1. BCO could be doing a Whipsaw. 2. Waiting for the correct rank of correction sets up r:r for the motive waves.

a break of trend line, and an impulse correction impulse of a lower degree(wxy) would set up 1 motive wave up.

1. Will be looking for a break of trend line for a wave up. (with chance to run) 2. key levels are 1.67663 & 1.66516

EURAUD. Bullish Bias if price maintains above 1.58682.

Allowing corrective waves supports favourable risk-to-reward for long positions.

AUDUSD 0.65139 is at a crucial price level with NFP around the corner...

-Biased Long however... -This week, price action is in a Whipsaw and requires risk adjustment.

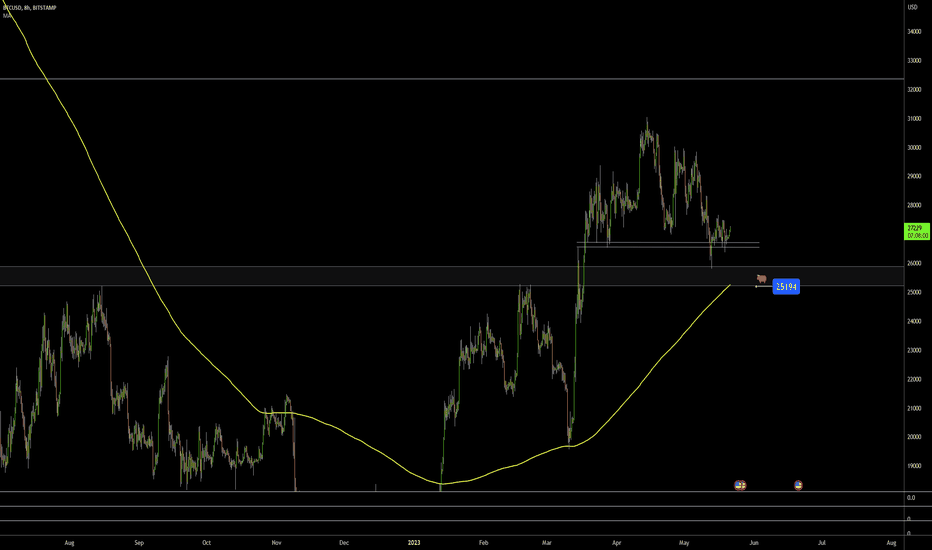

If BTC PA maintains above 25194 and MA, BTC Bulls got your back.

Next week, if price would stay above the Daily trend line, then Buy setups are a good idea.

if USDJPY is able to maintain below 142.200, bearish entries are a good idea.

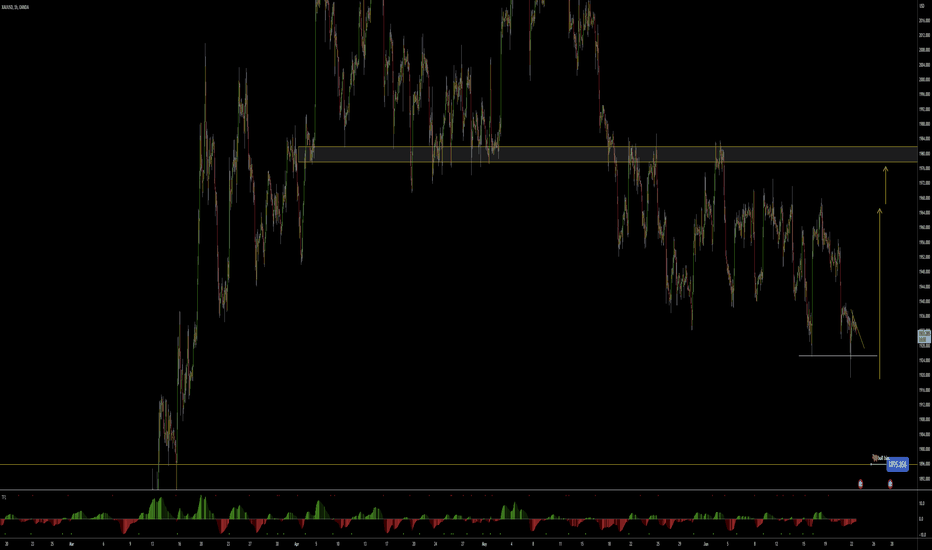

if gold would maintain above 1895, looking for reasons to buy. because its a reaction trade, lots have to be reduced by 3.

If price would maintain below 1935, potential whipsaw opportunity for harmonic traders. Sell at Resistance, Buy at Support.

GBPUSD could give us 1 more wave up, a continuation of the 3rd wave

BTC has a Bulls Bias... however.. if BTC maintains below 28683 this week, a bearish setup can stop out early bulls, breaking the previous low where Stops are.

1. AUDUSD has a Bear Bias. 2. TP some near 0.65667, and allow rest to run. 3. On break of 0.65667, focus will be on sell setups. Expecting volatility as the US approaches June's Debt Default

SpaceX targeting April 20 for next Starship launch attempt.

...early bias suggestion using TV's H&S indicator and a line.

BCOUSD could make a retrace followed by a bearish breakout on a lower time frame for the next motive wave down.