robashir

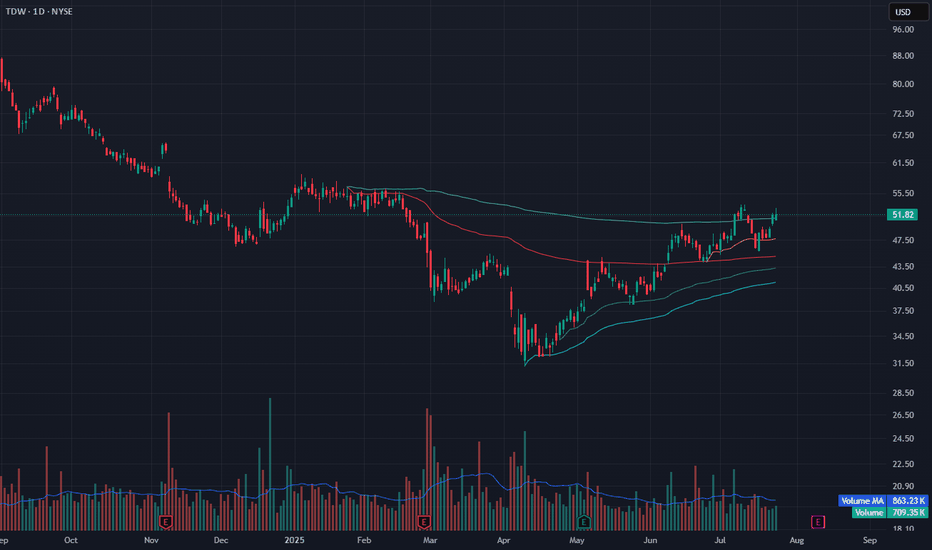

EssentialTDW has broken out from a clean VWAP stack structure and is now testing long-term resistance near $52. Price has made a strong recovery since April and is currently holding above the yellow and red VWAP levels with a higher low pattern. Today’s close at $51.82 keeps it right at resistance, and a break above $52 could open room toward $55+. Volume is slightly...

TDS is making a clean breakout with strong follow-through, gaining over 2% today and closing near the session highs at $39.90. Price is trading above all key anchored VWAP levels (yellow, green, and blue), with the most recent bounce holding firmly above the yellow VWAP. Volume confirms strength — today's 1.75M is well above the 1.37M average, reinforcing buyer...

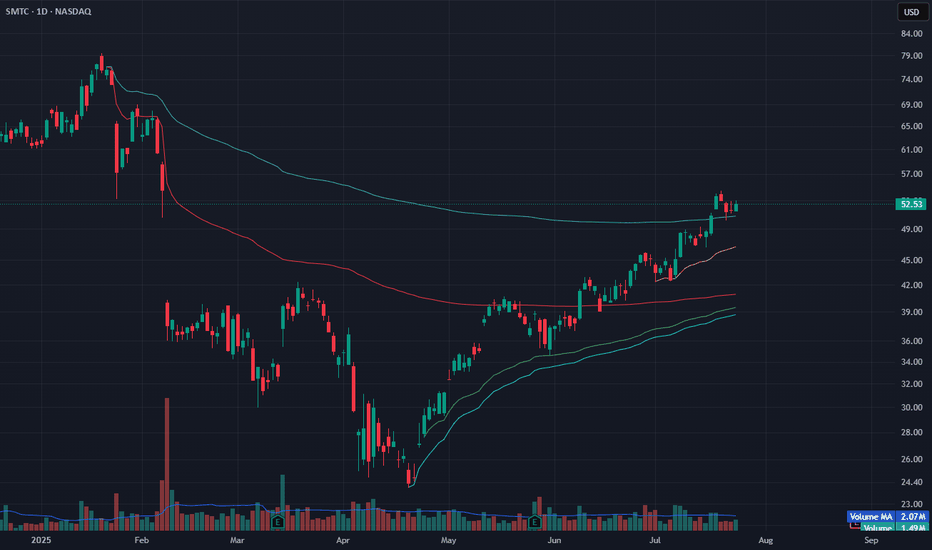

SMTC is consolidating just below a major resistance level around $53. Price has been riding above all key anchored VWAPs, with the yellow VWAP offering recent support throughout the move. Today’s +1.70% gain comes as the stock holds the breakout zone and volume stays stable at 1.49M (just under the 2.07M MA). If price breaks and holds above $53.50, a continuation...

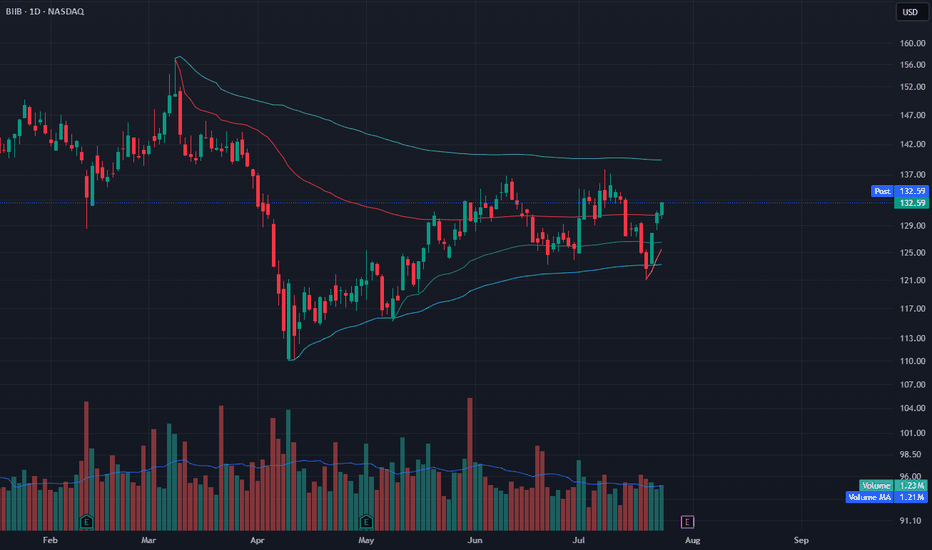

BIIB is climbing after bouncing off a VWAP cluster (yellow and green zones) and reclaiming key levels. Price held support near $125 and is now pushing toward the upper range near $134. Volume is slightly above average (1.23M vs. 1.21M MA), and price structure looks constructive with a clean higher low in place. The red VWAP still acts as overhead resistance, but...

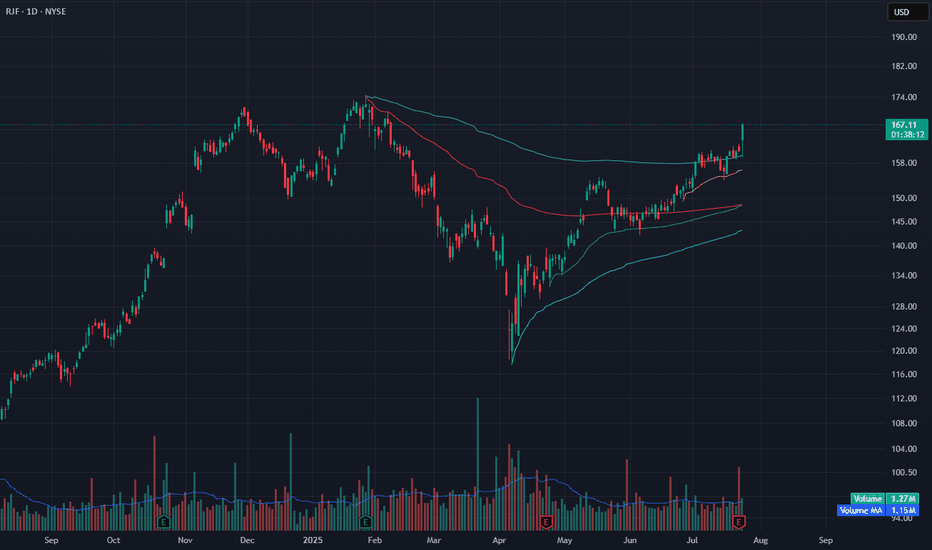

RJF broke out with a strong +3.88% candle, clearing the previous range and reclaiming its upper VWAP zone. Price is now trading above all key anchored VWAP levels, with the yellow VWAP acting as near-term support. Volume came in above average (1.27M vs. 1.15M MA), confirming demand. The breakout clears a long consolidation zone that started in February. A...

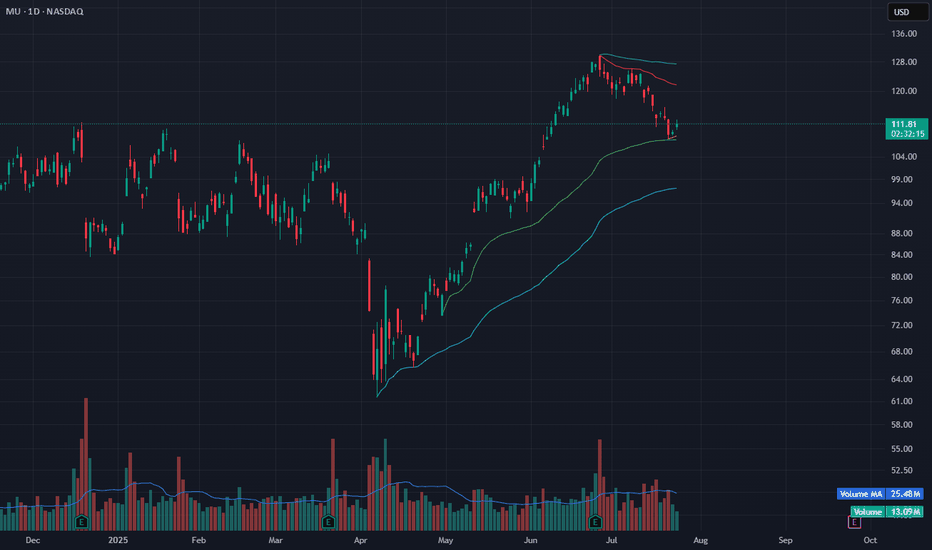

MU is showing signs of a potential reversal after a multi-week pullback. Price held the anchored VWAP zone (green line) near $109 and bounced today with a +1.83% move on 13M volume. This level also aligns with the lower Bollinger Band — a common mean-reversion setup after extended downside. A short-term bounce toward $118–120 could be in play if the move gains...

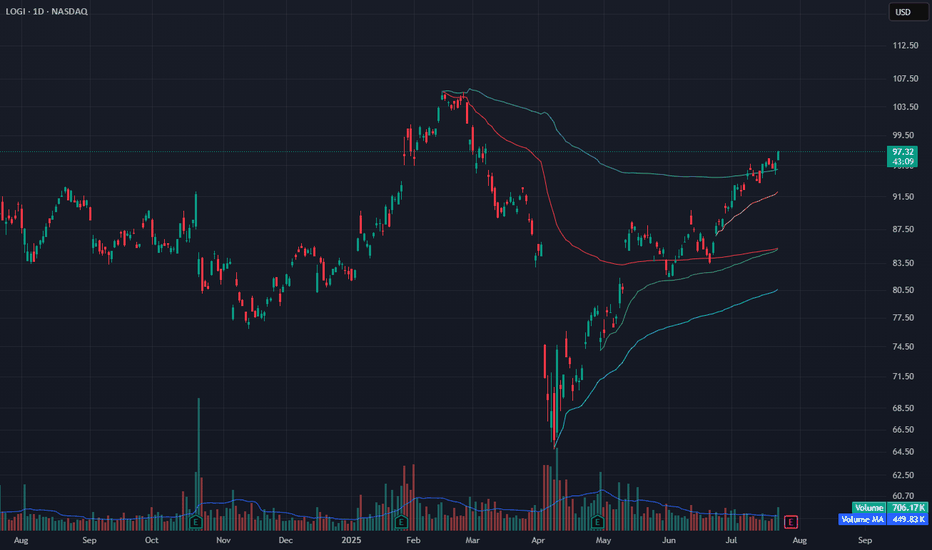

LOGI continues to grind higher along the upper anchored VWAP band, trading just under $99. Volume is healthy, and price action has been clean since reclaiming the red VWAP zone in June. The yellow VWAP (from recent swing low) is acting as dynamic support, while the upper Bollinger Band is expanding — signaling possible continuation. If price breaks above the...

DLO bounced today from a key mid-range VWAP support zone, holding above $10.80 with a +2.79% move. Price has been consolidating for over a month, and this bounce suggests a potential mean reversion back toward the upper range near $11.60. The lower Bollinger Band held, and price stayed above the green VWAP, showing demand at support. Volume remains below average...

QBTS surged nearly 10% today on above-average volume (50M vs. 46M MA) and is currently trading above all key anchored VWAP levels. Price reclaimed the short-term breakout zone and showed strong buyer interest near the yellow VWAP band. This continuation move is happening with healthy volume expansion and support from recent consolidation. If price holds above...

CCL just broke out to new local highs with strong follow-through and volume rising above 15M. Price is well above all anchored VWAP levels, including the recent breakout VWAP (yellow line) and deeper trend VWAPs (green and blue), showing strong bullish momentum. This kind of clean separation often signals the start of a new leg up. If the breakout holds above...

Exxon Mobil crossing weekly supply, XLE Energy ETF also crossed the daily supply, with the next supply at the weekly level @ 94.50.

Entergy Corporation (ETR) crossed monthly supply. XLU (Utilities ETF) is also trending up with daily resistance which I expect XLU will cross tomorrow morning.

Consolidated Edison, Inc. (ED) crossed weekly supply with monthly resistance at 95.70. XLU (Utilities EFT) is also trending up with daily resistance which I expect to be broken tomorrow morning.

Krispy Donut is breaking out of monthly supply, next resistance at &12.09 weekly supply.