Please checkout my Facebook chart to see the similarities. Retracement to algo target then pushed up and broke the trendline. I have two areas of algorithmic confluence in green boxes. These are areas to watch for a retracement. There is no doubt we will get a small pullback soon for an elliot wave 4 before we see a top. The short will be epic on this one. Good...

Hey guys real quick. Got a potential setup here on Facebook. Where we took the fibonacci pull from the genesis point to the previous all time high. We pulled from here because we went straight to the algorithmic target at the 50% fibonacci level. We broke the upper trendline and are currently testing it. Dont fight the uptrend.taking out the all time high recently...

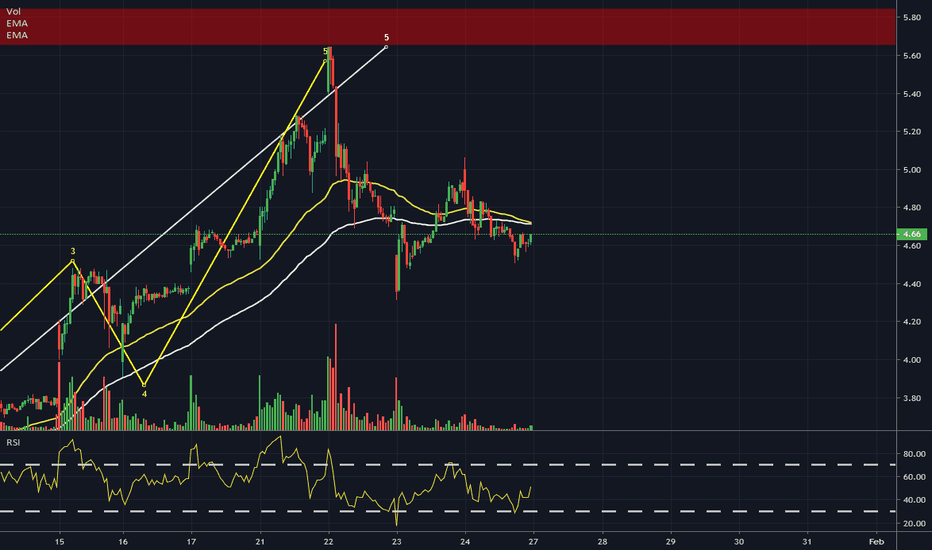

Real quick. We have a couple scenarios for bitcoin right now. In white the bullish scenario where we get 5 waves up and an abc correction that follows. I'm leaning towards this one because the fibonacci extension target for a wave 3 was hit. I wouldnt be buying up here though.ill be waiting for a retracement so I can go long. In red is the bearish scenario where...

I came back to this chart because a fellow trader got caught up in a bad trade and we try and devise an exit strategy. I used elliot wave and fibonacci extensions to identify targets and helped to build a roadmap of where the price action may be going in the next week or so but ultimately its up to him to make the call. Good luck guys and gals. please try to build...

the other day i posted a video on bitcoin showing the higher timeframes. in this video i take a look at the current price action and breakdown a couple scenarios. thanks for your time rigo

A video analysis for YQG123 i run through some more examples of the 89% fibonacci level being an important buy zone off of a big sell off. We are awaiting volume to start picking up but this asset seems to have great potential to the upside after it broke out of a major downtrend line. good luck and happy trading rigo

This analysis was requested by Casperghost. Its important for us to use different tools to help identify a trade. especially in charts that dont have much price action compared to other names with lots of history. in this example i used fibonacci retracements, elliot wave, rsi, chart patterns, support zones to help build a roadmap for what we can expect from...

I did a quick analysis to add to the other views on bitcoin and potentially add some clarity on the bitcoin chart. bitcoin loves complex corrections so it throws a lot of people off their game. i hope this helps in your own analysis. good luck, build a case for your trade and always have an entry and exit on every trade. Rigo

requested analysis for bootleggerx1 i use elliot wave, fibonacci retracements and extensions to show you a couple different outcomes on this asset. i use this along with rsi and the MACD to paint a possible roadmap. Good luck and happy trading. if you need help trying to figure out a chart. let me know in the comments or PM me and i can do a full anaylsis for...

posting for a friend. questions or comments? Do you have an asset that you would like my opinion on? let me know and i can do it free of charge. i want to see people succeed. money is good and all but there are things more important in life. Happy trading thanks, Rigo

We have two scenarios on the table for GE here. If it holds support at the 89% fibonacci level then we can expect a potential move much higher shown with green boxes as targets. I derived these targets using fibonacci extensions. the elliot wave subwaves are in yellow. If it breaks below the 89% fibonacci level we can expect a potentially devastating scenario...

On this chart I'd like to show you guys a breakout of a downtrend pattern with weekly rsi divergence on this weekly chart.this can be a powerful sign that the downtrend is coming to an end.of course we can still go down the the fibonacci 78.6% retracement. We are currently sitting at the monthly 55 EMA. Which is another powerful support. Also I'd like to mention...

we are nearing an end to this correction with some upside possibilities as the short positions begin to take profit down here and hunt for long positions. the risk reward is there in this ABC correction. this is a perfect setup for some longterm call options when we begin to trade above the 1hr 200 moving average. look for a 4hr golden cross to go long if you like...

Bitcoin has definitely been sucking the life out of altcoins but does this chart show bitcoin is running out of steem? With 5 elliot waves right to textbook fibonacci targets it's hard to argue that it may be time to start looking at some altcoins. Especially with that 200 ema(in orange) just above this dominance chart. When you do a fibonacci pull on bitcoin on...

A fibonacci retracement to the 89% fibonacci level is a must take trade with a stop under the previous swing low. This asset is just sitting there forming a reversal bottoming formation.it broke out its downtrend wedge with a beautiful ABC correction.the 5th wave of the C wave is questionable right now but there is no question you must start laddering in right...

I'm taking a look at this current structure we have and theres a couple ways to count this using elliot wave. I believe simpler is better and I like the way this count is looking. With a 5 wave structure up from the 2018 low. We currently have a retracement to the golden zone which could be it for this correction if your counting the structure as a WXY...