Find the trend, follow the trend and stay on the trend. If can't find the trend then wait, trading is a marathon and not sprint.

When you find the trend, follow it and stay on it as long as it is valid. I uses STFLAT and oh boy, happy I did.

Just learn how to be patient and stay on the trend. STFLAT FTW!! So far it has giving me so much confidence on staying on the trend. Still not seeing an upside move for BTC

With a very turbulent market and yet when you are calm and patient.

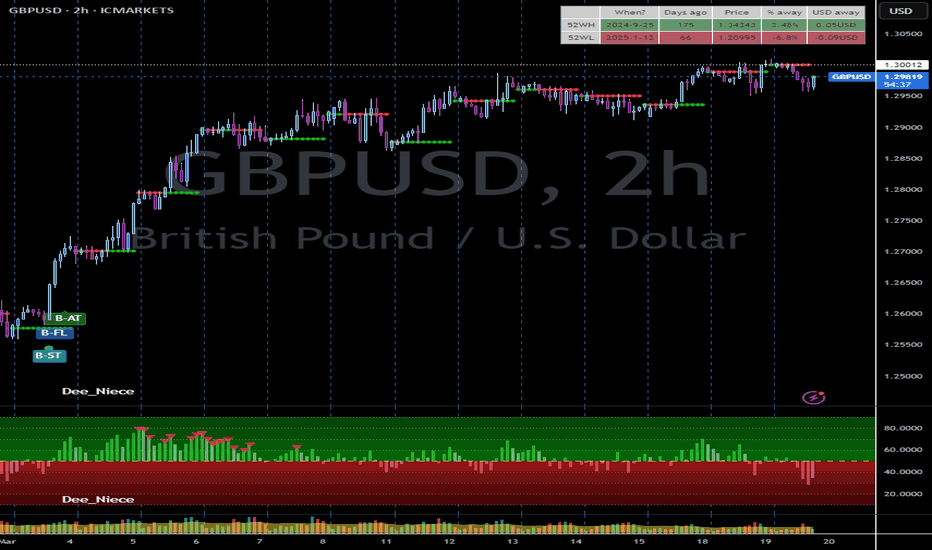

As I always says : Find the trend, Follow the Trend and Stay on the Trend. Trading is hard, too many parameters to consider so why make it harder. Wait for confirmation before jumping on shorting $GBPUSD.

Won 2 lost 1, So far so good, can't win them all. Important is to have proper risk management. Find the trend, follow the trend, stay on trend.

XAUUSD - Possible for a bearish continuation for next week, with NFP forecasted to be weaker. But watchout for some retrace / correction for intraday play.

After many times of back testing and analyzing the combination of various indicators, results so far is quite impressive. One thing I learned so far using STFLAT is minimizing my early entry without strong confirmation.

Find a trend and stay on trend, take profit when you can and when happy.

I just had to say big thanks to @KivancOzbilgic as most if not all of these combined indicators are created and shared by his wizard. I combined various indicators into one which for me helps me greatly to find a trend and stay on trend.

For my scalping or Intraday trade, I created this pine script combining various indicator (namely the famous Alphatrend by @KivancOzbilgic, Previous Day Close and 52WeeksHigh/Low) into one indicator. If price goes above the PDC and Alphatrend is a buy then I will make quick long trade. If price goes below the PDC and Alphatrend is a sell then I will make quick...

As mentioned in previous post, I tried to keep it simple and further trust and learn the system I currently uses. From my perspective, one should trust their system, the most lethal of technical aspect is not fully understanding the potential of your system. Trade results from my recent buy bias for XAUUSD. Volume, Trend, Impact - determine these areas and you...

This process never fails me and always been my to go process especially after I saw some manipulation in the market.

If FED will not disappoints market with a 50bps market pricing in rate cut, then some key levels are plotted that is due for corrections / retracement. Later all eyes will focus on Powell speech whether he will take an aggressive approach for November FOMC.

A quick recap on XAUUSD NFP day and possible scenario for Monday and Tuesday.

Adding Regression Trend clearly shows that overall move for Gold will be bearish for the week of November 27 - December 1 week.

Taken into consideration the calmer geopolitics tension, EOM rebalancing and a possible correction on USD - all of these contributing to possible bearish move for XAUUSD.

Considering the relatively muted weekend activity and the ongoing weakening of the USD, it's reasonable to anticipate a slight bearish correction for XAUUSD in the coming week. The absence of a significant weekend push and the prevailing market conditions suggest the potential for downward movement. However, it is essential to closely monitor any shifts in global...