rifqonr

Position update: July 10, 2025. Key factors: 1. Confirmed stage 2 uptrend. 2. A textbook Flat Base with a clear, low-risk entry. 3. The base has VCP characteristics. 4. The stock moves on its own drummer, hitting an all-time high while the index struggles to reclaim its highs. 5. A shakeout that weed out weak holders has strengthen the setup properly. 6....

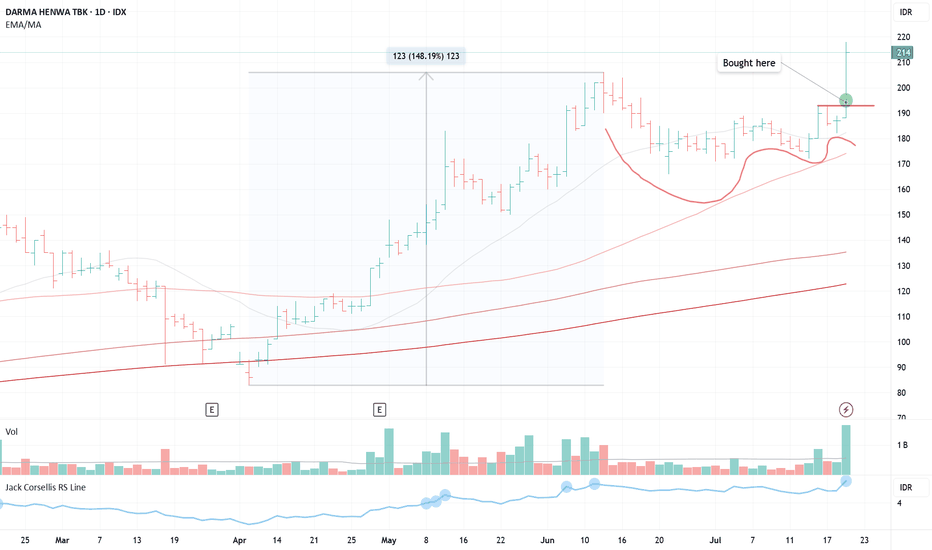

Position update: July 21, 2025. Key factors: 1. Confirmed stage 2 uptrend. 2. A textbook Volatility Contraction Pattern (VCP) with a clearly defined, low-risk entry point. 3.Currently forming a VCP following a prior price surge of nearly 150%, demonstrating strong momentum. 4. The stock moves on its own drummer, rallying close to 150% while the broader market...

Position Update: May 6, 2025 Key factors: 1. Low-risk entry point. 2. It has a very tight correction area. 3. A strong sign of continuation of upward momentum. 4. Corrects below 4% during this pause, indicating big institutions' reluctance to sell their positions. 5. High relative strength, outperforming the general market. 5. The stock is moving on its own...

Position update: July 9, 2025. Key factors: 1. Confirmed stage 2 uptrend. 2. A textbook VCP setup with a clear, low-risk entry 3. Has absorbed its majority line of supply. 4. The stock moves on its own drummer, hitting an all-time high while the index struggles to reclaim its highs. 5. High relative strength. 6. Volume has dried up, indicating less supply...

Position Update: May 16, 2025 Key factors: 1. Low-risk entry point. 2. Very clear bases with VCP characteristics. 3. A confirmed Stage 2 uptrend, indicating upward continuation. 4. The stock is outperforming, rising even as the broader market trends lower. 5. Displays strong relative strength against the market and peers. 6. Volume dries up suggests less...

Position update: March 25, 2025. Key factors: 1. Confirmed stage 2 uptrend. 2. A textbook double bottom with VCP characteristics. 3. Has gone through its majority line of supply. 4. Moving on its own drummer, the stock consolidates while the index suffers a terrible decline. 5. High relative strength. 6. Volume dries up as less supply coming to the market. 7....

Position Update: February 6, 2025 Key factors : 1. Low-risk entry point. 2. Very clear bases with VCP characteristics. 3. Has gone through its majority line of supply. 4. Moving on its own drummer, the stock price increased while the market crashing down. 5. High relative strength stock. 6. Volume dries up as less supply coming to the market. 7. The breakout...

Position update: December 20, 2024. Key factors: 1. Low-risk entry point. 2. Confirmed stage 2 uptrend. 3. Has gone through its majority line of supply. 4. Moving on its own drummer, the stock went up +125% while the index remains nowhere. 5. High relative strength. 6. Volume dries up as less supply coming to the market. 7. Both breakouts accompanied with a...

Position Update: December 6, 2024 Key factors: 1. Low-risk entry point. 2. The stock offers a low cheat, a creative entry. 3. The stock moves so rapidly in the last couple months. 4. A 30% pullback from its all-time high indicates a normal profit-taking phase within the context of a broader uptrend. 5. High relative strength, outperforming the general...

Position Update: December 6, 2024 Key factors: 1. Low-risk entry point. 2. A first proper and buyable base after an IPO. 3. Has gone through its majority line of supply. 4. Moving on its own drummer, the stock went up +96% while the index remains the same spot. 5. High relative strength stock. 6. Volume dries up as less supply coming to the market. 7. The...

Position Update: October 16, 2024 Key factors: 1. Low-risk entry point. 2. The stock offers two entry points with a very tight risk. 3. A power play on top of another power play, this is a strong sign of continuation of upward momentum. 4. Corrects 18% during this pause, indicating big institutions' reluctance to sell their positions. 5. High relative...

Position Update: October 22, 2024 Key factors: 1. Low-risk entry point. 2. The pause formed a small cup and handle. 3. It surged over 100% within eight weeks. 4. Corrects only 15% during on the pause, indicating big institutions' reluctance to sell their positions. 5. High relative strength, outperforming the general market. 5. The stock is moving on its own...

Position Update: October 23, 2024 Key factors: 1. Low-risk entry point. 2. Very clear bases with VCP characteristics. 3. High relative strength stock. 4. Established a clear Stage 2 uptrend, indicating upward continuation. 5. The recent reduction in volume suggests diminished supply in the market. 6. Many stocks start showing traction based on my own stock...

I bought my positions today October 9, 2024 Key factors: 1. Low-risk entry point. 2. Established a clear Stage 2 uptrend, indicating positive momentum. 3. Breaking into its all-time-high. 4. High relative strength, the stock went up +80% compared to a modest 11% increase in the index. 5. The recent reduction in volume suggests diminished supply in the...

I have my position today September 9, 2024 The reasons: 1. Low-risk pivot point 2. The stock offers a very tight entry in a power play setup 3. It surged over 250% in less than eight weeks 4. Corrects only 8% during this pause, indicating big institutions unwilling to sell their positions 4. High relative strength, outperforming the general market 5. The stock...

I bought the stock today August 30, 2024 Reasons: 1. Low-risk entry point 2. Long base cup development 3. Formed a classic cup with a nice drifting handle 4. Newly IPO stock in late 2022 5. High relative strength 6. This is the second buy-able base since the IPO (first: vcp on 8/2/24) 7. More stocks start showing traction. Flaws: 1. Not really in a...

I bought the stock today September 11, 2024 Reasons: 1. Low-risk entry point 2. Long base cup development 3. Formed a classic cup with a nice drifting handle 4. VCP characteristics on the handle 5. One of the leaders in banking sector beside IDX:BRIS 6. We're in a general market bull campaign 7. More stocks start showing traction. Flaws: 1. Currently...

I bought my positions today September 26, 2024 Key factors: 1. Low-risk entry point. 2. Confirmed stage 2 uptrend. 3. Has gone through its majority line of supply. 4. Moving on its own drummer, the stock went up +130% while the index only up 10%. 5. High relative strength. 6. Volume dries up as less supply coming to the market. 8. Many traction based on my...