siddhantsamaiya

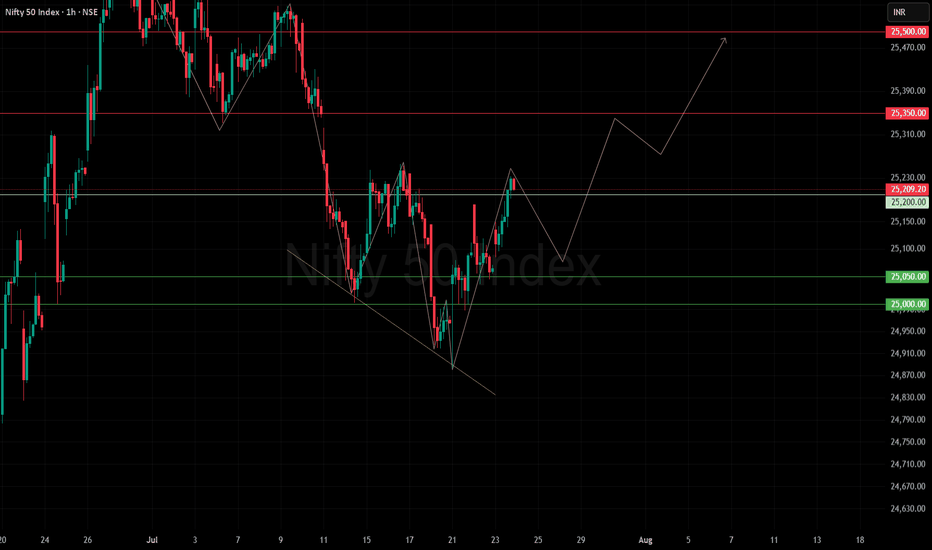

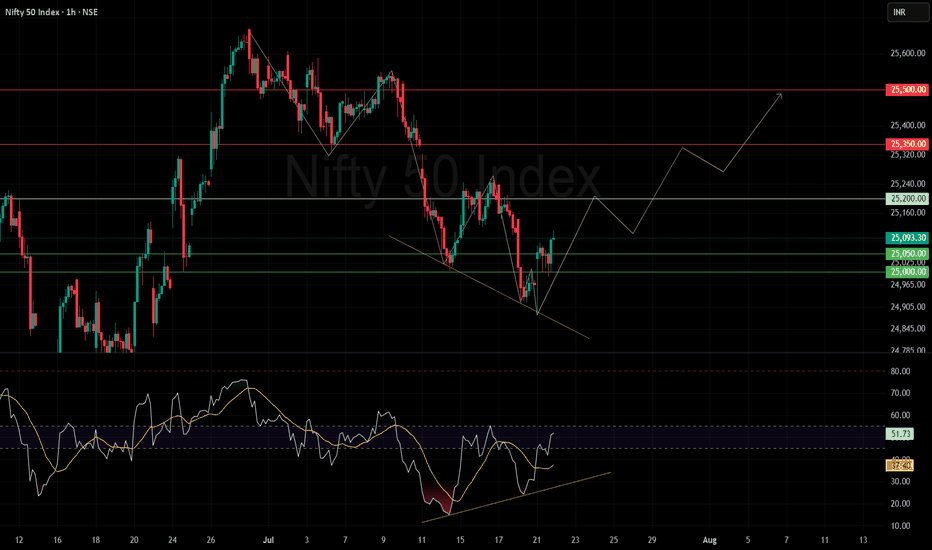

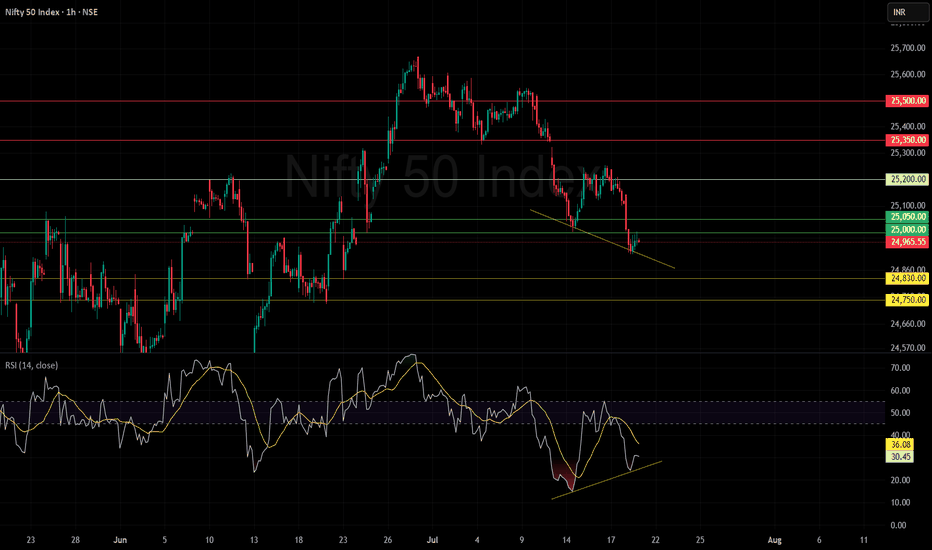

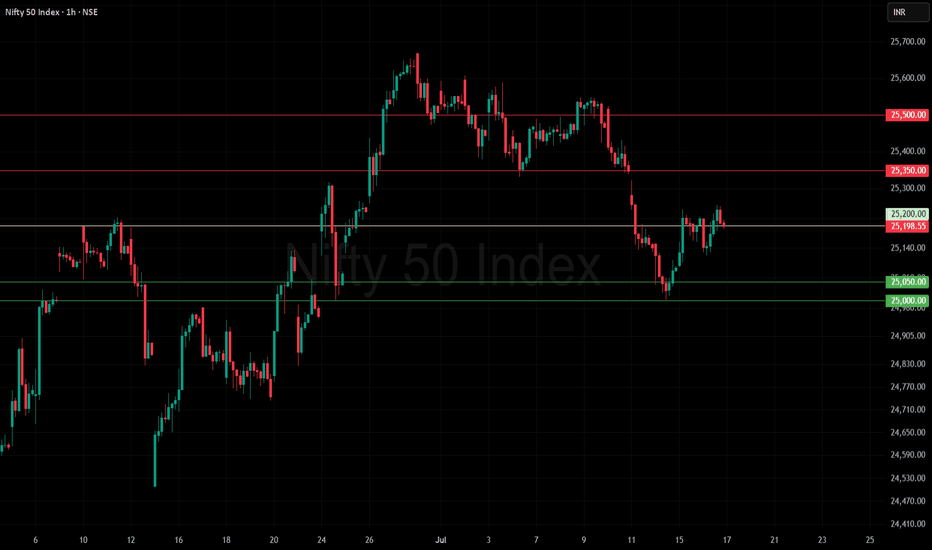

PremiumNifty’s recent rise can be attributed to short covering ahead of the monthly expiry, which often results in a surge as traders close their short positions. Currently, the index faces a strong resistance zone around 25,000–25,100. A clear move above this range could indicate a trend change or a shift towards a more bullish outlook. If Nifty does not decisively...

The stock is currently following a strong uptrend, forming higher highs and higher lows since April. After a recent correction (Wave 4), it’s showing signs of starting a new upward move, supported by a breakout and a spike in trading volume. The chart structure suggests the stock is in the final leg of a 5-wave impulse pattern, with the next resistance targets at...

SAGILITY INDIA LTD Technical Analysis Overview Breakout Confirmation: The stock has convincingly broken out above a long-term descending trendline, accompanied by a sharp 9.98% surge in price and a significant jump in trading volume (181.83M). This combination of price action and volume generally indicates strong bullish sentiment and marks a potential trend...

IOL CHEM AND PHARMA LTD (Weekly Chart) – Key Points Trend: The stock has finished a long consolidation (Wave ④) and is starting a new upward rally (Wave ⑤ expected). Price Movement: Current price: ₹101.47 after a recent sharp rise. Important resistance to watch: ₹120–₹130 zone. Momentum (RSI): RSI at 67.59 — shows strong momentum. Volume: Rising volume...

Our observation aligns well with the earlier analysis. The time cycle highlighted July 29 as a potential inflection point, and the strong short covering during the monthly expiry has clearly supported the 200+ point bounce today. With NIFTY closing at 24,820, if it manages to cross the 24,850 level tomorrow, the path to 25,000 and possibly higher resistance...

A short-term technical rebound is favored if 24,730-24,810 holds as a support zone and positive divergence with RSI also visible; upside targets lie near 25,000 and 25,050-25,200. A decisive close beneath 24,730 would invalidate the divergence setup and open room toward deeper supports.

Bajaj Healthcare Ltd: #BAJAJHCARE Above 3-Year Range: The current price action is holding above a multi-year sideways range, signaling a potential transition out of consolidation. Support Zone: Price is consolidating above a significant support zone (₹480–₹500), a level that has historically shown resistance and limited downside from here. Momentum: Short-term...

Nifty showed an alternating trend this week with sessions closing both in red and green, indicating indecision and no clear sustained direction. The index faced strong resistance near 25,250 but pulled back afterward. It closed near the key support zone around 25,050–25,000, an important area for bulls and bears. Key Support and Resistance Zones Immediate...

The Nifty PSU Bank Index is attempting to break out above a key resistance (~7,200). Momentum is neutral-to-positive but not strongly overbought, indicating a potential for further upside if resistance is decisively breached. A failure to break out might result in another consolidation or pullback.

The Nifty Auto Index is breaking above major resistance near 24,200, signaling a strong bullish breakout. The RSI is at 60.39, indicating positive but not overbought momentum. This breakout suggests potential for further upside as long as the index holds above the new support level (24,200).

Nifty Outlook: Current Zone: Nifty has bounced from the 25,000 support and is now testing resistance at the 25,200–25,250 zone. Immediate Resistance: 25,200–25,250 is a strong supply zone. A decisive breakout above this range is needed for further upside. Upside Targets: If 25,250 is cleared, expect momentum toward 25,350 and 25,500. Support Levels: 25,000...

Market Action Overview Breakdown Below 25,000: The Nifty 50 index recently dipped below the psychologically significant level of 25,000, a move that likely triggered stop-loss orders and drew out short-sellers. Liquidity Grab: This action can be interpreted as a classic "liquidity grab," where the market briefly breaks a key support, absorbs sell-side liquidity,...

NIFTY 50 25,000 is the Consensus Key Level: Most market participants are watching 25,000 as a critical psychological and technical zone. Sustaining above this keeps the market in a neutral range; a strong close above 25,200 is required for any momentum shift toward 25,350 and 25,500. Bearish Liquidity Trap Likely: Due to widespread focus on 25,000, a brief dip...

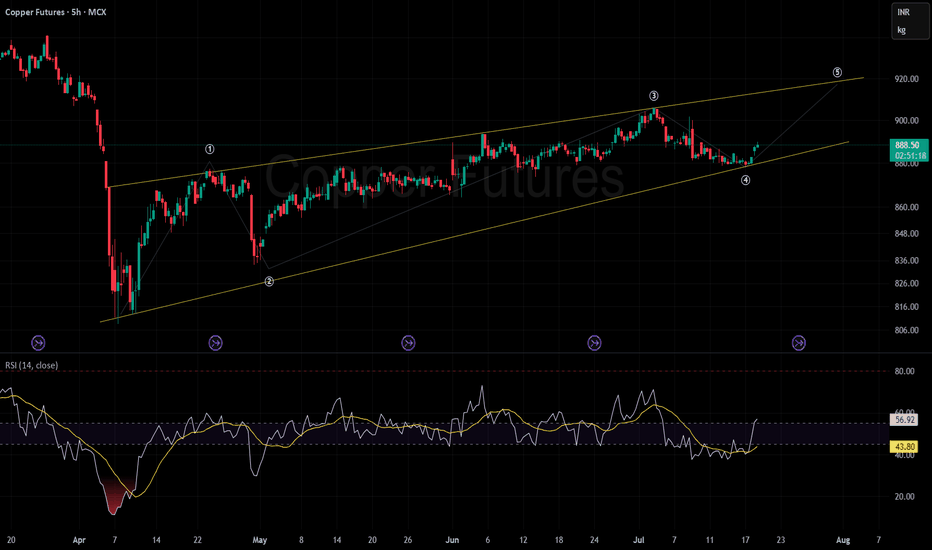

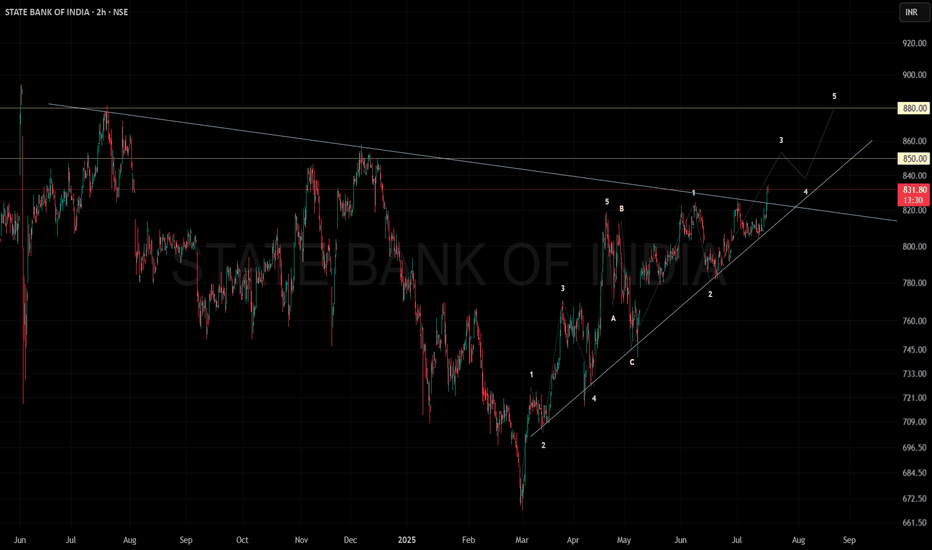

Key Observations Channel Pattern & Elliott Wave Count: Price action is moving within a well-defined upward-sloping channel (yellow lines). An Elliott Wave structure is marked (① to ⑤). The price just completed wave ④, suggesting the next move may attempt to form wave ⑤ towards the upper channel boundary, targeting roughly the 920 level. Price Support &...

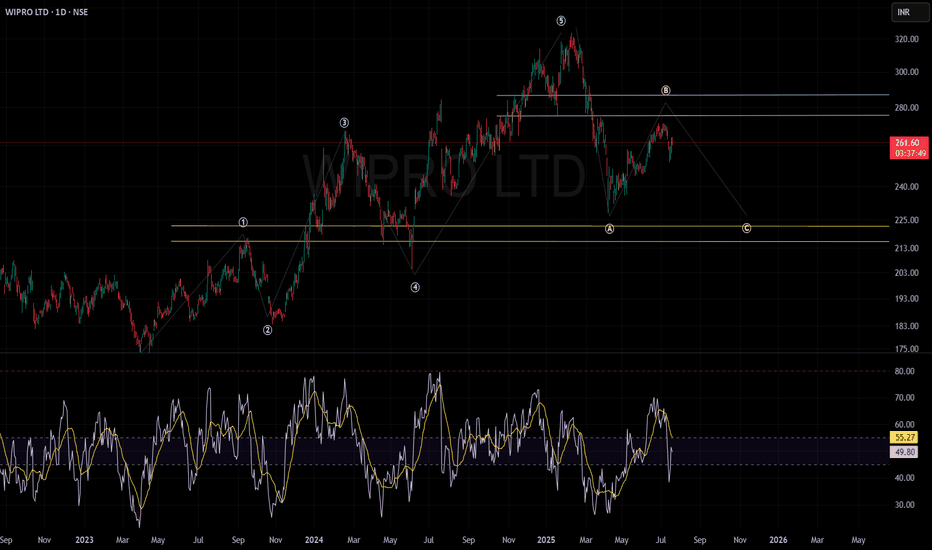

WIPRO LTD. Wave Structure: The chart depicts a well-defined Elliott Wave pattern, illustrating a completed five-wave impulse sequence succeeded by a classic ABC corrective phase. Wave B retracement appears to be underway, with resistance anticipated around the ₹275–₹285 zone. Support & Resistance: Key resistance levels are established at ₹275–₹285, which...

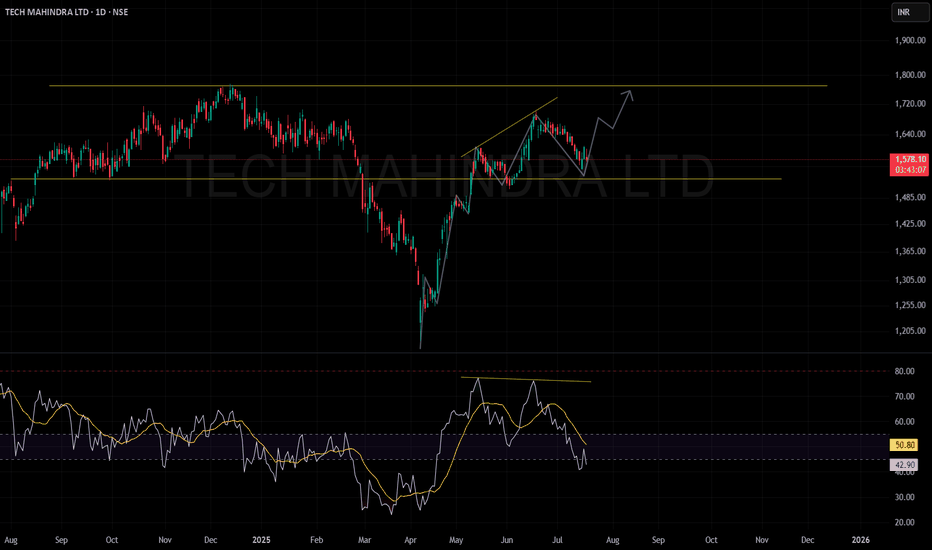

#TECHMAHINDRA Support and Resistance: A support zone is identified near ₹1,500 (lower yellow horizontal line). The resistance zone is marked around ₹1,800 (indicated by the upper yellow horizontal line). Trend Analysis: Following a significant decline, the stock has shown a sharp recovery and is now consolidating. A possible bullish scenario is depicted,...

Nifty Update (16 July 2025) 📈 Nifty is range bounded after a rebound from the support zone of 25,000–25,050 and closed positively ✅ It crossed above the initial target of 25,200 and approached the resistance zone near 25,350 🔹 Support: 25,000–25,050 (key for dip-buying opportunities) 🔹 Resistance: 25,350 (next immediate hurdle)

The technical setup suggests bullish momentum with Elliott Wave supporting continuation higher. Key upside levels are ₹850 and ₹880, as long as the price holds above trend support near ₹820-₹830. A failure below this zone would weaken the bullish outlook.