs and...

=> Here eyeballing the recent break after failing to pierce the channel to unlock 0.6928 for a test => The broad based USD strength continues and we have December hikes to begin pricing in. After NFP today (expected to overshoot) odds will be in the 'done deal' category for hikes. => While Australia's trade surplus helps as a buffer against the yield disadvantage...

=> The two month correction has begun coming under pressure again here as we approach the Brexit finishing line => A daily close below 1.2934 will open up 1.2786 for a test and if we crack the lows then 1.210x is next with nothing else in the ladder in-between. => This is a nightmare situation for the UK and we maintain our base case scenario on Brexit as...

=> Here we have an important chart update for NFP => For those who have been following our flow since FED, we tried outguessing some profit taking from shorts being done into NFP anticipating a pullback towards 1.165x(edited) => The fear of inflation returning is causing large hands to sell bonds and as a result yields are rising giving USD a strong bid. => Here...

=> Here we are expecting a clean break of the 50 fib to unlock 97.87x in the DXY => NFP today is widely expected as overshoot/inline ..anything else will short circuit the flow (odds are very low) => We also have December hikes on the horizon so markets will have to start pricing that assuming NFP remains on trend. => GL all

=> Here we are actively looking for a USD short to add to our EM FX portfolio => With Chile fundamentals remaining attractive, strong economic growth and increase in business sentiment we are seeing a helping hand driving investment. => From a monetary policy perspective the BCCh are expected to raise rates this month by 25 bp => We are targeting the 38.2% fib...

=> Here we are updating our EURCHF chart for trading view => For those following the telegram we have been going through a great live example of this trade in how to scale into positions => EURCHF has remains stable despite the BTP-Bund spreads widening which is surprising to say the least. It implies that those in Switzerland likely hold large hedge ratios on...

=> With oil creeping higher again we are maintaining a bearish view on India => There is no reason for INR to no longer remain offered as US yields push higher and attract foreign capital and global uncertainties rise. => The Indian government deficit has rising for half a year now and we are seeing a widening of corporate spreads with equities selling off. =>...

=> Here this is a very complex and advanced environment for all trading the break above => Our base case scenario on Brexit is for a hard/no deal, although with that said there is still enough political momentum in the short short term to give further gains to Sterling. => UK Yields are rising with PMI and housing data remaining robust (won't be the case for very...

=> We are eyeballing a break of the current range to the downside here in EURSEK => Our targets are 10.00x with stops above the 76.4 fib at 10.600x => This is a very technical play in an environment where SEK valuations are attractive to say the least. We've done superbly well in our USDSEK shorts so far despite the broad based dollar strength and we see SEK...

=> Here we are expecting dollar strength to remain in the spotlight and EM to come under further pressure one more time before year end. => Although there has been some improvement on the political side in South Africa the foreign positioning in SAGB's remains heavy. => Yields are rising in the US as we widely expected since earlier in the yearend we see South...

=> What are we tracking here? => Late bears are starting to overload on shorts here and we are outguessing a temporary bottom => Fundamentally Australia provided very strong Q2 GDP data last week. => The commodity currencies will get bid across the board as we start to see a focus shift from EM vulnerability => We expect manufacturing data to remain steady whilst...

=> We are eyeballing a move to the 1.25xx handle here with BoC hikes expected this month. => Expecting NY to lower the bid as early as today, this trade is not at all crowded ... => The Canadian economy is strong and with rising rates the CAD is trading at a discount. There are little idiosyncratic factors influencing Canada other than the recently cleared "NAFTA"...